Potential signal:

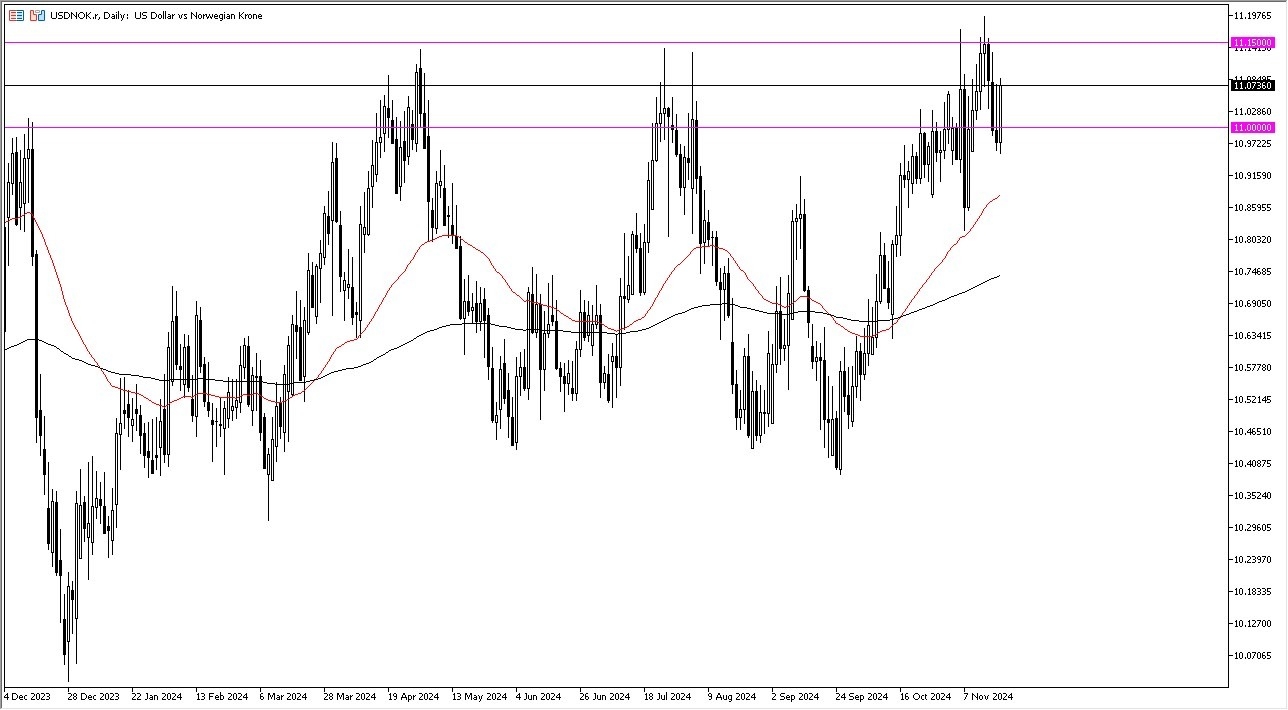

I am a buyer of the USD/NOK pair at 11.16 level, with a stop loss at the 11.06 handle. I would be aiming for a move to the 11.40 NOK above.

- In my daily analysis of exotic currencies, the USD/NOK level has captured my attention as we had initially dipped below the 11 NOK level, only to turn around and jump to the 11.07 NOK level by the time New York had gotten on board.

- With this being the case, it does look like the US dollar is going to continue to steam higher, especially against some of these smaller currencies such as the Norwegian krone.

All things being equal, this is a market that has been very noisy as of late, and it certainly looks as if the 11.15 NOK level is an area that I think a lot of people will be paying close attention to.

Top Forex Brokers

This has been a major resistance barrier multiple times, so I think if we do break above there, then it will likely open up the possibility of a much bigger move, and it would probably show the US dollar strengthening against most currencies, especially Scandinavian ones, as they all tend to end up moving in the same direction against the greenback.

Technical Analysis

The technical analysis for the USD/NOK pair is very strong, and it’s obvious to me that the 11.15 NOK level is an area that we need to pay close attention to. If we can break above that level, then I think it opens up a move to the 11.50 NOK level, which is the next large, round, psychologically significant figure.

The 11 NOK level underneath continues to be important and is probably worth noting that the 50 Day EMA is sitting right around the 10.90 NOK level and rising. The 200 Day EMA is near the 10.73 NOK level and rising as well, so we have a lot of things that come into the picture and offer plenty of support even if we do get some type of pullback. Nonetheless, I think we’ve got a situation where if and when we finally get a bit of momentum, it should just have quite a bit of follow through as “FOMO trading” may come into the picture.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.