- The US dollar has bounced a bit during the early hours on Thursday, to turn things around against the Japanese yen.

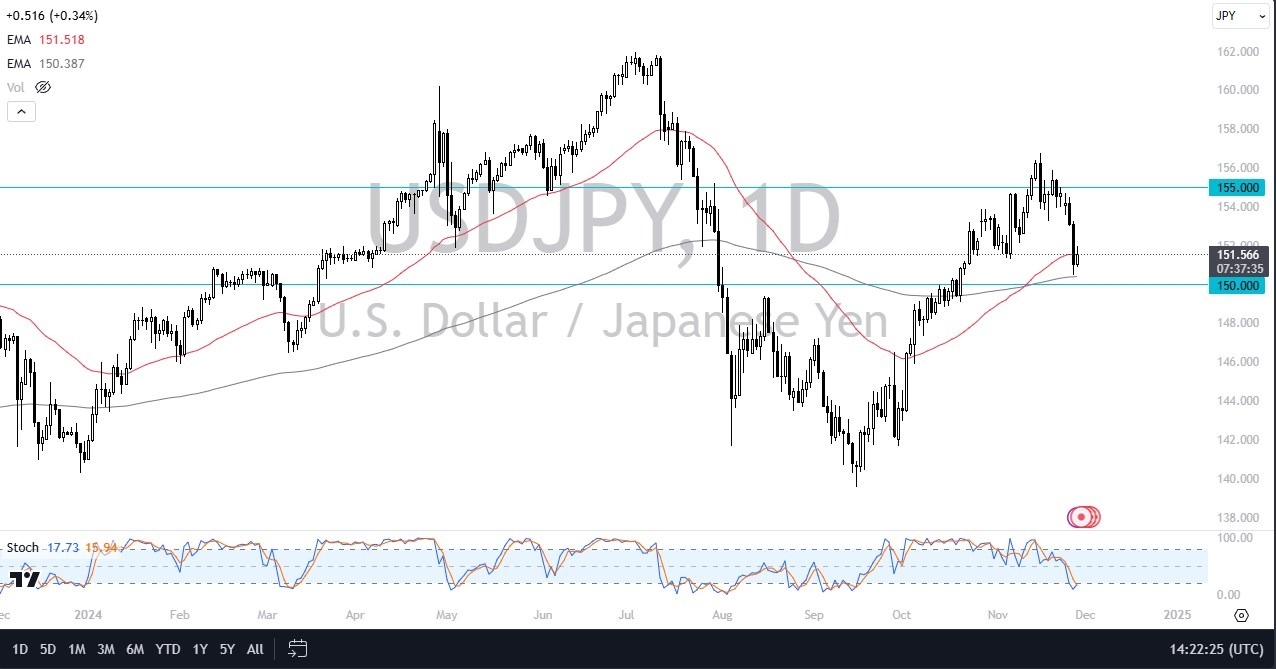

- In my daily analysis of the USD/JPY pair, the first thing that comes to my attention is the fact that we had bounce from the 200 Day EMA from the previous session, which just happens to be right above the ¥150 level.

- The ¥150 level of course is a large, round, psychologically significant figure, and it is an area that we had previously seen resistance at.

All things being equal, this is a very strong uptrend, and I think that probably continues to be the case over the longer term, because of a whole slew of fundamental reasons. With this, I think you got a situation where traders are taken advantage of the interest rate differential, in the so-called “carry trade.” The “carry trade” has lost its luster over the last couple of weeks, so what we need to see is a little bit of financial stability. There are a lot of questions as to whether or not the Bank of Japan will do something to stabilize the yen, but really at this point in time anything that the Bank of Japan does will more likely than not be somewhat lackluster.

Top Forex Brokers

Going Forward

Going forward, I think you’ve got a situation where a lot of traders will continue to look for an opportunity to take advantage of the interest rate differential, and of course try to find some type of support near the ¥150 level. The ¥150 level is a major spot on the chart, and therefore I think you’ve got a scenario where a lot of traders are going to be paying close attention to this region. You probably have a lot of options traders there as well, so that comes into the picture also.

The size of the candlestick during the trading session on Wednesday was rather brutal, but the question now is whether or not that was a bit of a “washout” for the sellers. After all, there may have been a couple of different things going on at the same time. Not only would you have people trying to take advantage of a weakening US dollar, but you might have had a lot of US-based traders just simply collecting profit before the holiday.

Want to trade our daily USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.