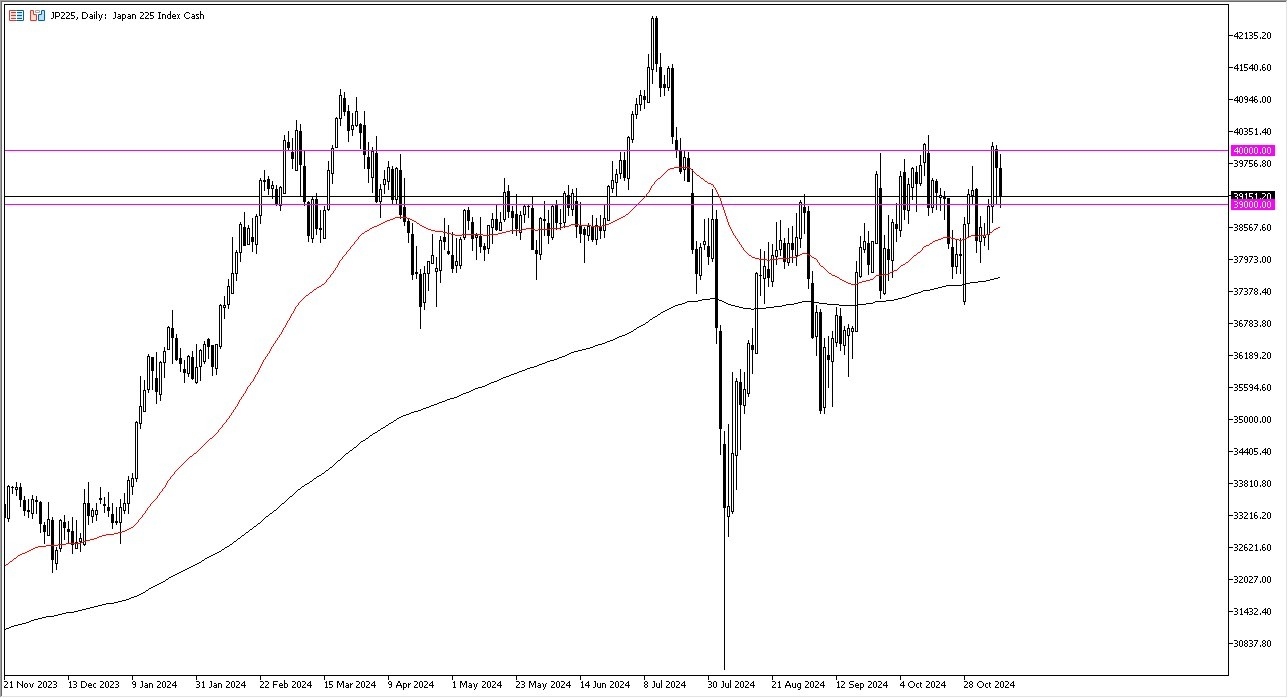

Dear my daily analysis of global indices, the Nikkei 225 has caught my attention as we just ended up making a bit of a “double top” near the ¥40,000 level. By pointing back the way we have, it looks like we are still trying to sort out where to go next, which of course will be driven by the Japanese yen.

- Keep in mind that the Nikkei 225 it is driven by the idea of exports coming out of Japan, and therefore think you got a situation where weaker Japanese yen is probably what you are waiting to see.

- The Japanese yen strengthening during the Friday session has had a bit of a negative effect on this market, and with this being the case, think you got a situation where traders will continue to watch both the USD/JPY pair, and of course the Nikkei 225 chart.

- That being said, there is a huge negative correlation between the USD/JPY pair in this market, so those correlation should go back to normal over the longer term.

Top Forex Brokers

Technical Analysis

The ¥39,000 level is an area that has been important a couple of times in the past, with the 50 Day EMA underneath there offering a certain amount of support and rising toward that level. If we were to turn around and rally from there, the market could go looking to the ¥40,000 level above.

We did end up forming that “double top”, so I do think that if we can get a daily close above the ¥40,000 level, this market could really start to take off. Keep in mind that the market could be very volatile, but I think that could probably be said for most indices around the world, and Tokyo won’t be any different. If we were to turn around a breakdown below the 50 Day EMA, then we could go down to the ¥37,500 level, near the 200 Day EMA.

Ready to trade our daily forex forecast? Here are the best CFD stocks brokers to choose from.