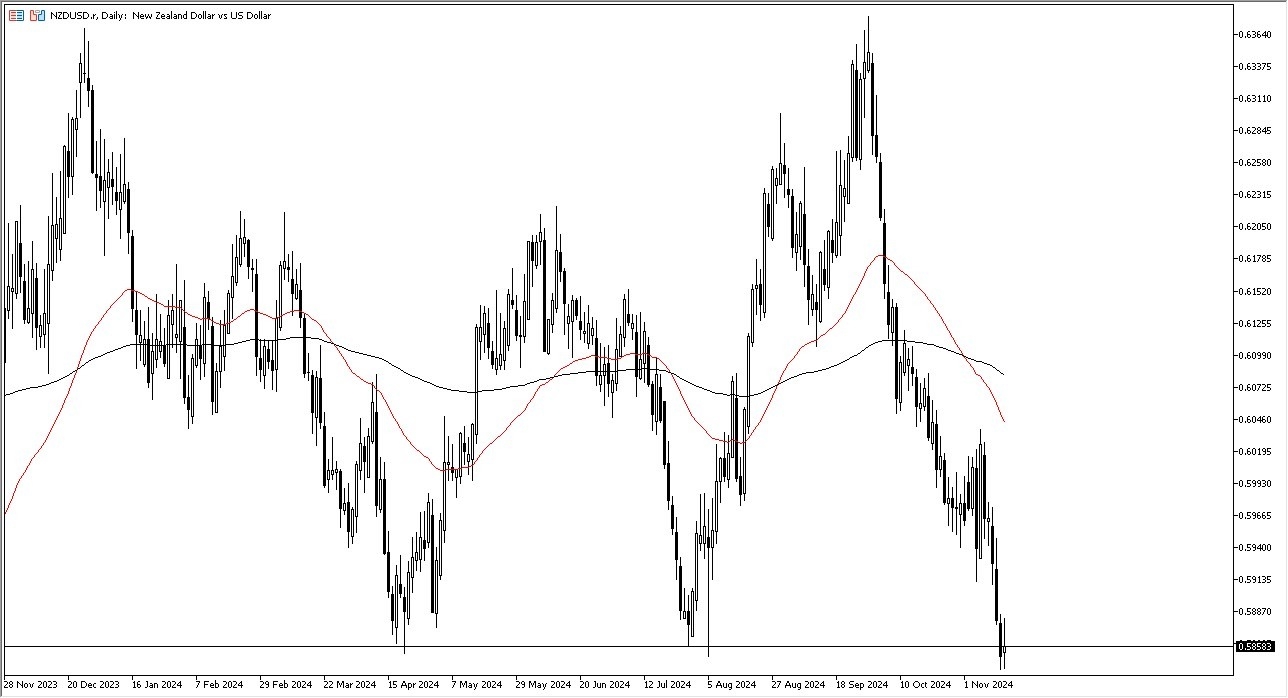

- During my daily analysis of the NZD/USD pair, it looks as if we are threatening a major breakdown.

- After all, we are sitting at a major floor in the market, in the form of the 0.58 level.

- This is an area that a lot of people will be paying close attention to, because quite frankly, if we were to break down below that level this market could pull apart and we could see the New Zealand dollar get absolutely eviscerated.

At this point in time, the market is likely to continue to see a lot of questions asked of risk appetite, as the New Zealand dollar is so highly correlated to risk appetite. Furthermore, we also have to keep in mind that the US dollar has been rallying quite significantly, as interest rates in the bond market have been very strong as of late. With this being the case, the market is likely to continue to see a lot of questions asked of any rally, and therefore I think it’s very likely that we could see sellers jumping into this market to get short of the New Zealand dollar on signs of exhaustion.

Top Forex Brokers

Technical Analysis

The technical analysis for the NZD/USD currency pair is obviously very ugly, as we have fallen quite drastically over the last several weeks. The 50 Day EMA sits just above the 0.60 level, which of course is a large, round, psychologically significant figure, but it is also an area that people have seen previous resistance, so I think ultimately this is a scenario where that could be your ceiling.

All things being equal, this is a market that I just don’t have any interest in buying, at least not until the interest rate situation in the United States calms down. With this, I think you’ve got a situation where you are looking for value when it comes to buying the US dollar going forward.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.