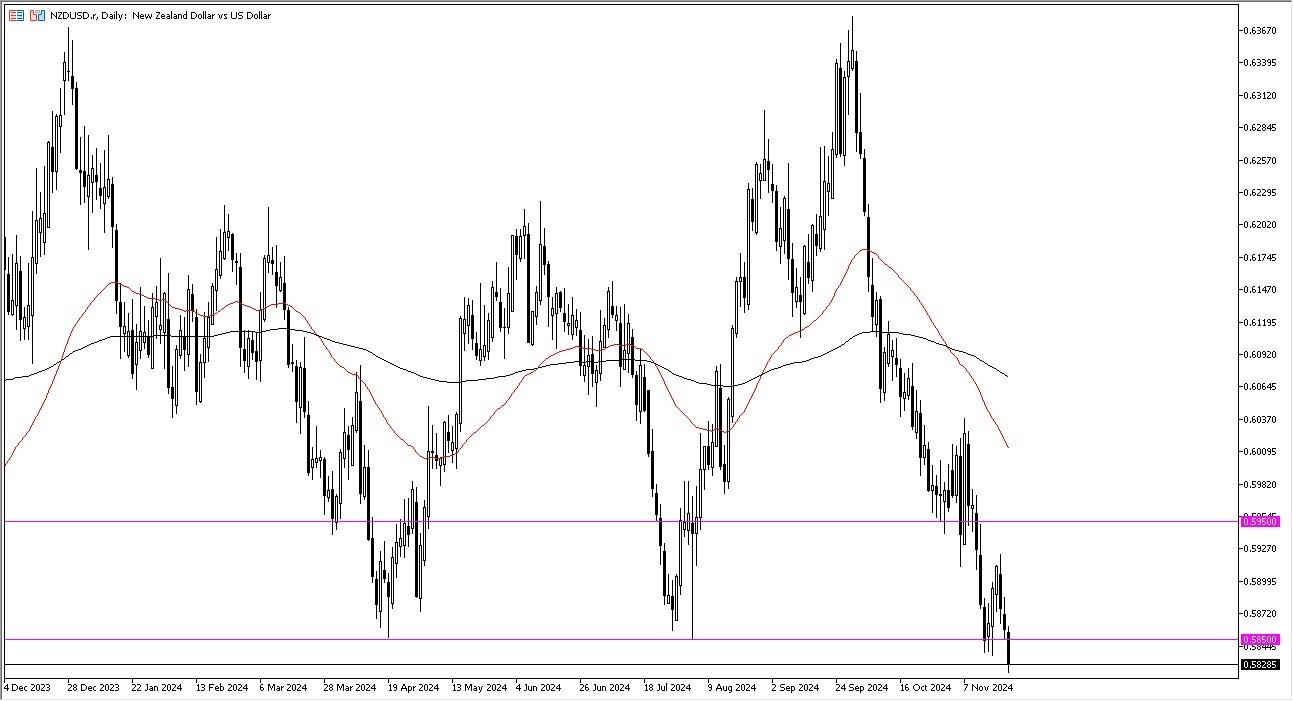

- During my daily analysis of the NZD/USD pair, it’s obvious that the market is very negative, as we have broken down through a significant support level in the form of the 0.5850 level.

- Because of this, it looks like the New Zealand dollar will continue to struggle in general, as the markets are likely going to go looking to the 0.58 level given enough time.

On short-term rallies, it’s likely that the market will come back into the picture and show signs of exhaustion that you can start shorting. The 0.5950 level above is an area that also could cause a bit of trouble, as it was previous resistance as well as support.

All things being equal, this is a market that has recently seen the so-called “death cross” form, which is when the 50 Day EMA breaks down below the 200 Day EMA indicators. This is typically a very negative turn of events, and longer-term traders look at it as a shorting signal.

Top Forex Brokers

New Zealand Dollar is a “Risk On” Currency

At this point in time, it’s likely that the risk appetite will continue to be a major factor here, due to the fact that the New Zealand dollar is highly sensitive to the commodity markets, as well as what’s going on in Asia. With this being the case, I think you have to pay close attention to other risk appetite markets such as the stock markets in the United States, as well as Europe and Asia. Beyond that, you also should probably be looking at the Australian dollar, because quite frankly, the Reserve Bank of Australia recently held its interest rates firm, which of course suggests that the Aussie should outperform the Kiwi. If the Australian dollar starts to fall, that could put even more pressure on this currency through the so-called “knock on effect” that we quite often will see.

Rallies at this point in time are not something that I would be looking to take advantage of, unless of course we show signs of exhaustion that you can start shorting. I have no interest in buying this market until we break well above the 0.5950 level on it daily close, if not a weekly one.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.