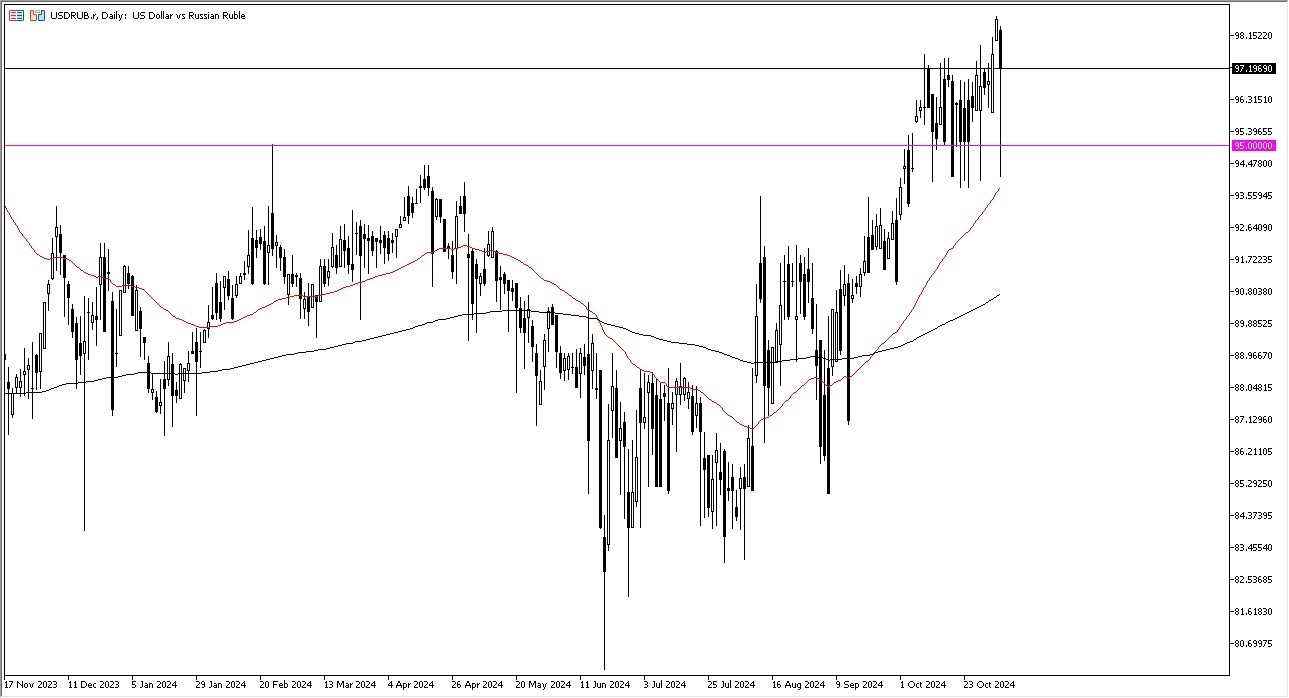

Potential signal:

- On a move above 98.77, I am a buyer of this pair.

- I would have a stop loss at the 96 level but would aim for the 99.85 level.

The US dollar fell pretty significantly during the trading session on Tuesday to plunge below the 95 ruble level only to turn around and show signs of support. All things being equal, this is a market that continues to see a lot of choppy behavior and consolidation after a massive move to the upside. This is a situation where traders will continue to have to be somewhat cautious, especially with the scenario with the election and the Federal Reserve all coming into the picture.

Top Forex Brokers

The USD/RUB market tested the 50-day EMA during the trading session before turning around, but it's probably worth noting that the 94.33-ish area has been support multiple times. All things being equal, the market does look like it is trying to do everything it can get to the 100 ruble level, and if we can break above there, then we could see a blast to the upside.

Oil and the Ruble

Keep in mind that the Russian ruble is highly influenced by oil, but it's also influenced by all of the sanctions. And then again, of course, we have the US dollar moving based on elections. The noise is coming after that. Furthermore, on Thursday, we have the Federal Reserve interest rate decision coming on Thursday. So that has a major influence as well.

In general, I think it continues to be very choppy. The US dollar being more of a safety currency than the Russian ruble, obviously. And therefore, I think between that and the bond market showing yields going higher, regardless of what the Fed does, it's likely that the US dollar will continue to be favored over the Russian ruble. This will be especially important to watch, as the situation in Ukraine and the oil markets both have a major influence on what happens next. That being said, the market will also look at the risk appetite overall to get a gauge on what happens next.

Ready to trade our daily Forex signals? Here’s a list of some of the top forex brokers in Russia to check out.