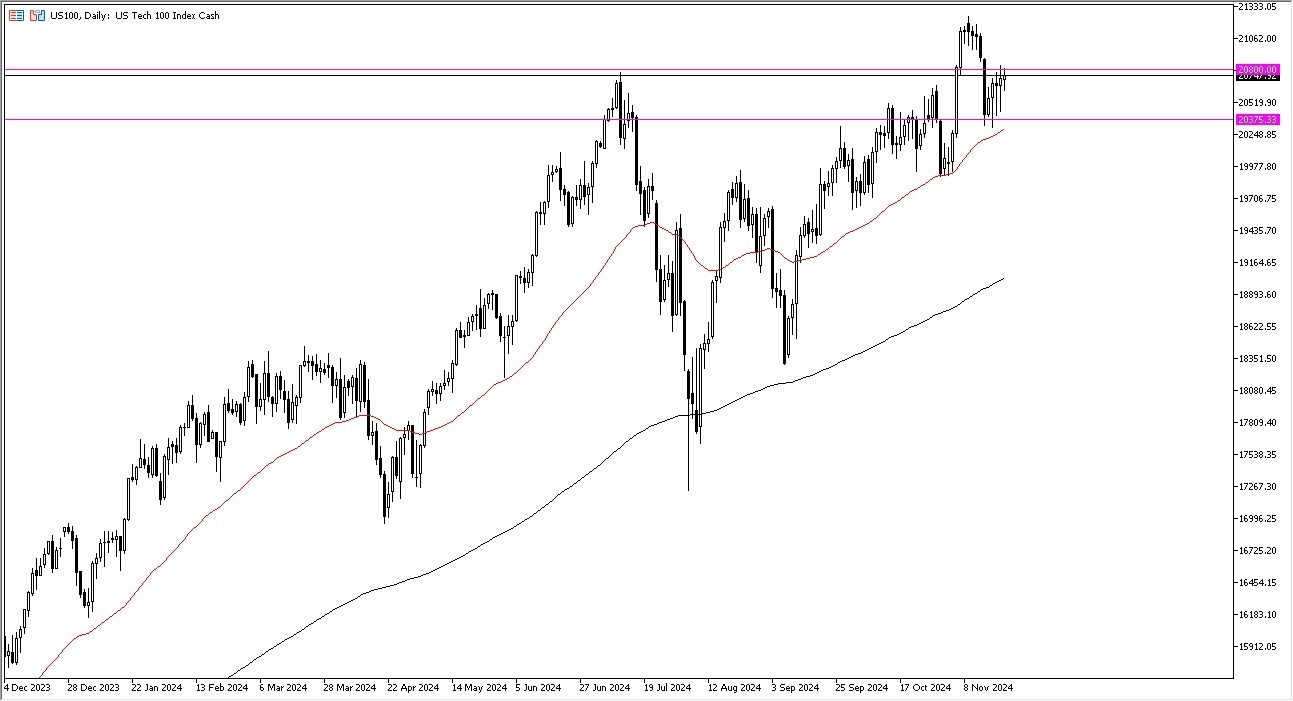

- The NASDAQ 100 has gone back and forth in the early part of the Friday session as we continue to see a little bit of trouble near the 20,800 level.

- That being said, what I would also point out is every time we pull back, there seem to be plenty of buyers.

- So, with that being the case, I think it's probably only a matter of time before we do squeeze higher.

In fact, it really wouldn't surprise me at all to close the day above that level. If we do, then it opens up the possibility of a move toward the 21,200 level above, which is basically where the swing high ended. This is a market that's been bullish for a while, and despite the fact that we are in the midst of earning season, I think that there are plenty of people willing to just jump in and take advantage of it. Interest rates go higher, the stock market ignores it.

Top Forex Brokers

Correlations are Being Ignored Overall

So, most of the correlations are busted at the moment and people are just jumping in chasing performance. That is about to get worse. We will get the so-called Santa Claus rally sometime between now and Christmas where money managers do everything, they can to push stocks higher to make up for performance that they didn't have earlier this year.

It's a cyclical phenomenon that happens most years. It's not something that you can guarantee, but it happens often enough that people are aware of it. In that environment, it almost becomes somewhat self-fulfilling. So, I don't think there's any way to short this Nasdaq market anytime soon. Short-term pull banks continue to see massive amounts of support, especially near the 20,375 level, which is also where the 50-day EMA is racing to get to as well. This could be a very interesting area to watch if we do in fact fall towards it. At this point though, it doesn’t look that likely.

Ready to trade the daily stock analysis? Here are the best CFD brokers to choose from.