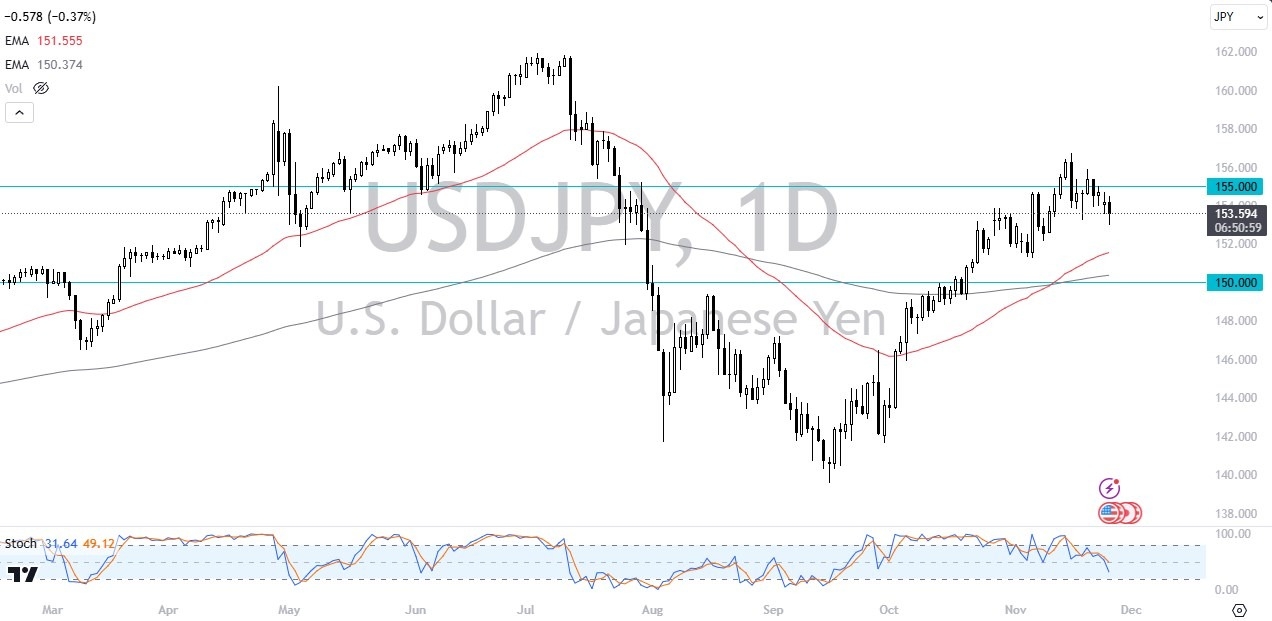

- In my daily analysis of the USD/JPY pair, the first thing that jumps out is that we continue to drift a bit lower.

- However, it has been somewhat of a controlled demolition, so I think this is just simply a little bit of profit-taking as we continue to challenge the ¥155 level.

- The ¥155 level of course is a large, round, psychologically significant figure and an area that has been important multiple times. Because of this, I think if we can finally break free of this level, then we will start to continue to see the upward trajectory going forward.

Top Forex Brokers

Short-Term Pullbacks Possible

I do believe at this point in time it’s likely that we will continue to see short-term pullbacks, but those should offer value as a lot of traders will be taking advantage of the swap at the end of the day that you get by going long the US dollar against the Japanese yen. The Japanese yen of course is considered to be a safety currency, and therefore I think you need to look at the risk appetite of traders around the world in order to see whether or not the Japanese yen will continue to fall. If we start to see stocks around the world rally, then it is more likely than not will favor this pair to go higher.

On the other hand, if we see a bit of a drop from here, we may have to challenge the ¥152 level, which sits right around the 50 Day EMA. Anything below there could open up the possibility of a move down to the ¥150 level, which I think is the bottom of the overall trend at this point. If that were to happen, we would probably see a major “risk off” scenario, where we start to see a lot of things fall apart, not just this currency pair.

Keep in mind that the Bank of Japan is essentially stuck with its monetary policy at the moment, due to the massive amount of debt that the Japanese are saddled with. With that being the case, the Japanese yen will continue to be a funding currency in general.

Ready to trade our daily forex forecast? Here are Japan's Best Forex Brokers to choose from.