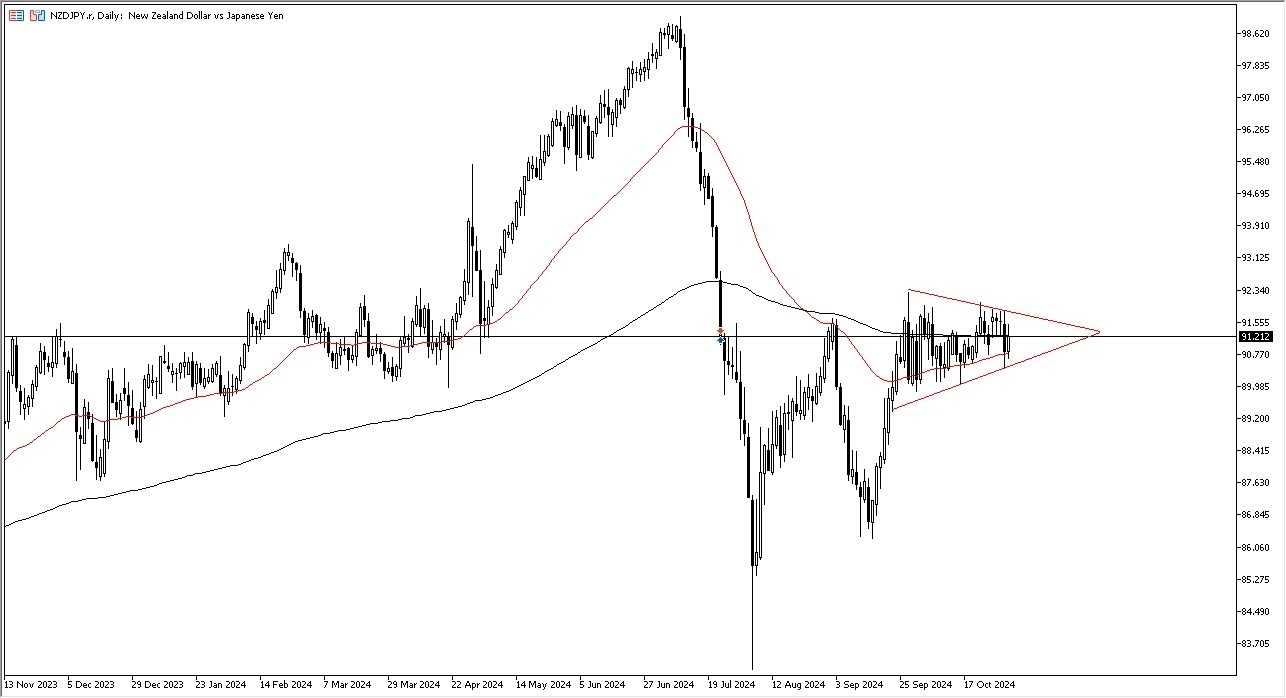

- In my daily analysis of the yen related pairs, the NZD/JPY pair has caught my attention, due to the fact that we continue to bounce around 2 of the biggest moving averages that traders pay attention to.

- This of course means the 50 Day EMA, and the 200 Day EMA. Both of these very crucial, and the fact that both of them are flat suggests to me that we are in fact essentially just consolidating a bit in order to try to sort out where to go next.

Further adding interest to this pair is the fact that we are in the midst of a symmetrical triangle, so we are almost certainly going to see some type of explosion in one direction or the other.

If we break to the upside, that could see a move to the ¥95 level, as the Japanese yen itself would probably be in trouble around the world.

Top Forex Brokers

On the other hand, if we were to break down from here, we could drop to the ¥89 level where we might be able to find some support. Either way, the fact that we are compressing the way we are does suggest that we are probably going to see some problems as far as volatility is concerned sooner rather than later.

Risk Appetite

The NZD/JPY currency pair is going to be very sensitive to risk appetite as the New Zealand dollar is considered to be a “risk on currency”, and of course the Japanese yen is considered to be a major “safety currency.” With this being the case, think you have to look at it through the prism of what the rest of the market is doing, because quite frankly if we see traders suddenly pick one direction or the other as far as whether or not risk appetite is picking up, then we could see an explosive move here.

All things being equal, keep in mind that you get paid at the end of every day to hold onto this pair, so I do favor the upside, but that of course assumes that we get some type of momentum play as well. In the short term, there are a lot of people out there taking advantage of the carry trade.

Not sure which broker to choose? We've made a list of the best forex brokers for you.