Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 34.25.

- Set a stop-loss order below 34.05.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 34.75.

Bearish Entry Points:

- Place a sell order for 34.75.

- Set a stop-loss order at or above 34.90.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.45.

Turkish lira Analysis:

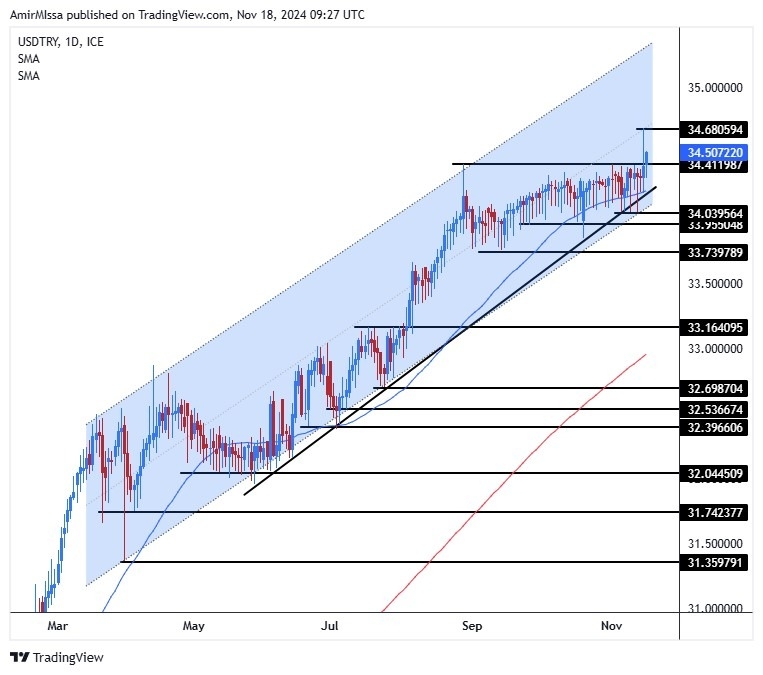

Recently, the dollar has appreciated against the Turkish lira at the beginning of this week's trading, after the pair recorded record levels during last Friday's trading, pushing the pair out of the limited trading range within which it had stabilized for several weeks. The previous peak for the pair was at 34.41 lira against the dollar, before the pair recorded new levels on Friday at 34.68 lira, while at the time of writing this report, it was trading at 34.50 lira.

The lira's movement came from the financial authorities in the country, which effectively control the lira's movements. Moreover, as discussions continue about increasing the minimum wage in Turkey for two months, as about 10 million people depend on these wages. The issue is politically sensitive, as an increase affects inflation and reflects voter satisfaction with the government. Currently, the minimum wage is 17,002 Turkish lira (about $490). Estimates indicate that a 25% wage increase may be possible, but exceeding this limit could threaten price stability.

Mehmet Simsek, the current finance minister, is a key figure in addressing inflation. Also, Simsek is distinguished by his ability to pass decisions that overcome economic challenges calmly. Furthermore, despite the conflict between his policies and President Erdogan's vision regarding the impact of interest rates on inflation, he is allowed to work independently for now. As December approaches, negotiations between unions, employers, and the government on wages are expected to intensify. Meanwhile, Simsek asserts that the priority is to achieve price stability, experts indicate that any significant increase could increase inflation, which fell to 48.6% in October after peaking in May.

It is worth noting that inflation rates have slowed down in terms of the rate of decline in recent months, which prompted the Turkish Central Bank to revise its inflation forecasts for the current and coming year.

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair rose on Monday morning, as the pair extended its rise within the overall upward trend that dominates the dollar's movements against the lira. The pair relies on the ascending trendline as well as the 50-day moving average, which are the best resistance levels for the pair. At the same time, the price movement within an ascending price channel supports the upward trend. The Turkish lira price forecast includes a rise in the pair with every dollar decline, which represents an opportunity to buy again with the aim of reaching the previous peak at 34.68 lira and 34.75 lira.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from.