Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 34.15.

- Set a stop-loss order below 33.90.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 34.35.

Bearish Entry Points:

- Place a sell order for 34.32.

- Set a stop-loss order at or above 34.51.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.99.

Turkish lira Analysis:

The USD/TRY pair has maintained its stability over the past week and the beginning of this week. The Lira has stabilized amid support from the Turkish Central Bank and government banks in the country, which have pumped millions of dollars into the market. Furthermore, the Lira has not declined against the dollar despite the rise of the dollar globally following Trump's victory in the US elections.

Over the end of last week and the beginning of this week, investors followed a series of data released from Turkey which, despite its importance, will not have a significant impact on the trajectory of the Turkish Lira, which moves through a process managed by the Turkish authorities. Furthermore, the most prominent data released was about the increase in the total reserves of the Turkish Central Bank, which reached its highest level ever in the week ending November 1st. Also, total reserves increased compared to the previous week, from $159.3 billion to $159.6 billion. Simultaneously, net reserves recorded an increase from $60.9 billion to $61.2 billion. Net reserves, excluding foreign exchange swaps, also increased to $45.7 billion during the same period. Similarly, gold reserves increased by $720 million to reach $66.61 from $65.89 billion.

In other data, the Turkish Statistical Institute announced that the unemployment rate remained stable at 8.6% in September 2024, despite an increase of 95,000 in the number of unemployed, bringing the total number of unemployed in the country to 3.2823 million. The figures showed an increase in the number of unemployed among the working age group of 15 years and over to 3.1%, while job opportunities increased by 35,000 compared to the previous month.

Top Forex Brokers

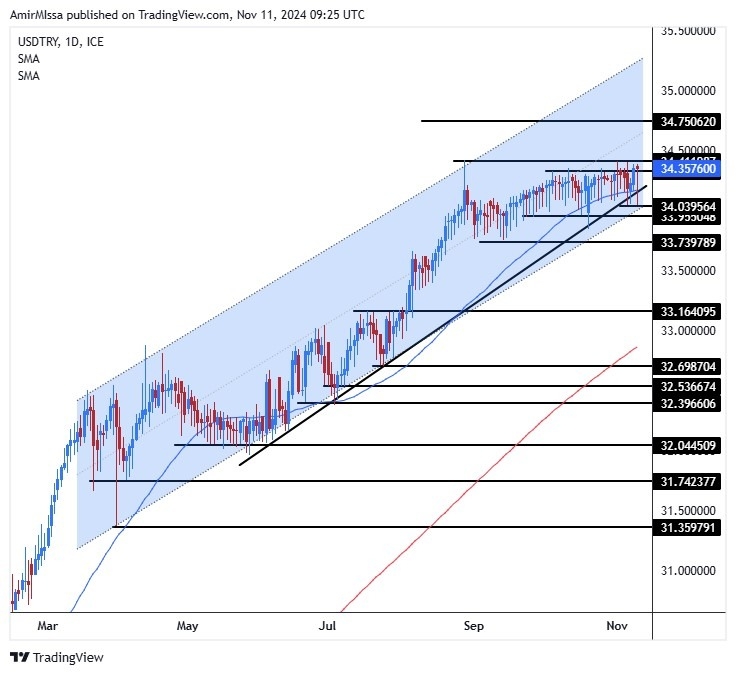

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair stabilized at the beginning of the weekly trading, with no significant changes compared to the levels of the previous week. The pair moved around an average of 34.20 Lira, supported by the upward trend line shown by the chart. Also, the 50-period moving average on the 4-hour timeframe represents strong support levels, along with the price moving within an upward price channel. The pair is dominated by volatility in the medium term, while in the long term, the price trades above the 50 and 200-day moving averages, respectively. In general, the expectations for the Turkish Lira price still include an increase with every decline in the dollar, which represents an opportunity to buy again.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.