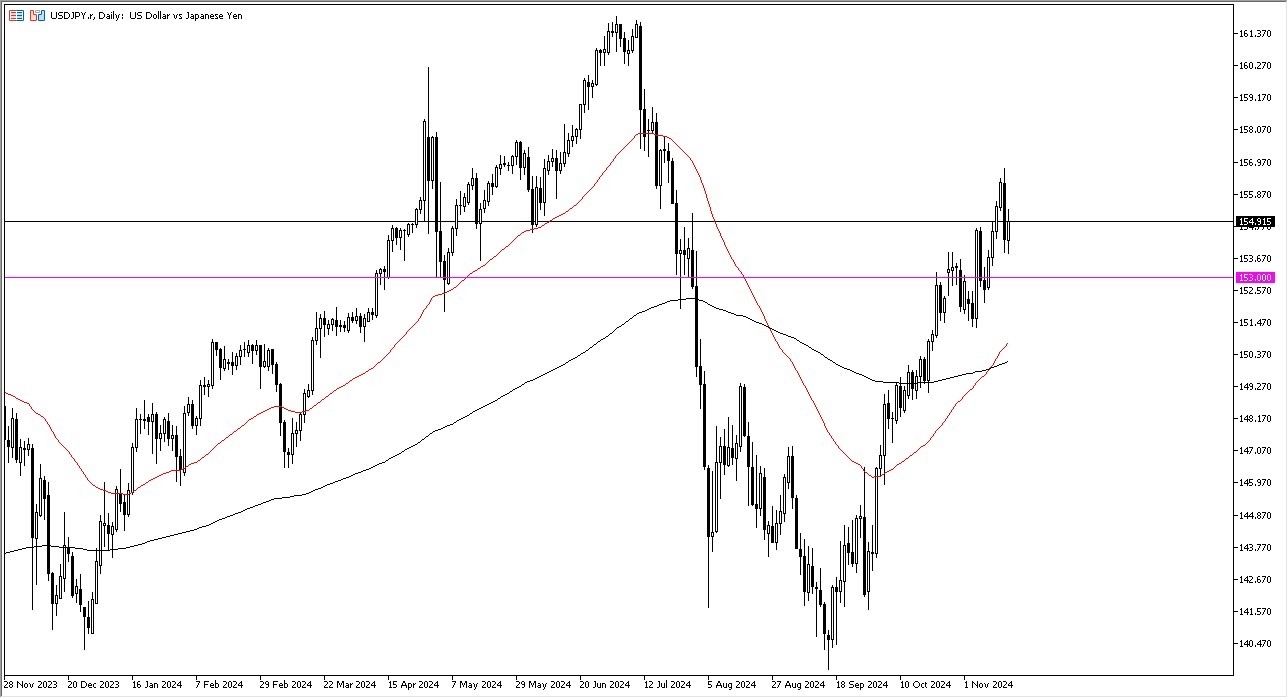

- During my daily analysis of the USD/JPY pair, the first thing I notice is that we did recover about half of the losses from the previous session, which of course is a very bullish turn of events.

- Furthermore, it’s probably worth noting that a lot of people were worried about the idea of the Governor of the Bank of Japan suggesting that the interest rate policy in Japan was about to get tighter.

- He chose not to say anything about this, and therefore it makes a lot of sense that we have seen things turn right back around.

Top Regulated Brokers

Carry Trade

Do not forget the carry trade. This of course has a major influence on what happens next, and it’s probably worth noting that most traders are very well aware of the fact that they get paid at the end of every day when they hold this pair. In fact, I think that will continue to be the story here, despite the fact that the Federal Reserve has tried to do everything it can to bring down the rates. Quite frankly, traders in the bond market don’t want to hear about it, and it has made interest rates rise. If that’s going to be the case, then the US dollar will be much more preferable than the Japanese yen going forward, which of course is settled by extraordinarily loose monetary policy.

Further bolstering the carry trade will be the technical analysis, which of course is very bullish. The 50 Day EMA has recently broken above the 200 Day EMA, kicking off the so-called “golden cross.” Furthermore, I think that the ¥153 level is an area that people will be paying close attention to, as it is a large, round, psychologically significant figure. This area should offer support, and I think that if we were to drop below it, it could change a lot of things but right now it just doesn’t look very likely to happen. Yes, we did get a massive bearish engulfing candlestick for the Friday session, but I think in the big scheme of things it won’t really matter.

Ready to trade our daily forex forecast? Here are Japan's Best Forex Brokers to choose from.