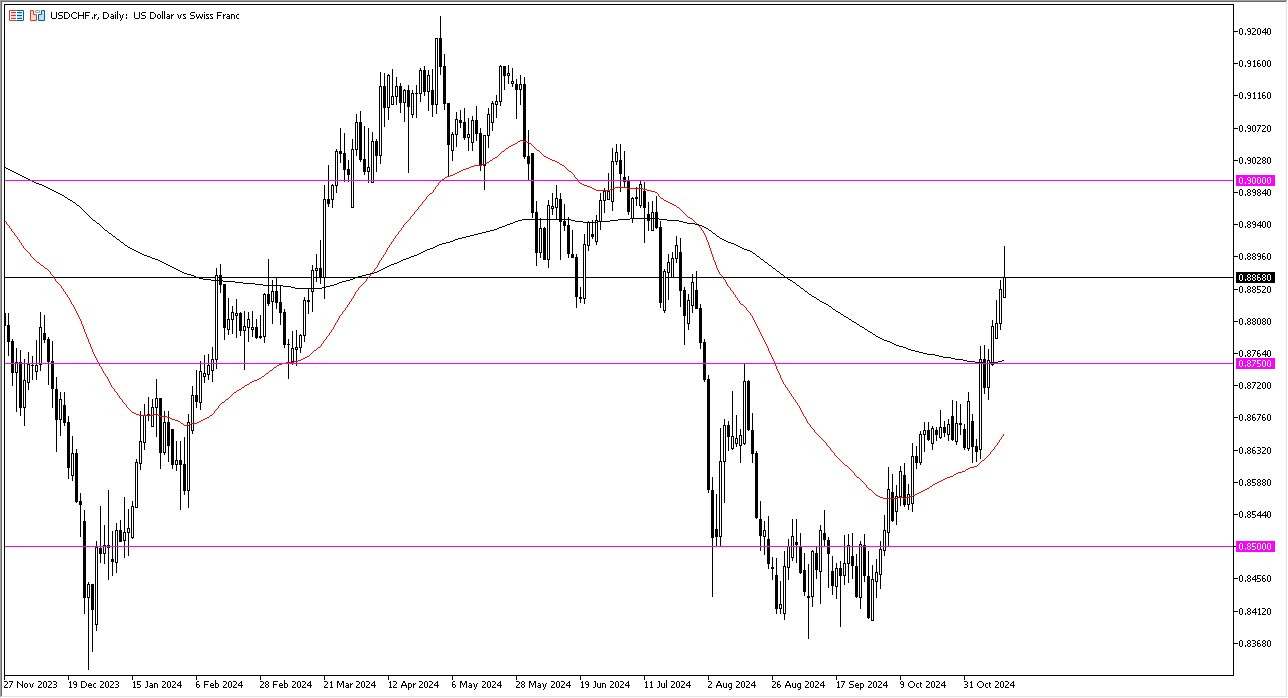

- The US dollar has rallied a bit during the course of the trading session on Thursday against the Swiss Franc, although we are seeing a little bit of give back later in the day.

- That does make a certain amount of sense and therefore I think you have to look at this through the prism of a situation where if we do pull back a bit, I think you have to look at it through the prism of finding value, the 200 day EMA sits around the 0.8750 level, which of course is an area that's been important multiple times.

So, I think that is your short term floor in this market. I don't necessarily think this is a market that you can just jump into with massive amounts of money at this point and chase the trade. Chasing the trade is probably one of the easiest ways to lose money in the markets that I know of.

Top Forex Brokers

Buying the Dips Probably is Still the Right Trade

I do think you need to find a little bit of value. Nonetheless, over the longer term, the interest rate differential will continue to favor the US dollar. And right now, the US dollar is really flexing its muscles against most assets around the world, with the exception of maybe Bitcoin. So, with that being the case, I think you have to look at this through the prism of trying to find a good entry. I think a day or two of negativity would do wonders for this pair and offer an opportunity to start going long the US dollar against the Swiss franc, which at the end of the day does pay a positive swap. And that is something that you need to pay close attention to. The Swiss National Bank is nowhere near tightening monetary policy, and the bond markets in America have been doing just that. So, it'll be interesting to see how this plays out.

Ready to trade our daily Forex analysis? We’ve made a list of the top brokers in Switzerland for you.