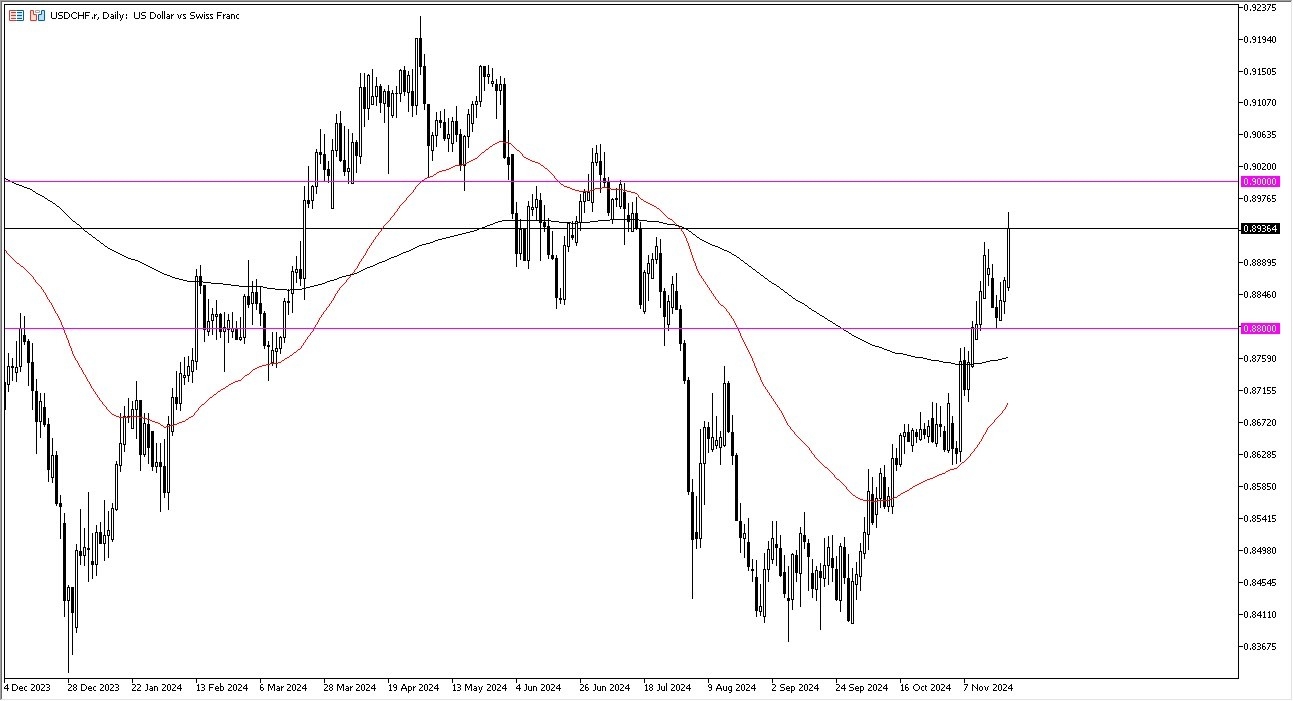

- The US dollar rallied significantly during the early hours of Friday, breaking to the upside and reaching a new high.

- In my view, short-term pullbacks present buying opportunities, with the 0.88 level likely providing strong support in this market.

- In fact, I think that is a scenario that you have to look at as a value trade.

As the interest rate differential continues to favor the US dollar over the Swiss Franc anyway. In fact, when you look around the world, it's basically the US dollar you want to own the rest of it? Not so much, and that of course will show itself in this USD/CHF pair just as it would with the euro against the dollar, the British pound against the dollar and so on.

Top Forex Brokers

A Potential Target Above?

At this juncture, I think the 0.90 level is a target that we are trying to reach. And in that environment, it's very possible that we could see a little bit of resistance. But if we were to break above there, that will kick off more FOMO trading and we could go to the 0.9150 level.

Like I said previously, the 0.88 level is an area that I do think holds that support. But if we were to break down below there, then you have to look at the 200 day EMA underneath as a potential support level as well. The impulsive nature of this move to me just screams rally for a longer term event. After all, the interest rate differential continues to pay you at the end of every day, and it’s probably worth noting that the US dollar strength is no accident.

As bond markets continue to see rising yields in America, it just makes it a better investment on the US dollar than the Swiss franc at the moment, although the Swiss franc of course is holding its own compared to some other markets.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.