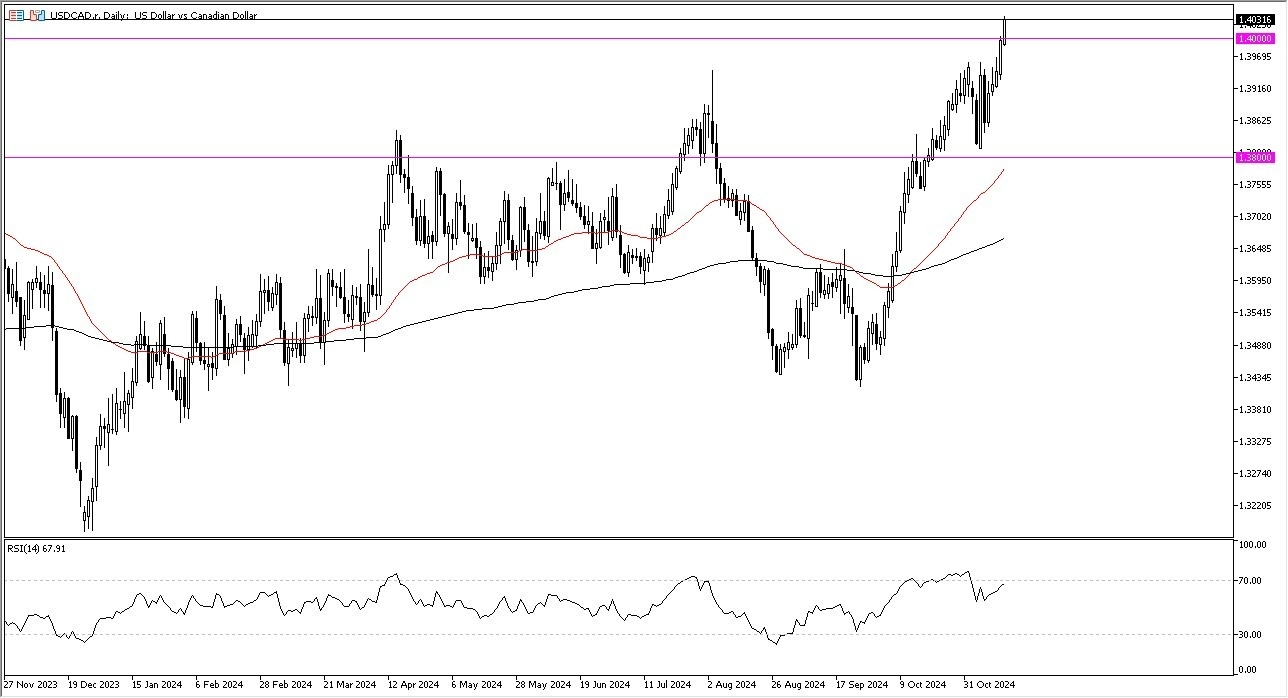

- During my daily analysis of the USD/CAD pair, I have seen a lot of upward pressure, and we are now well above the crucial 1.40 level, an area that has been important multiple times over the years.

- By doing so, it looks like the market is ready to continue to go much higher, but I would also warned that the last time we reached above the 1.40 level, we did see a lot of noise all the way to the 1.45 region. In other words, even though this market looks extraordinarily bullish, I don’t necessarily think that we just shoot straight up in the air.

Top Forex Brokers

Interest Rates

The interest rate differential between the United States and Canada still remains, mainly due to the bond market selling off quite drastically in the United States. Bond market positioning does tend to suggest that perhaps traders are not excited about the idea the United States spending the kind of money it does, but really at the end of the day, these higher yields will only attract more interest, at least for owning these bonds. After all, if you can earn a comfortable return by simply buying bonds, it makes quite a bit of sense that you do that, at least with a portion of your portfolio.

On the other side of the 49th parallel, the Canadians have quite a bit of trouble in their economy, and of course we have recently seen the Bank of Canada cut interest rates, while we also have a major housing problem in the Greater Toronto Area, and of course Vancouver. This has been a running problem for the Canadian economy, and I just don’t see it changing anytime soon.

That being said, the Canadians do benefit from a stronger America, as the United States is by far its largest export destination. That being said, the market is still very pro-US dollar at the moment, so while I think the Canadian dollar might do okay against other currencies, it is still going to take a backseat to the US dollar.

Ready to trade our daily forex forecast? Here are the best Canadian Forex brokers to start trading with.