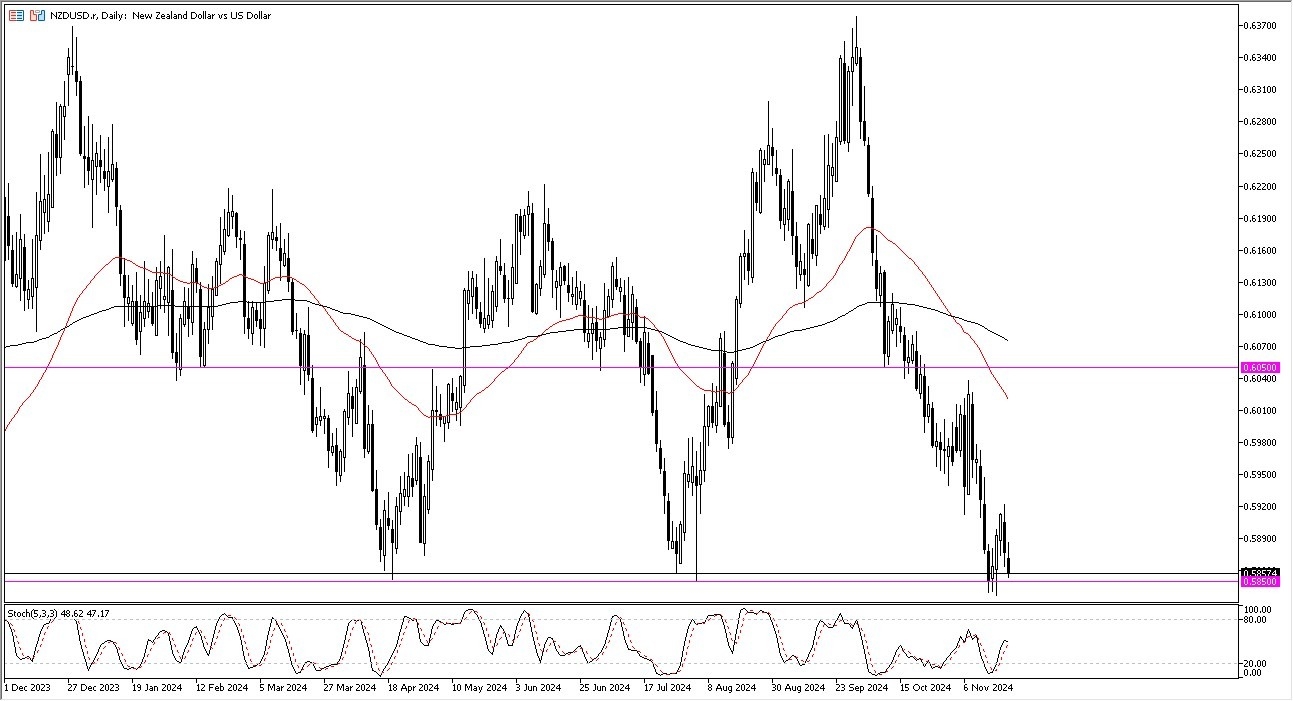

- During the trading session on Thursday, we've seen the New Zealand dollar try to rally a bit, but it gave back gains rather quickly and has turned around to reach towards the 0.5850 level.

- It's behaving very much like the Australian dollar, as you would expect as commodity currencies and the currencies not called the US dollar are struggling.

- The 0.5850 level is the beginning of pretty significant support, support that has been held for a couple of years now.

Not Surprising to See this Action

Top Forex Brokers

So, it's not a huge surprise to see that the New Zealand dollar is just simply hanging out here and not breaking down. However, I would point out that the Euro is in the process of trying to bust through the floor of its two-year range. So, if that happens, I suspect you'll see a bit of a knock-on effect in this NZD/USD pair as well as many others that the US dollar would strengthen. There is an argument to be made for the US dollar to strengthen on multiple fronts. The first one of course is interest rates. While the Federal Reserve has cut interest rates recently, the reality is that the bond market doesn't care, and rates continue to climb.

As this is the case, it makes more sense for some traders out there that are concerned about geopolitics, and let's face it here, we have plenty to worry about when it comes to geopolitics, to put their money into a high-yielding bond. It's much more palatable than trying to guess where the currency market or stock markets or whatever go next. In general, this is a market that is on the precipice of something big, so we'll have to wait and see whether or not it breaks down. If it does, we'll probably see the US dollar just swallow everything, not just the Kiwi dollar, but several other markets as well.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.