- The S&P 500 has rallied rather significantly during the trading session on Wednesday as the United States elections are done and gone and in the rear-view mirror with a Donald Trump presidency, a Republican Senate, and a Republican House of Representatives.

- It looks like a pro-business approach in America is more likely than not.

- Because of this, you would see a lot of noise about the idea of buying equities of the largest American companies that do international trade.

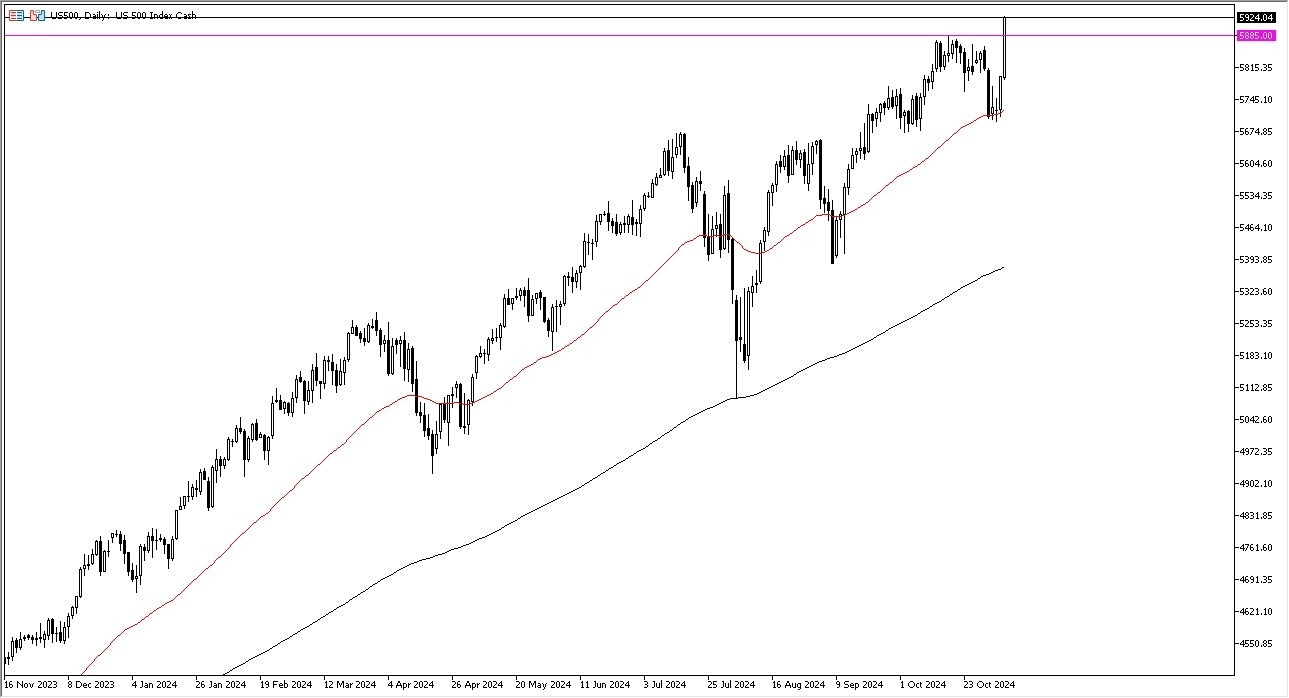

If that's going to be the case, then it does make a certain amount of sense that the S&P 500 will end up benefiting from this. It's probably worth noting that we are in the midst of earnings season, but really at the end of the day, the most important thing on this chart is the fact that we have upward momentum.

Top Forex Brokers

That being said, pay attention to the fact that Thursday is a Federal Reserve interest rate decision, and therefore I think you've got a real possible scenario where we get a little bit of a whiplash move, with the overall upward trend continued. Because of this, I think we have a situation where no matter what happens next, we will eventually go higher.

If We End Up Showing Volatility

If that ends up being the case, then so be it. Most buyers will be looking at a dip as a potential buying opportunity. It is worth noting that in the last couple of days, we have bounced from the crucial 50 day EMA and now have reached fresh new highs. I think at this point in time, there's not much to keep this S&P 500 market from reaching the 6,000 level, which could be sooner rather than later. We'll just have to see how the market reacts to the volatility around the Federal Reserve interest rate decision, or perhaps more importantly, how it reacts to the idea of the press conference afterward and what that does to overall stocks.

Ready to trade our daily stock market forecast? Here are the best CFD brokers to choose from.