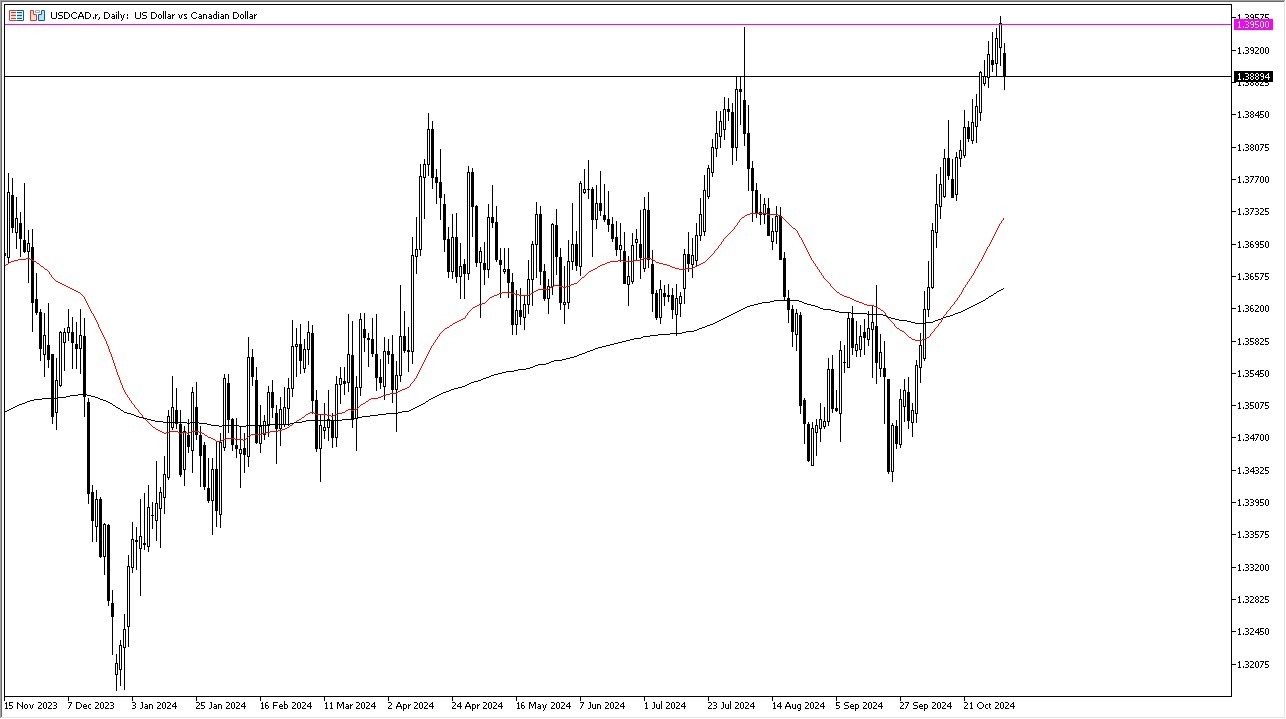

- And what I can only assume is a bit of profit-taking, during my analysis on Monday of the USD/CAD pair, the first thing I notice is that we have pulled back from the crucial 1.3950 level.

- This is a level that has been important multiple times, so it’s not a huge surprise to see that there is a bit of a reaction, especially after we have shot straight up in the air to get here.

- That being said, I don’t necessarily think that this is the end of the trend, I just think that we had gotten a little bit too far ahead of ourselves.

Technical Analysis

The technical analysis for the USD/CAD currency pair of course is very strong, but it is worth noting that the area right around the 1.40 level has been very difficult to overcome over the last several years. The question now is whether or not we have some influence from the US elections, or if it’s going to be a situation where we are waiting on the Federal Reserve? I suspect it will probably be a little bit of both, and there are a multitude of scenarios that could cause chaos.

All that being said, most traders on Wall Street are probably wanting to see some type of gridlock in the US government, because quite frankly it keeps them out of the way of people trying to make money. If there is in fact a Republican sweep, that might actually end up being somewhat negative initially, due to the fact that people won’t really know what to do with themselves.

Furthermore, I also suspect that we could see a little bit more volatility over the next couple of days as traders try to not only discern whatever happens with the election, but also whatever the statement says coming out of the Federal Reserve.

While I remain bullish on this market, I would not be surprised at all to see a drop down to the 1.38 level or even beyond that. It is not until we break down below the 1.37 level and thereby the 50 Day EMA that I start to think that we are about to make a “round-trip move.”

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.