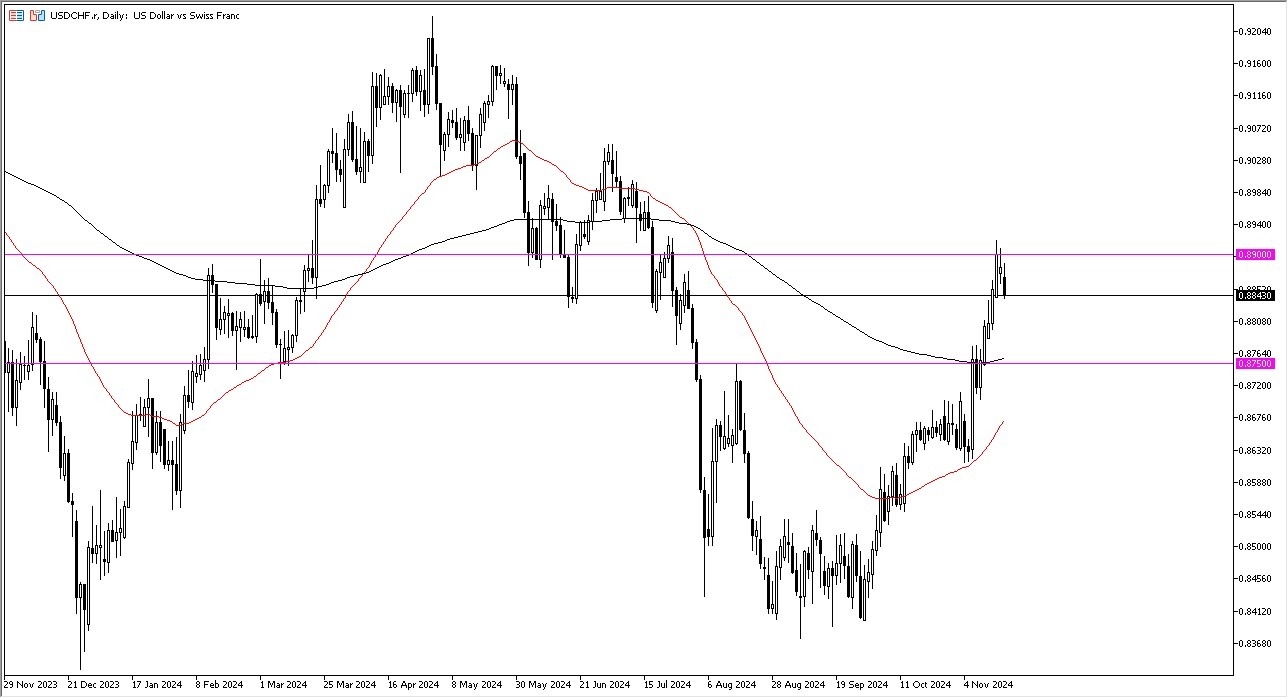

- The US dollar initially tried to bounce after gapping lower on Monday but turned around to show signs of exhaustion.

- This suggests the US dollar may be undergoing a well-deserved pullback, considering its recent upward trajectory.

- No market can go in one direction forever, so this is something that makes a lot of sense.

However, this pullback could present a buying opportunity. The 0.8750 level, where the 200-day EMA currently resides, is of particular interest. Previously a resistance level, it could now act as support. Conversely, if the market were to break above the 0.89 level, it might signal a more impulsive phase, which would be surprising given recent market dynamics, and the fact that the interest rates in the United States will continue to play a big role in what happens next. After all, this is what has set a lot of the world’s markets on fire, and is something that people will continue to focus on.

Top Forex Brokers

Is This Value? Probably. But Patience Will Be Needed.

Overall, this USD/CHF market seems poised to offer value on a dip, though it might be challenging to pinpoint the perfect entry point. I’m inclined to buy the US dollar on a pullback but remain cautious about timing. One approach I’ll avoid is shorting this market, as the Swiss franc has been struggling recently and is likely to continue facing challenges.

Given that the pair has rallied about 3.5% over two weeks, a pullback or sideways consolidation would be a natural development. I’ll be closely monitoring for a pullback as a potential opportunity to go long in this market, one that I still favor quite a bit. However, I also recognize the importance of waiting to see a bounce in order to find the necessary momentum. This market is one that is typically cautious, and one that is often going to be somewhat slow. The market is likely to see a bit of hesitation

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.