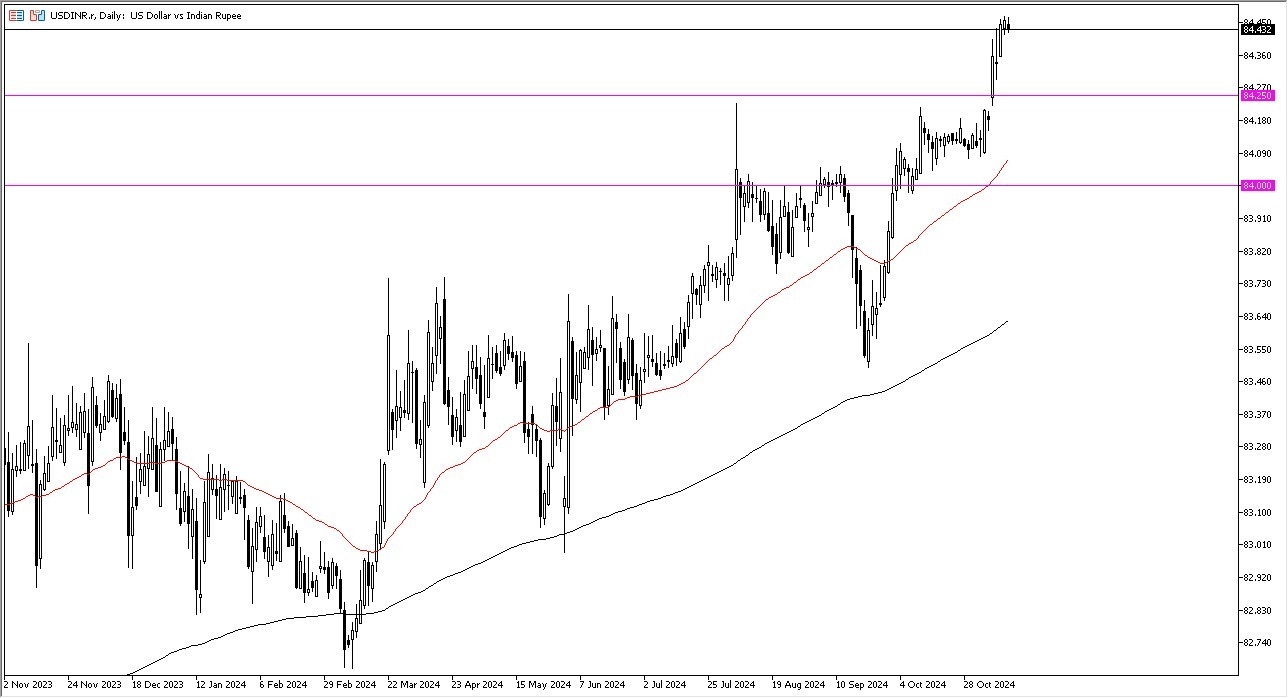

- During my daily analysis of exotic currency pairs, the USD/INR pair has been relatively quiet during the Monday and Tuesday sessions.

- Because of this, the market has the idea of the ₹84.50 level being a barrier, which makes a certain amount of sense as the Indian rupee tends to move in ₹0.25 levels.

- With this being said, we are just simply grinding a way to the upside, which makes a certain amount of sense considering that the Bank of India tends to be very active in this market, and it does tend to manage the decline of Indian rupee over the longer term, because it does assuage inflation.

The Trend Continues

The trend should continue, and I do believe that it continues to be very positive. The market pulling back at this point in time will only offer “cheap greenbacks” that a lot of people will be paying close attention to. The ₹84.25 level should be support based upon “market memory”, assuming that we can even pull back to that area. If we do, I think there will be plenty of value hunters out there willing to take advantage of this move. On the upside, the ₹84.50 level will be an area that a lot of people pay close attention to as a potential ceiling. If we break above that level, then I think you’ve got a situation where the US dollar continues to rally, perhaps on its way to the ₹85 level over the longer term.

Top Forex Brokers

Keep in mind that the US dollar is stronger against most currencies, not just the Indian rupee. Because of this, I think you have to watch the US dollar against multiple currencies before placing any trade, because once the market moves in one direction against multiple pairs, it gives you a clear sign as to what’s going on with the greenback. As things stand right now, it certainly looks like the greenback is favored against most currencies, and the Indian rupee won’t be any different as far as that is concerned.

Ready to trade our daily Forex analysis? Here’s a list of some of the best forex brokers in India to check out.