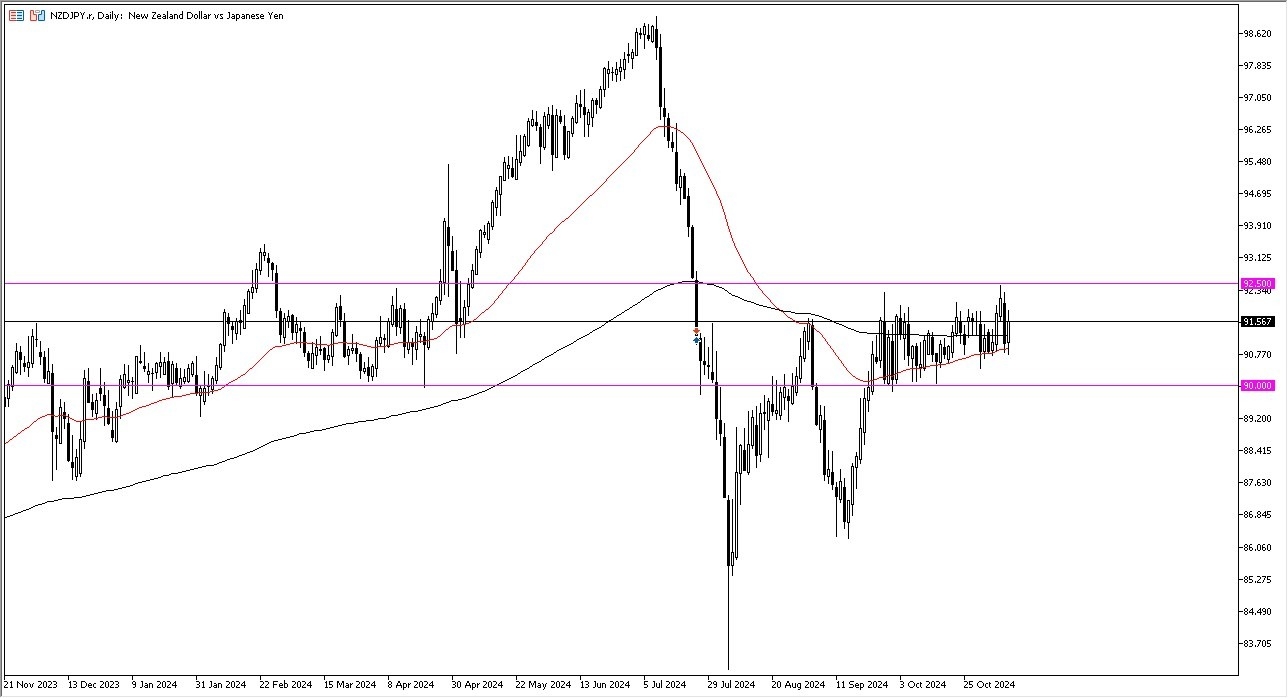

- Looking at the New Zealand dollar against the Japanese yen the New Zealand dollar initially did pull back just a bit to test the 50 day EMA, but then turned around to show signs of life.

- Ultimately, this is a pair that I pay quite a bit of attention to in terms of whether or not risk appetite is picking up or if it is falling.

- I think this is a market that we'll be watching the 92.50 yen level very closely as a potential barrier to further progress to the upside.

If we do in fact break above that level, then I think you've got a real shot at this market taking off to the upside for a much bigger move. Once we break above there, then we could be looking at a move to the 95 yen level rather quickly. That being said, the 50 day EMA, as well as the 200 day EMA indicators both are going sideways and essentially doing a whole lot of nothing.

Top Forex Brokers

Sideways Action Could Continue

So, it does suggest that perhaps this sideways action may continue. However, I would also point out that the low price as we go further into the future seems to be rising. So that tells me that we are building pressure to the upside. The interest rate differential between New Zealand and the Japanese yen will continue to favor those who hold this pair, and I think that is a big takeaway here that you cannot overlook.

Eventually, I do think we break out, and therefore I am a buyer of dips, but I also recognize that you're waiting for the market to finally get some type of momentum to really get things going. If we were to break down below the 90 yen level, that could change some things, but really at this point in time, that doesn't look very likely. A move below the 90 yen level would have me very concerned about all of the Yen-related pairs, not just this one.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.