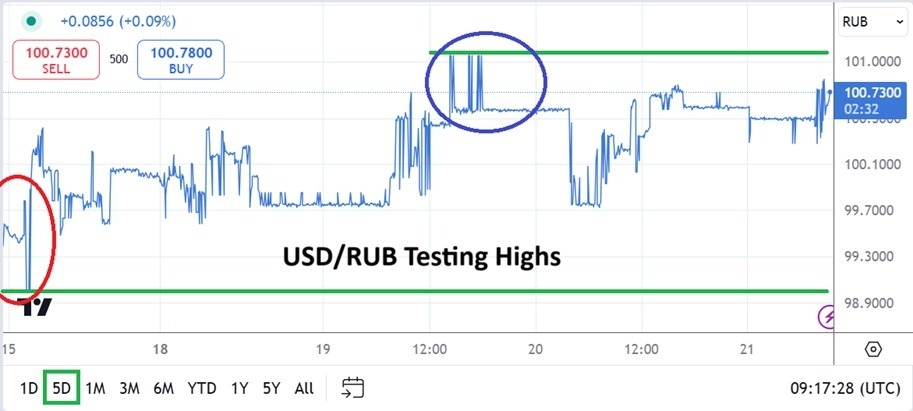

The USD/RUB continues to challenge higher price levels and yesterday’s value 101.0760 approached levels not seen since October 2023, and the currency pair remains within an apex speculative realm.

This morning’s trading in the USD/RUB continues to see the currency pair remain within sight of the 101.0000 ratio at values are tested. There is a large spread in the currency pair that speculators will need understand immediately when trying to pursue wagers. The bids and asks within the USD/RUB are wide and this is because of geopolitical noise coming from the Russia Ukraine conflict which has grown more threatening the past few days.

Top Forex Brokers

The USD/RUB does not have a lot of volume to begin with in Forex, and brokers who offer the currency pair to retail traders will be watching the values closely today to make sure the spreads for traders leave enough room to withstand potential volatility for their companies. This means day traders need to also be careful and use entry price orders when pursuing the USD/RUB to receive a realistic price fill.

USD/RUB and Tensions Escalating

Before a trader decides to bet wildly on the USD/RUB becoming increasingly bullish they should consider that the Russa Ukraine war has been taking place for a while. The increased tension around the conflict is real, but it also includes saber-rattling which might not be acted upon. Yes, the USD/RUB is challenging higher apex levels not seen in a year. And the USD/RUB traded much higher in the early days of the Russia Ukraine war, when the currency pair surged above 133.000 in late February of 2022. However, betting on wild fluctuation upwards could prove to be costly endeavors because they may never materialize.

The USD/RUB has shown a sincere ability to correlate for long durations with USD centric notions in global Forex. The run higher in the USD/RUB in recent trading could also be argued to have been affected by the stronger USD across the board. However, that is likely only part of the story, but it is hard to know the exact dynamics regarding the Russian Ruble unless you are an insider. The escalating tensions between Russia and Ukraine may boil over into unwanted destruction, but they also might deescalate.

USD/RUB Wagering and Behavioral Sentiment

Traders of the USD/RUB must pay attention to news developments. And traders need to make sure they are not overreacting to emotions, which financial institutions may not consider as threatening for the value of the USD/RUB. Speculation in the USD/RUB at this time is interesting for those who have a taste for adventure, but they should also have strong stomachs to handle the potential volatility.

- The USD/RUB did trade near the 99.7000 support level quite a bit this week too, meaning if things get quieter that lower levels could be quickly tested. Again be careful of the spread in the USD/RUB that is being offered.

- Looking for upside with take profit targets may be the choice for many bets, and it is unlikely that a sustained strong move lower is going to develop in the near-term.

- Risk management is essential for the USD/RUB.

USD/RUB Short Term Outlook:

Current Resistance: 101.3500

Current Support: 100.7000

High Target: 102.0000

Low Target: 99.9000

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.