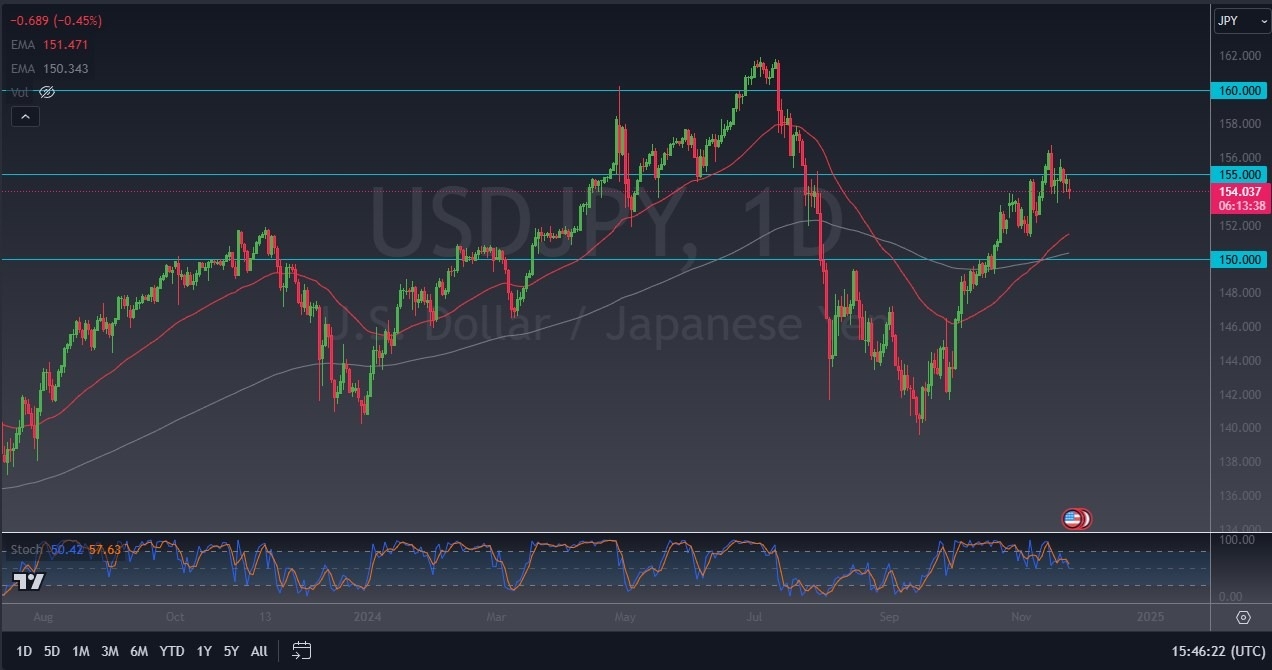

- Dear my daily analysis of the USD/JPY pair, the market has shown itself to be rather flat, which is not overly surprising, considering that we had been consolidating for a couple of weeks previously.

- The ¥155 level continues to be a bit of a barrier, but if we can break above there I think it will release quite a bit of kinetic energy in this pair.

Keep in mind that this is a market that still has a positive swap, and that will continue to be a major factor in how people approach it. After all, the Bank of Japan can do nothing to tighten monetary policy at this point, because quite frankly there is so much in the way of debt that is attached to the Japanese economy that it would completely implode domestic conditions if they approached to aggressively.

Top Forex Brokers

Technical Analysis

I believe that the ¥155 level is crucial, and if we can break above there could open up a move to the ¥160 level. The 50 Day EMA has recently broken above the 200 Day EMA, roughly at the ¥150 level, kicking off the so-called “golden cross” that a lot of longer-term traders pay close attention to. The market has been bouncing rather significantly over the last month or so, and we have seen the Japanese yen lose quite a bit of strength. Perhaps we are entering an area of digestion, which would make quite a bit of sense considering that we had reached the ¥150 level in rather short order.

Going forward, it does look like this is a “buy on the dips” type of market, with the 50 Day EMA offering potential support near the ¥151.50 level. After that, we have the 200 Day EMA sitting just above the ¥150 level, which of course is an area that would attract a lot of attention from a large, round, psychologically significant figure standpoint, and of course the same indicator that most trend followers pay close attention to over the longer term anyway. I remain bullish, but I recognize we may be a bit noisy in the short term.

Ready to trade our daily forex forecast? Here are Japan's Best Forex Brokers to choose from.