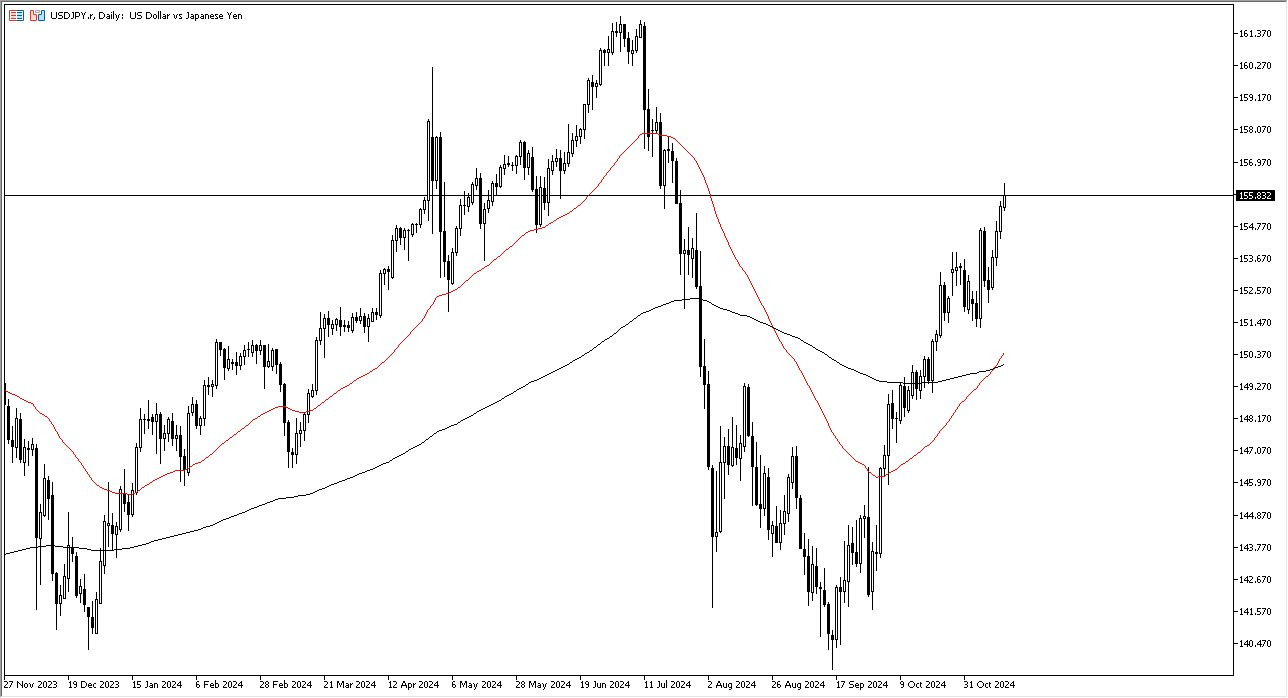

- The US dollar initially rallied a bit during the course of the trading session on Thursday as we reached the 156 level and peaked above there but have since pulled back ever so slightly.

- At this point, I think this remains a buy on the dip market.

- This has been the pay for some time, and I think it will continue to be going into the future at this point. The interest rate differential has been a great way to pad your account for some time.

So, you need to keep that in mind, but we are a little stretched. So, it's not a huge surprise to see a little bit of give back in the middle of the day. Regardless, there's almost no way you can short this pair because the interest rate differential alone will destroy your account. The interest rates in. The United States continue to climb. And until that changes, there's really no hope for the Japanese in as the Bank of Japan has no recourse for tightening monetary policy.

Top Forex Brokers

The Debt of Japan is the Real Issue Here

Quite frankly, it's obvious to all involved that the Japanese economy is so far in debt, there's no way it can hang on to that debt and pay a reasonable interest rate. So, with that being said, the Bank of Japan can't get too aggressive with tight monetary policy. short term pullbacks, I think will continue to attract a lot of attention. And therefore, I like the idea of buying dips. We've recently had the so-called golden cross. That's when the 50 day EMA breaks above the 200 day EMA. So, some longer term traders probably got involved as well. Nonetheless, I do think we're going to go looking to the 160 yen level eventually. It probably will take some time to get there, but I do think that is our destination.

Ready to trade our daily forex forecast? Here are Japan's Best Forex Brokers to choose from.