EUR/USD

The Euro has found the week to be absolutely horrible, as we have finally broken below the 1.05 level. By doing so, the market looks as if it is ready to go much lower, and short-term rallies at this point in time is the entry point that short sellers will be looking for. With interest rates climbing, it does make quite a bit of sense that the US dollar continues to strengthen. At this point, this is a “sell only” type of situation.

AUD/USD

The Australian dollar has rallied a bit during the course of the week, as it looks like we are approaching the 0.65 level as a bit of a magnet for price, and therefore I think you have to look at this through the prism of a market that is trying to do everything it can to try to recover, but ultimately, we also have to keep in mind that the US dollar is much stronger than most other currencies around the world, so I think there is a bit of an anchor around the neck as it were. Short-term rallies will almost certainly continue to be selling opportunities in this market.

USD/CAD

The US dollar has pulled back rather significantly during the course of the week against the Canadian dollar, despite the fact that the US dollar has been stronger against most other things around the world. On Friday, we got the Retail Sales numbers out of Canada, which came in at 0.4% as expected, month over month. Because of this, it looks as if although the Canadian dollar will be weaker than the US dollar of the longer-term, candida probably stabilizes. With this, I think a short-term pullback makes quite a bit of sense here, but that should end up being a short-term buying opportunity.

Top Forex Brokers

USD/MXN

The US dollar initially pulled back just a bit during the course of the week but has turned around to show signs of life again. By doing so, we are testing the area of the wicks of the 2 previous weekly candlestick. With that being said, it looks likely that the market is going to do everything it can to get to the 21 MXN level. That being said, it will more likely than not be a situation where it’s more of a grind higher than anything else. Short-term pullbacks should continue to see plenty of buyers, especially near the 20 MXN level, which of course is a large, round, psychologically significant figure.

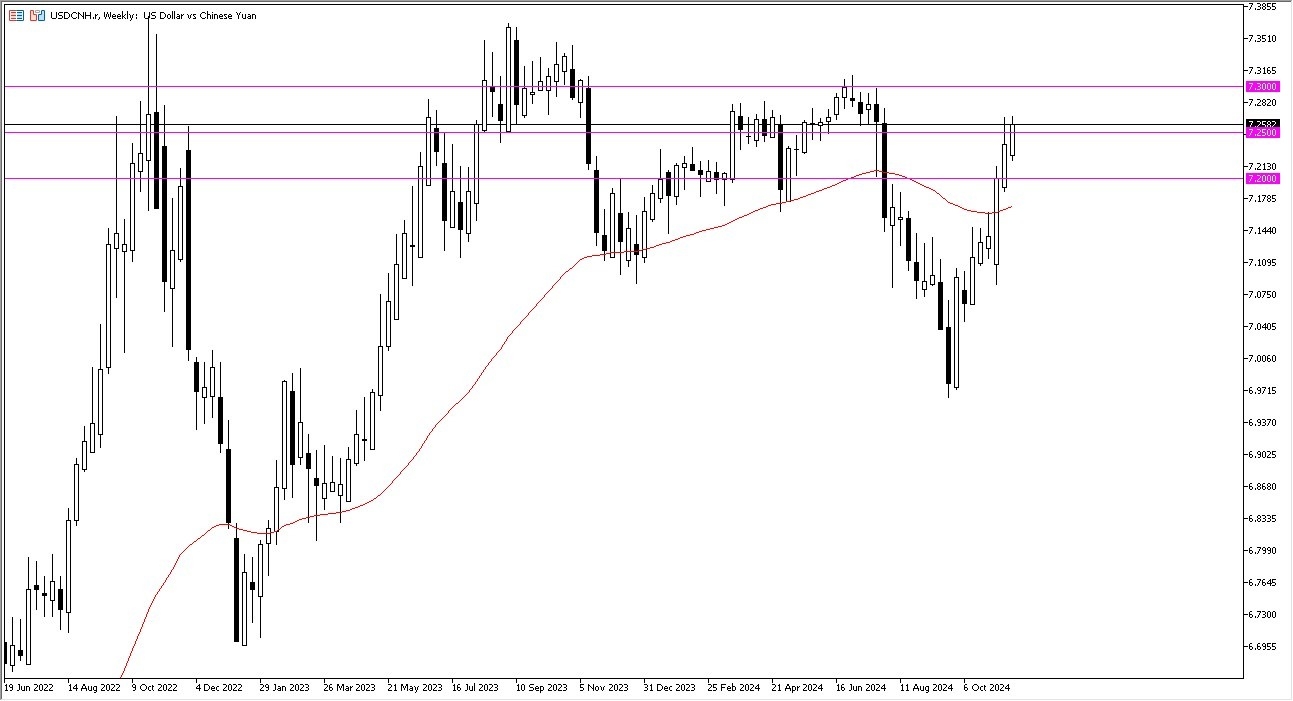

USD/CHN

The US dollar continues to Rally against the Chinese yuan, reaching above the 7.25 CHN level on Friday. That being said, we are getting a little stretched at this point, and although I am bullish, I recognize that short-term pullbacks will probably be necessary for this market to continue going higher. At this point, I think that you have a market that is doing everything it can to reach the 7.30 CNH level, which of course has been important multiple times in the past and therefore you would expect a little bit of “market memory” showing up as resistance in that general vicinity.

CAD/JPY

The Canadian dollar has rallied rather significantly against the Japanese yen, as we are threatening the ¥112 level. If we can break above the ¥112 level, then it’s likely that the Canadian dollar can continue to go much higher against the Japanese yen, perhaps reaching as high as ¥118 above. Short-term pullbacks I continue to offer a lot of support, especially near the ¥110 level, and then of course the 50 Week EMA near the ¥109.40 level, which is also rising to the upside. At this point, it looks like we continue to grind higher, but it may be more of a slog and less of a shot higher.

Gold

Gold markets have rallied rather significantly during the course of the week, showing enough strength to swallow the previous weekly candlestick, and completely repudiating the idea of gold falling into a downtrend. Because of this, it’s obvious that the market will continue to see plenty of buyers, and short-term dips will probably end up being thought of as opportunities to pick up a little bit of value. All things being equal, it looks as if this market is going to try to return to the $2800 level below. I have no interest in shorting this market.

NASDAQ 100

The NASDAQ 100 has been a bit bullish during the course of the week, as we continue to grind higher overall. All things being equal, this is a market that is still very strong in its uptrend, and I think momentum itself will continue to push this market to the upside. All things being equal, this is a market that will eventually try to get toward the most recent swing high, and if we can break above there, then I think it opens up the next major “FOMO trading.”

Ready to trade our weekly Forex forecast? We’ve made a list of some of the best regulated forex brokers to to choose from.