- During the trading session on Tuesday, we have seen the Japanese yen strengthen quite sharply in the early hours, only to see a turnaround and give back its gains.

- Perhaps this was a run into safety as Vladimir Putin and the Russians announced that they were going to ease the restrictions on using nuclear weapons after Ukraine fired at least six NATO missiles into the deeper parts of the Russian Federation.

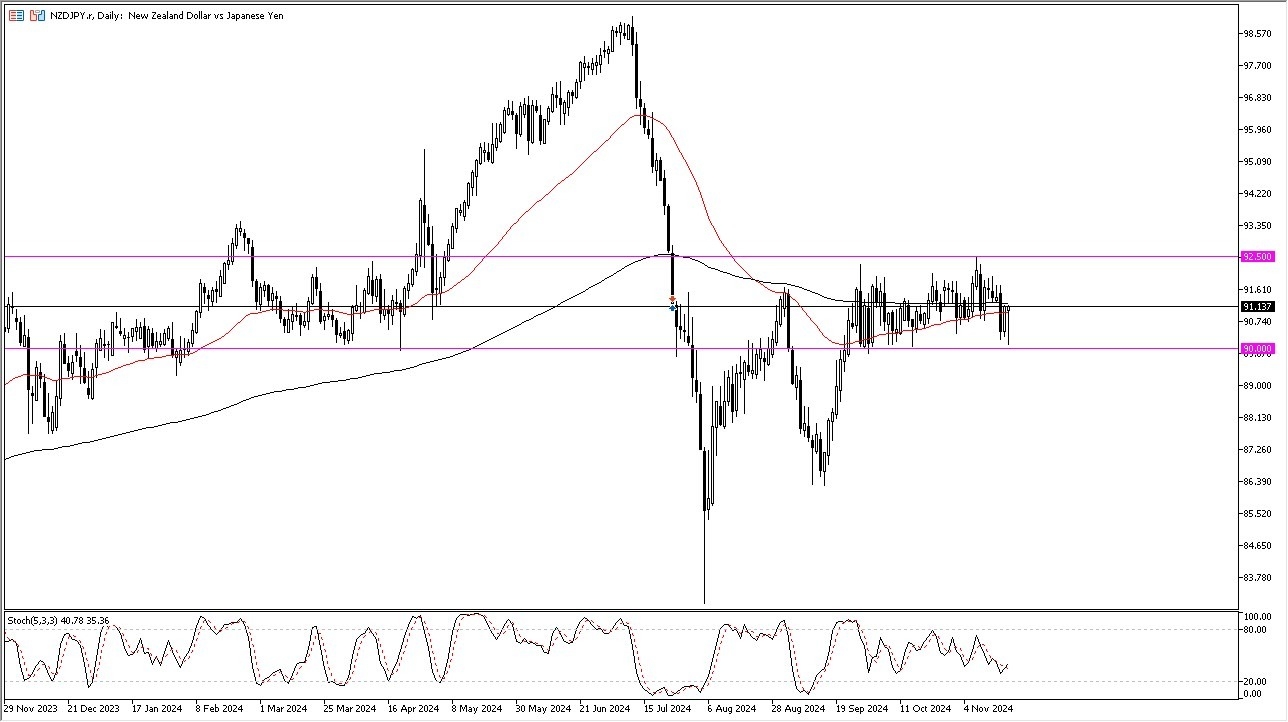

- That being said, it looks like the market has given this back and I think ultimately you have a scenario where we stay within the range that we have been in.

- If you are a short-term trader, this is an excellent opportunity due to the fact that the market is so clearly defined right now in the 250 pip range.

I Believe the Upside is Still the Way

Top Forex Brokers

I would say that I favor the upside though, mainly due to the fact that the Bank of Japan can't do much with its monetary policy due to the massive amount of debt in Japan. It's a lot of nonsense every time somebody gets worried about the Japanese tightening monetary policy. They did slightly earlier in the year, and it's been pretty much normalized since then.

All things being equal, I think the 90 yen level continues to be a massive support level while the 92.50 yen level above continues to be a massive resistance barrier. The 50 day EMA as well as the 200 day EMA are both very flat, signifying that the market has nowhere to be. The stochastic oscillator is not oversold at this point, so if you use that as a guide that might not be the signal that you're looking for, but all things being equal this looks like a sideways market that is ready to continue more of the same perhaps on its way to break out to the upside.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.