- The US dollar has gotten hammered over the last couple of days against the Japanese yen, and has struggled against most currencies around the world.

- Part of this could be cooling interest rates, part of it could be just a simple profit taking move as we head into Thanksgiving in the United States, which obviously has a major influence on demand for the dollar over the next day or two. Or it could just simply be more volatility.

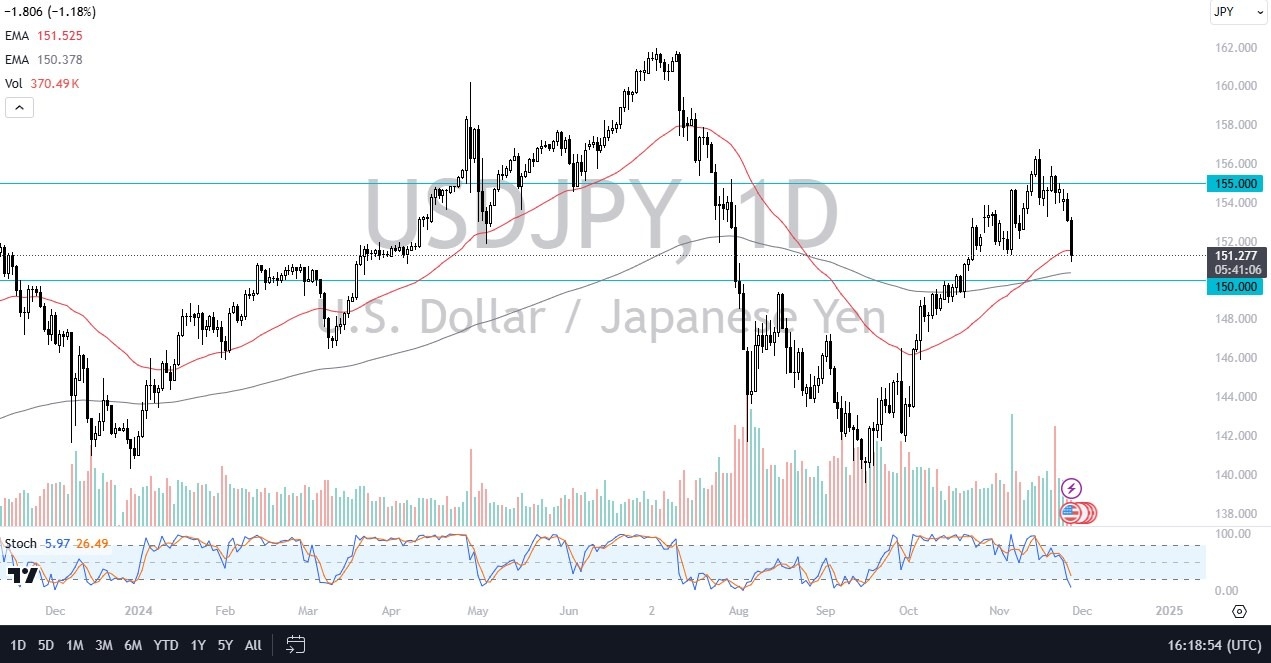

At this point, when I look at the dollar against the Japanese yen, the first thing I see is that the 150 yen level underneath is backed up by the 200 day EMA. So, I think we're getting close to an area where value hunting will begin. I would need to see a drop and then a bounce from here, perhaps something like a hammer to start to think about buying again.

Top Forex Brokers

Interest Rate Differential Still Favors America

The interest rate differential does favor the US dollar and in the longer term, that should come into the picture and start moving the market. If we were to break down below the 148 yen level, that could change everything. But until then, I think we still have a situation where the US dollar probably continues to outperform the Japanese yen over the longer term.

That being said, it really was only about two months ago that we were at 140 yen. So, it's not a big surprise to see this little bit of a pullback. I don't know that it makes any difference for the trend. I think it's a little early to call that, but when you look at a Fibonacci retracement from the entire move, the 150 yen level ties together with the 38.2% Fib. So, it's possible that might be where people get interested again. This would be a great value, assuming that the overall trend will continue over the longer term.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.