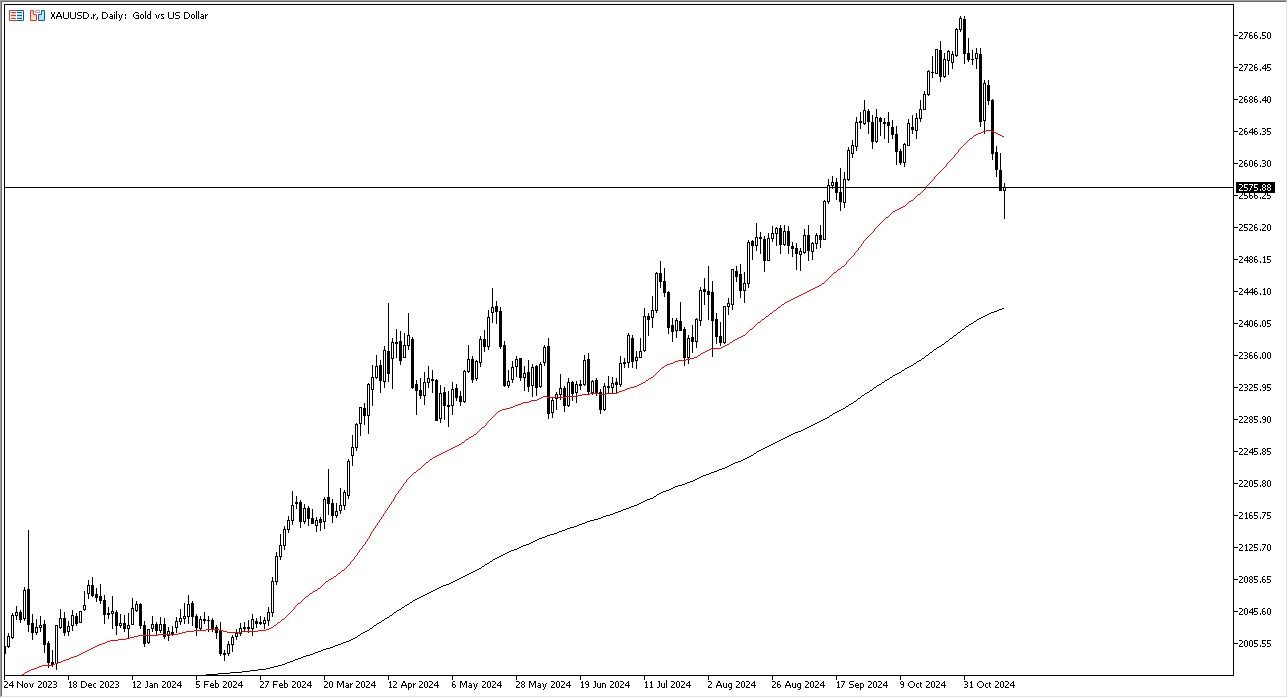

- Gold plunged initially during the trading session on Thursday, but then turned around to show signs of life by bouncing the way we have to form a bit of a hammer.

- I suggest this means that we could continue to see a recovery and move higher to the top of the range.

- Quite frankly, the gold market has been oversold for a while, so I don't think this is much of a surprise.

If you were to look at this through the prism of a market from a longer term perspective, you can see we've had a nice little pullback and now it looks like the value hunters have finally returned. With that being the case, I do like gold, and I do think that it tries to get to the 50 day EMA above given enough time, but that doesn't mean it's going to be easy. And because of that, I would not be aggressive here.

Top Forex Brokers

There are a lot of things working against the gold markets at the moment

Gold is suffering at the hands of higher interest rates in the United States, which has a knock-down effect of a stronger US dollar. And as long as that is the case, we could see gold underperform. That doesn't mean that it has to go down, it just means that it won't perform like other assets. Nonetheless, the strong US dollar short gold trade is getting a little long in the tooth. So, I would anticipate a bit of a bounce here, but really, I think you need to watch the $2,500 level underneath, because if that gets violated to the downside, it could lead to a pretty significant drop. Gold has lost some of the geopolitical concerns that we're propelling to hire, but we still have central banks around the world buying it. So that in and of itself could provide a bit of a cushion.