Potential Signal:

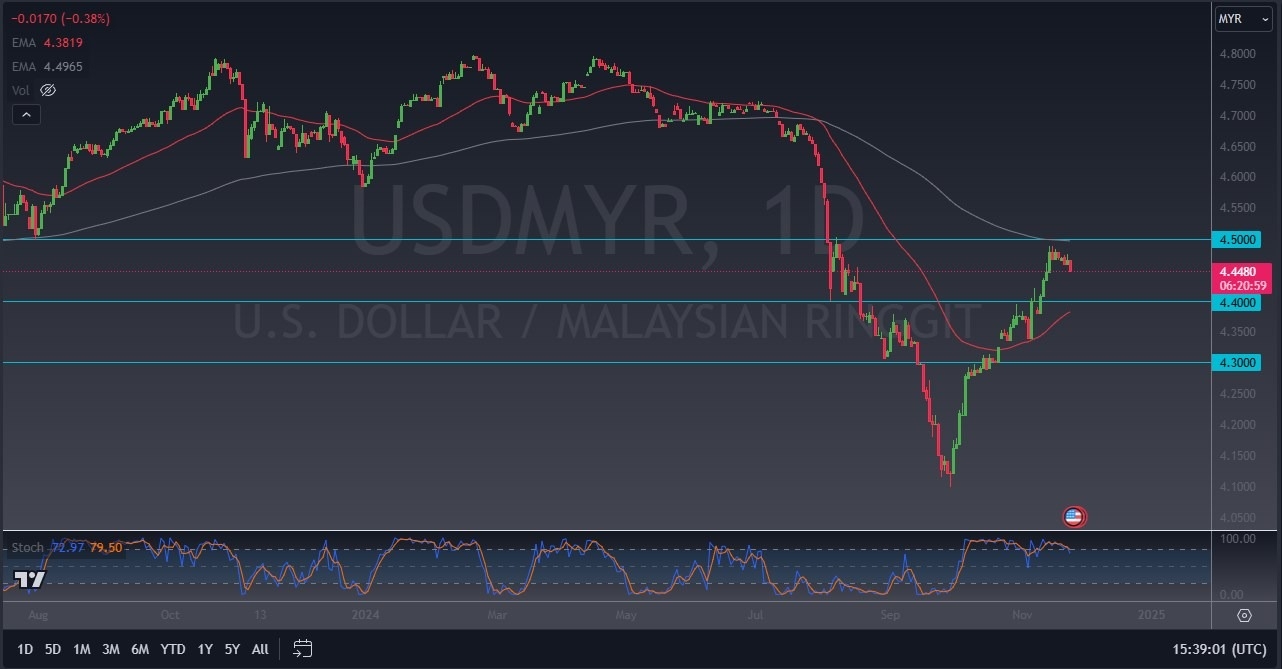

- if we can break above the 4.50 level on a daily close, I will be a buyer of this pair.

- I would have a stop loss at the 4.45 level, and be aiming for the 4.71 level.

In my daily analysis of exotic currency pairs, the USD/MYR currency pair has caught my attention due to the fact that we have a fairly significant technical set up, which I think will capture a lot of attention to those trading emerging market currencies. After all, we had reached the 200 Day EMA, which also sat right at the 4.50 level, which in and of itself would attach a certain amount of importance to itself due to the fact that it is a large, round, psychologically significant figure.

Top Forex Brokers

Underneath, we have the 4.40 level, and the 50 Day EMA is sitting right around there as well. As we are between the 50 Day EMA and the 200 Day EMA indicators, it makes a certain amount of sense that the market would be a bit noisy in this area, especially considering that the bond market has finally settled down a little bit in the United States at the same time. That being said, we have to start asking questions as to whether or not this was a significant bounce, or if it was the beginning of a trend change.

Further Technical Analysis

The further technical analysis looking at the USD/MYR exchange pair also brings to mind the stochastic oscillator, which is crossing over in the overbought condition, just as we had reached the 200 Day EMA, which is an indicator that a lot of people pay close attention to. Conversely, if we were to turn around a break above the 200 Day EMA, and by extension the 4.5 MYR level, then I think you have a major break out on your hands, and it’s very likely that the US dollar will continue to swallow other currency such as the Malaysian ringgit.

If we break down below the 4.40 level and the 50 Day EMA, then it’s likely that we continue to see a lot of downward pressure, and we might see the US dollar starts to lose a lot of value against multiple currencies, and not just the Malaysian ringgit. In other words, this could be a bit of a harbinger for multiple currency pairs.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Malaysia to choose from.