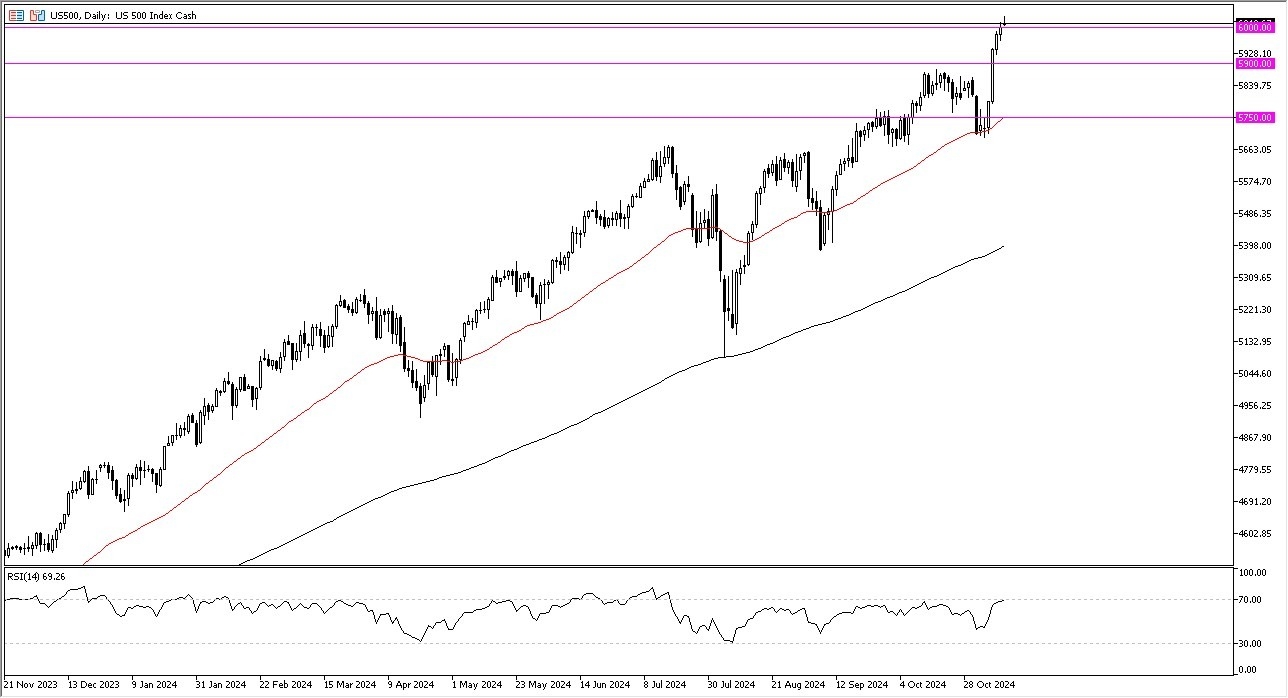

- Dear my daily analysis of US indices, the S&P 500 looks a little stretched, but it is probably worth noting that we are above the crucial 6000 level.

- The 6000 level of course is a large, round, psychologically significant figure that a lot of people will be paying attention to, so I think this is a big deal.

- Even if we were to break down below that level, I think the idea is that the 5900 level will give you an opportunity to be a buyer “on the cheap” as well.

Top Forex Brokers

Momentum

I believe the S&P 500 index is moving more or less on momentum, and the fact that we are starting to burn through that momentum could be a sign that we are going to struggle to continue to go higher in the short term. That being said, I do think that eventually the S&P 500 rallies based on the idea that we are going to see a very pro-business US administration, and therefore I think it’s probably only a matter of time before the S&P 500 really starts to take off to the upside. That doesn’t mean that we go straight up in the air, just that we go higher over the longer term.

The Relative Strength Index is reaching the overbought condition near the 70 level, and at this point in time I think we’ve got a situation where perhaps we do get a little bit of relief on a pullback, and therefore we’ve got value hunters that will almost certainly jump in and try to take advantage of any cheap contracts that they can get. If we were to break down below the 5900 level, then it’s likely that the market could drop down to the 5750 level, where the 50 Day EMA is.

All things being equal, the trend is very much to the upside, and therefore I think that the momentum will continue to be a major factor, and of course the fact that the Federal Reserve is likely to continue cutting rates into the future suggest that perhaps we have more of an up than down type of set up waiting to happen.

Ready to trade our daily stock market forecast? Here are the best CFD stocks brokers to choose from.