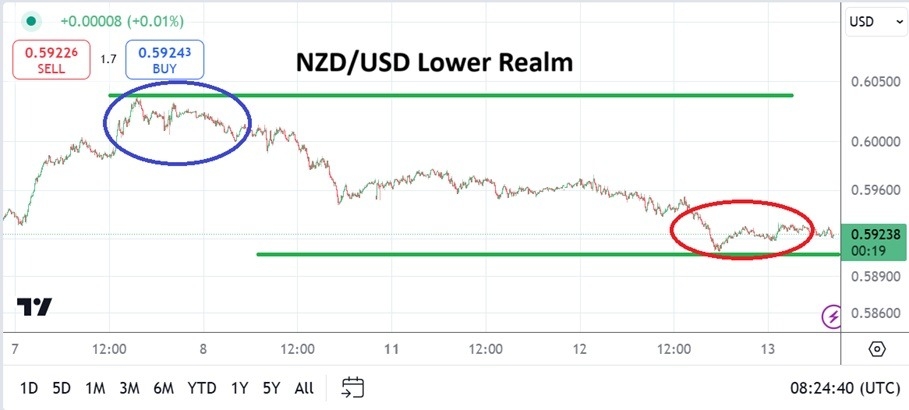

The lower depths of the NZD/USD continue to be tested, and the currency pair’s volatility has also been on full display as day traders try to speculate in dangerous conditions.

- The NZD/USD is near the 0.59225 ratio as of this writing with typically fast price action being demonstrated.

- Traders trying to wager on the NZD/USD over the past week have been dealt lightning quick conditions as behavioral sentiment remains on a nervous edge.

- The low for the NZD/USD seen yesterday traded below the 0.59100 ratio momentarily. Support levels have proven vulnerable in a handful of instances the past week of trading.

Top Forex Brokers

NZD/USD trading is unlikely to get much more comfortable in the near-term as an equilibrium is sought and sentiment remains fragile regarding outlook. There is also important inflation data coming from the U.S later today via the Consumer Price Index. But the question must be asked, even if the inflation data comes in weaker than projected will it help the NZD/USD create a sustained bullish move higher, this as financial institutions seem to be considering the coming Trump effect in the White House.

U.S Fed Did Cut Interest Rates Last Thursday

After the U.S election results were known the NZD/USD essentially went from 0.60200 towards a lower depth of 0.59150 rather quickly. Since then trading has seen reversals occur in both directions. The NZD/USD did climb to the 0.60400 level on Thursday in the wake of the U.S Federal Reserve’s interest rate cut, but then promptly fell to nearly 0.59500 on Friday. A high this Monday saw the 0.59800 level come into sight, but since then incremental selling has taken hold.

The NZD/USD is now within values seen in the first week of August. The NZD/USD was within lower realms it should be noted in late July. Behavioral sentiment in financial institutions remains fragile as they try to gauge their outlooks over the mid-term, and so far many large traders in the NZD/USD do not appear comfortable. The currency pair is not alone however, most other major currencies are struggling against the USD.

Near-Term and the NZD/USD

While it may be tempting for a day trader to look at technical charts and proclaim the NZD/USD is oversold, stepping in front of the move lower could prove to be expensive. Questioning where support levels will prove strong and when a sustained reversal higher will occur is legitimate, but it may remain wrong headed for the time being.

- Nervous sentiment may continue to linger in Forex a while longer, timing the exact time a change of attitude is going to take place is tempting but it is dangerous.

- A good barometer of sentiment today will be the U.S CPI numbers, if they are weaker and the NZD/USD remains in lower territory this will signal to retail traders the market is likely to continue testing support in choppy conditions over the near-term.

NZD/USD Short Term Outlook:

Current Resistance: 0.59285

Current Support: 0.59200

High Target: 0.59450

Low Target: 0.59060

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.