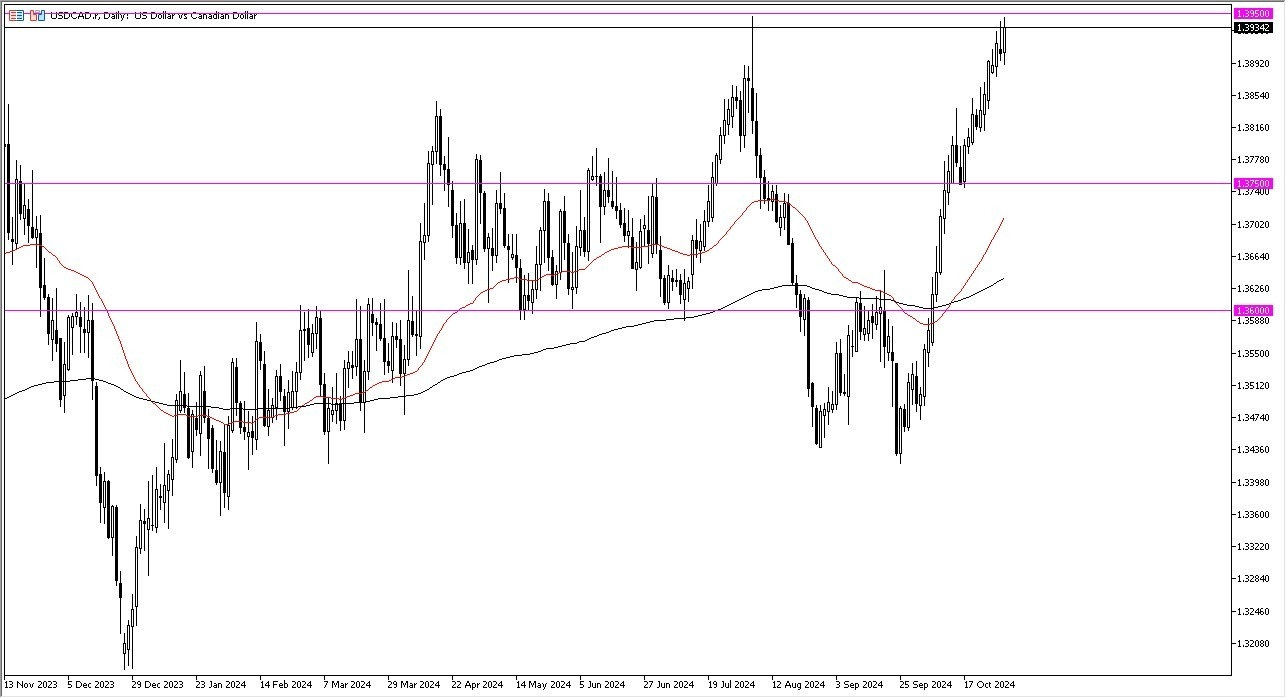

- During the early hours on Thursday, we did see a little bit of a pullback, only to turn around and show signs of strength again in the US dollar against the Canadian dollar currency pair.

- The 1.3950 level makes a certain amount of sense as resistance as it did offer resistance previously.

With this being said, the market continues to be one that is a little overdone. And I do think it's probably worth noting that the non-farm payroll numbers coming out on Friday will obviously have a major influence on what happens next. The US dollar of course has been racing higher based on economic concerns and the interest rates out there rising in the US bond market. So, all of that being said, I think you've got a situation where traders are looking at this through the prism of can we continue to break higher? I think we can, but what we need is some type of catalyst to really get this moving and we'll need a major surprise in the job market.

Top Forex Brokers

Zooming Out to the Long Term Charts

If you look at the longer term charts, the weekly timeframe, we have gone a bit parabolic. And that does make a certain amount of sense considering that at the same time we've seen oil somewhat weak and of course we have seen the Bank of Canada cut rates aggressively as well. So, with all this being said, I would love to see some type of pullback that I can take advantage of in this pair. And I do think that there are plenty of buyers underneath willing to get involved. However, on a daily break above the 1.3950 level, you'd have to think that we may enter yet another leg higher.

All of this being said, I also recognize that the oil market could very well be a thorn in the side of the trading public. However, the upward trend is very strong, so I think eventually we see the greenback emerge victorious.

Ready to trade our daily forex forecast? Here are the best Canadian Forex brokers to start trading with.