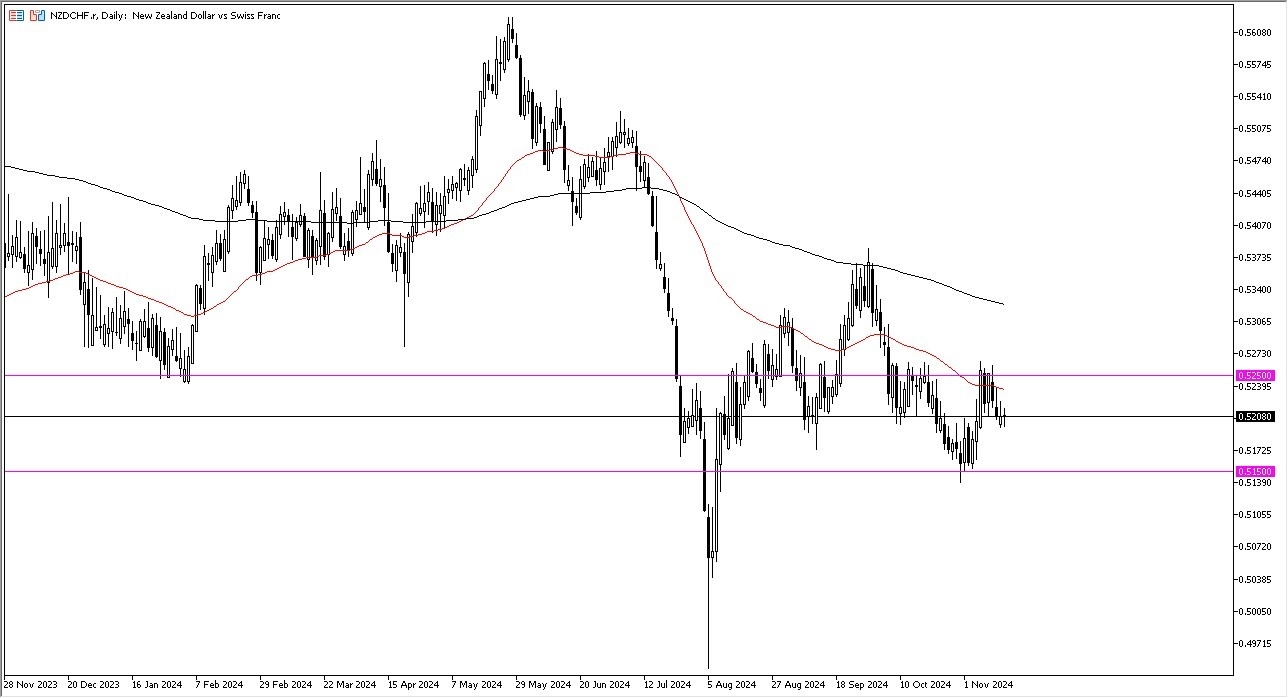

- The New Zealand dollar has been pretty sideways during the trading session on Friday against the Swiss franc as we are trying to sort out where to go next.

- I'd pay close attention to the area just above the 0.5250 level as it is an area that's been pretty resistive in the past.

If we can break above there, then it's possible that the market could go look into the 200 day EMA, which is presently near the 0.5333 level. Short-term pullbacks continue to be buying opportunities, but I also recognize that we could drop as far as 0.5150 and perhaps wipe out a lot of those trying to pick the pair up.

Top Forex Brokers

This Area Has Been Important Before

That region is an area that has been important a couple of times in the past, so we need it to hold it again. That being said, keep in mind that NZD/CHF is a pair that's highly influenced by risk appetite. So, we need to see more risk on behavior around the world for the Kiwi dollar to take off against the Frank.

If we were to break above, continue to go higher, I expect that not only will this pair go higher, but probably other ones such as the New Zealand dollar against the US dollar. Gold probably rallies. Perhaps we will see US indices start to take off as well. Of course, the exact opposite could be true if we see the Swiss franc suddenly strengthen because it could be a sign that we are in a little bit of trouble. In general, this is a scenario that I think continues to be very noisy, but I am leaning towards the upside. We just need a little bit of momentum to come into the picture and really start to lift things from here. Anything below the 0.5150 level would probably show some type of panic around the world.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.