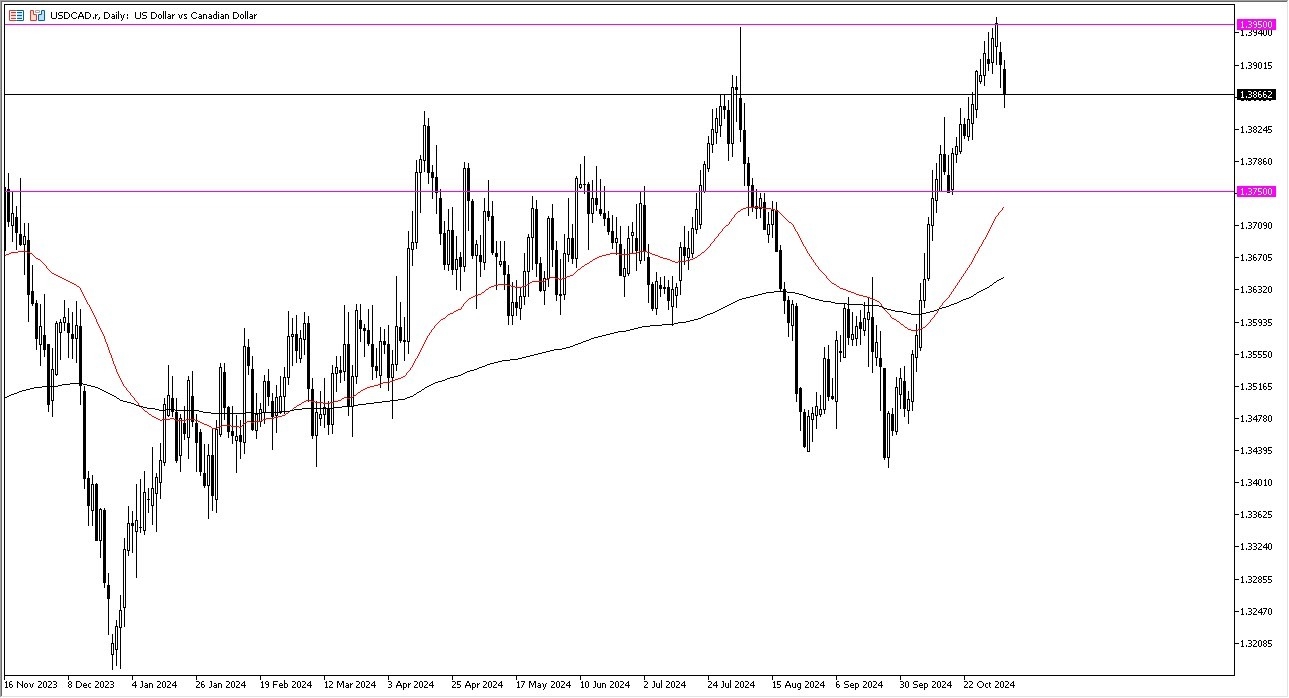

- The US dollar has fallen a bit against the Canadian dollar during the trading session on Tuesday, as the world paid close attention to the US election.

- That being said, I think the real driver here is probably people simply taking profit in a huge move to the upside.

- This is somewhat uncommon for this pair, so this is something that we need to be paying attention to, as the markets continue to see a lot of questions asked about whether or not the move can continue.

The market rallied all the way from the 1.35 level to the 1.3950 level in the course of a couple of weeks. Keep in mind that oil markets are somewhat soft, but ultimately, they are bouncing due to the fact that we had been in a two-year range and at the bottom of it. So, with that being said, I think a pullback to the 1.3750 level, then we have a massive amount of support, not only due to the previous action, but the fact that the 50 day EMA comes into the picture as well.

Top Forex Brokers

Value Hunters Will Still Influence This Pair

In general, I think this is a situation where value hunters are going to come into this market center later. If we were to break above the 1.3950 level, then the market could go looking to the 1.40 level. The 1.40 is an area that is a large round psychologically significant figure, and if we can break above there then the market really could take off. However, this is a situation where the market has been very noisy overall, but I think ultimately this is a little bit of consolidation after a huge move to the upside. I still favor the upside. I just don't favor chasing it at these higher levels, which is a situation where the market is simply overdone overall.

Ready to trade our Forex USD/CAD analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.