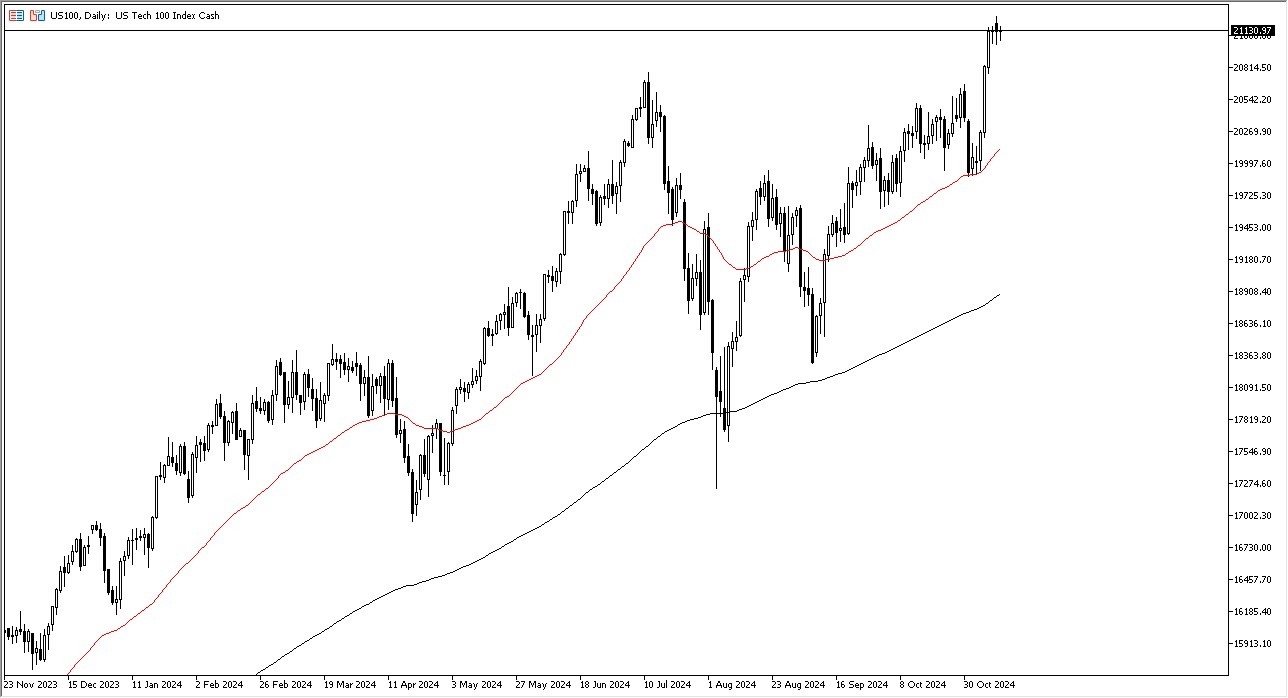

- The market has gotten back and forth during the course of the trading session Tuesday as we are just hanging around.

- With this being the case, I think we are working off a certain amount of froth.

- Last week we saw a major shot higher and therefore it does make a certain amount of sense that we are just hanging out trying to determine whether or not we can continue to rally in the way we had previously.

- Keep in mind that Wednesday features the consumer price index numbers and that will have a major influence, as inflation in the United States has quite a bit of influence on what the Federal Reserve will do next.

Regardless, I think at this point in time, unless something major happens, you're looking at any pullback as a potential buying opportunity in a market that has been bullish for what seems like a lifetime here. I think given enough time, we could go looking to the 21,500 level and then eventually the 22,000 level. That could lead to even more gains, but at this point in time, we will take a while to get going.

Top Forex Brokers

On a Pullback

As we pull back, I look at the 50 day EMA right around that crucial 20,000 level as a major support level and possibly even a bit of a floor in this market in general. All things being equal, this is a situation where we have a lot of choppiness, but I think, regardless, we are looking at the market through the prism of are we buying value? Or are we just waiting for more value? After all, the market cannot be shorted anytime soon as the market has been so obvious to the upside for quite a while, and the trend has been so strong overall. This is true with the NASDAQ 100, as well as other US indices.

Ready to trade the daily stock analysis? Here are the best CFD brokers to choose from.