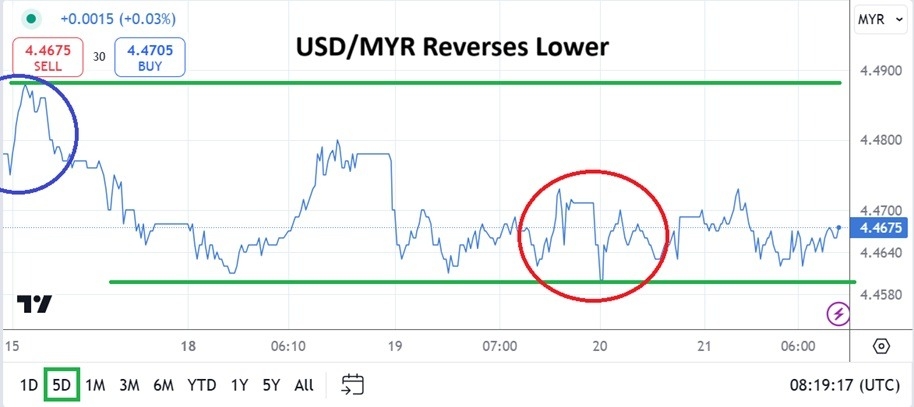

The USD/MYR has produced a reversal the past handful of days after touching a high last Thursday around the 4.4890 ratio, but the lower move can be considered fragile.

The USD/MYR is trading near the 4.4665 ratio at this moment. The currency pair touched a high last week around 4.4890 which had last been seen in the first week of August.

Top Forex Brokers

Perception about technical levels may create different viewpoints for a variety of speculators. The USD/MYR has been trading in a correlated manner to the broad Forex market. The ability of the currency pair to see a slight reversal lower in the past handful of days shows financial institutions may believe it has been overbought.

However with a look at a one month technical charts shows the USD/MYR remains within the higher realms of it is value. The comparison between a one week and one month chart highlights the anxiousness in financial institutions and day traders need to remain aware of the rather nervous sentiment that large traders are suffering. Fragile trading is dominating.

USD/MYR Lower Move and the Wait for More Impetus

The move lower is attractive for traders who believe the USD/MYR has been overbought since the end of September, but the question is if there is enough power from behavioral sentiment that will create a sustained selloff. The likelihood of a strong move lower in the near-term may be a bit too ambitious.

Day traders who want to look for more downside cannot be blamed, but until there is a momentum shift in USD centric risk adverse buying, looking for a fast ride lower in the USD/MYR may not happen. There has not been much economic data from the U.S to move sentiment this week, tomorrow there will be Manufacturing PMI reports. However, financial institutions are gearing their outlooks towards the incoming U.S White House administration and potential global trade intrigues.

USD/MYR and Support Levels as Targets

The USD/MYR did hit the 4.4600 ratio in yesterday’s trading and this may be a viable target to look for support at lower depths. The current price realm of the USD/MYR is probably going to produce a choppy range in the short and near-term, traders may be able to take advantage of the current lower realms to look for small moves higher.

Risk taking tactics should remain cautious today and tomorrow because sentiment in financial institutions remains anxious, this will create choppy conditions.

Looking for price action in a limited range may be effective, but take profit orders taking advantage of small moves will be needed to accumulate winnings.

USD/MYR Short Term Outlook:

Current Resistance: 4.4680

Current Support: 4.4640

High Target: 4.4695

Low Target: 4.4590

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.