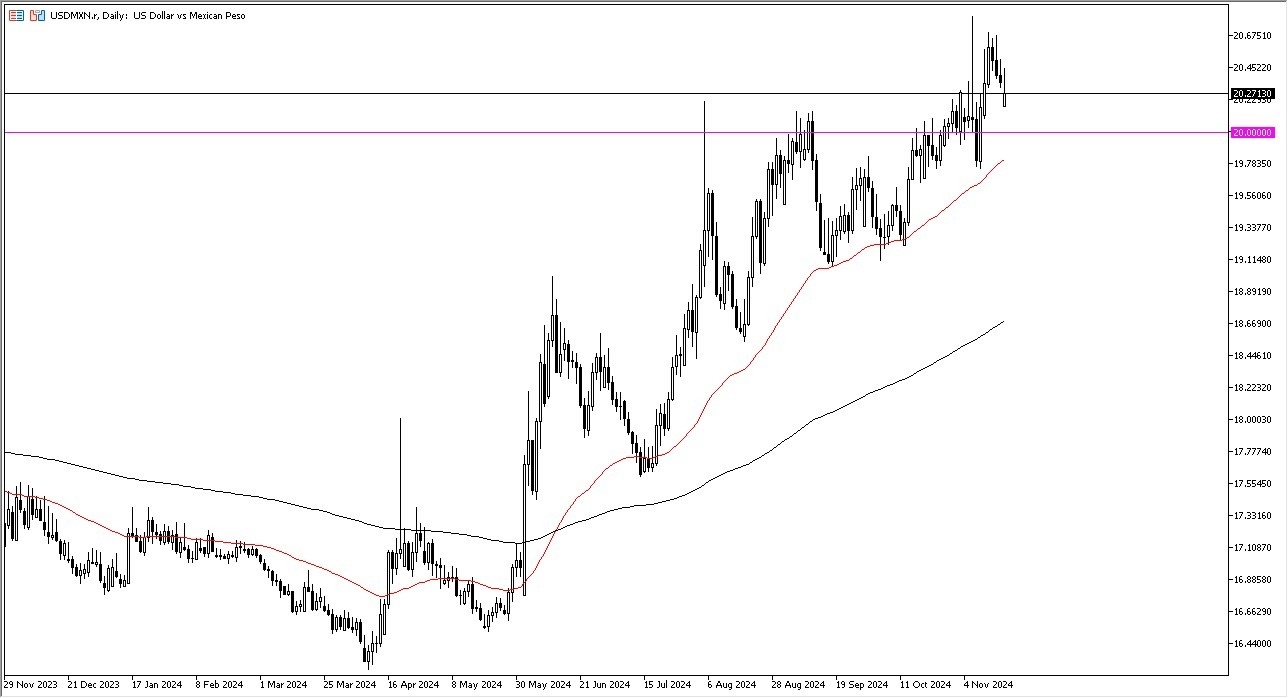

- The US Dollar gapped lower against the Mexican peso during the trading session on Monday, but then turned around to show signs of life.

- By doing so, the market reached as high as 20.50 MXN before pulling back.

- Quite frankly I think this is a situation where we will continue to see a lot of volatility, as there are a lot of questions asked about potential tariffs coming out of the United States, which of course would have a major influence on the strength of the US dollar, and of course whether or not immigration policy changes, because it will have a massive influence on what happens with the Mexican economy.

Top Forex Brokers

The Winds of Change

It is very likely that this pair will change quite drastically, due to the fact that the Trump administration will more likely than not ramp up mass deportations, perhaps at a clip of 1 million per year. This will have a major influence on remittances coming from the United States back into Mexico, as it is common practice for immigrants to cross the border, find work, and then send money back to loved ones. This has a major influence on this pair that most traders outside of North America don’t think about, and therefore it’s probably worth mentioning.

Underneath, I see the 20 MXN level as an area of extreme interest, as it is a large, round, psychologically significant figure, and an area that has seen a lot of action previously. If the market were to break down to that region, then we will see the 50 Day EMA come into the picture as well, as it is only going to reinforce the idea of of buyers in that general vicinity.

Ultimately, to the upside with the pay close attention to the 20.75 MXN level, as it was the recent swing high. If we can break above there, then the market is likely to continue going much higher, obviously targeting the 21 MXN level. Between now and then, I think the market will continue to see a lot of noisy behavior, but I still favor the upside in general.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.