- During the early hours on Thursday, we saw the US dollar rally and reach towards the 97.5 level only to turn around and show signs of weakness.

- All things being equal, this is a market that has a massive amount of resistance at that level but underneath we have a major support level in the form of the 94 level.

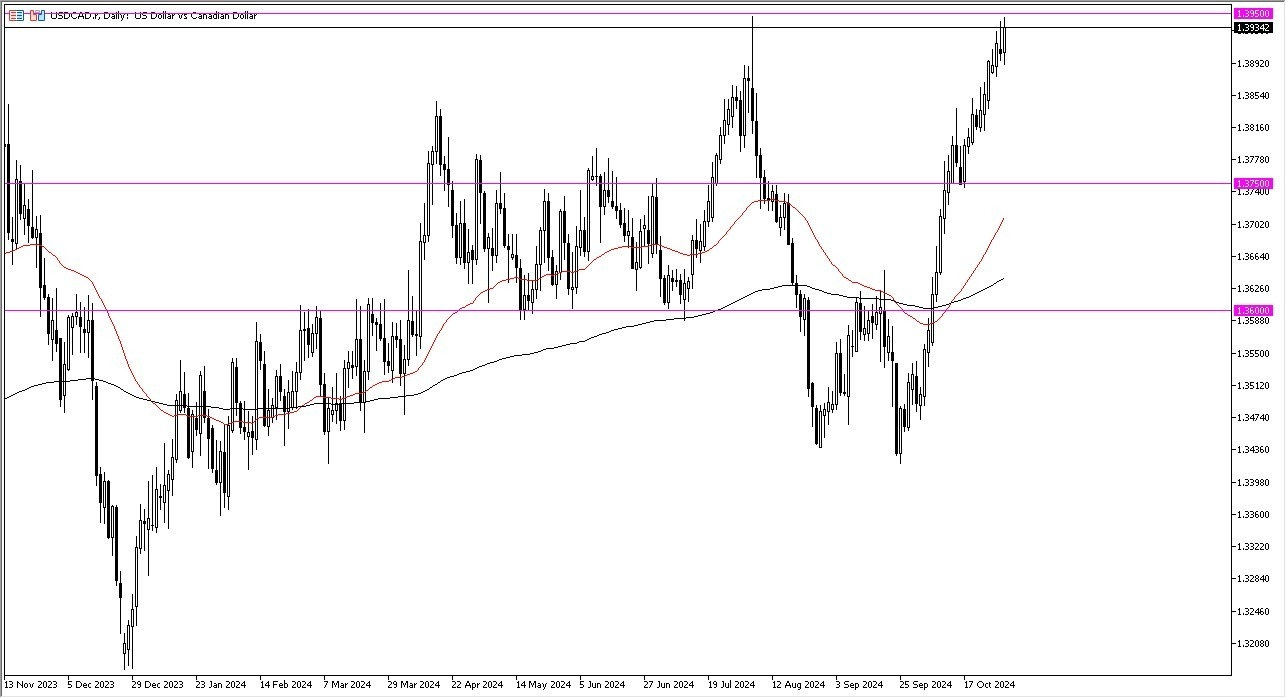

- This is an area that has been very tough to overcome.

Furthermore, we also have the 50 day EMA racing towards that area offering a certain amount of support. So, I think it all ties together quite nicely for a continuation of the consolidation. Obviously, we have been very bullish for a while. So, to work off some of the excess froth would not be a huge surprise. If we do break above the 97.50 level, then the so-called measured move would be for this pair to reach the 101 level. All things being equal, I do think that will happen, but keep in mind that Friday is the non-farm payroll announcement and that of course will have a major influence on the greenback. As goes the bond market and more importantly the bond yields, so goes the greenback.

Top Forex Brokers

Don’t Forget the Influence of Oil on the Ruble

Oil has been very soft and that has not been a friend to the Russian ruble, nor has it been a friend to the Russian economy, but quite frankly at this point I think we are reaching an area where a bigger decision needs to be made and that might be what we are in the midst of watching right now. Again, the jobs number on Friday will be crucial so we need to pay close attention to it. If America produces a blowout number, it is possible that people may run to the US dollar in general, and smaller currency pairs like this one will feel a somewhat outsized effect.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out