Fundamental Analysis & Market Sentiment

I wrote on 27th October that the best trade opportunities for the week were likely to be:

- Long of Gold in USD terms following a daily close above $2,750. This set up at Tuesday’s close and produced a loss over the rest of the week of 1.37%.

- Long of the S&P 500 Index following a daily close above 5,878. This did not set up.

The weekly loss of 1.37% equals 0.68% per asset.

Last week’s key takeaways were:

- US Core PCE Price Index – this crucial inflation indicator came in as expected at a month-on-month increase of 0.3%.

- US Non-Farm Employment Change and Average Hourly Earnings – average hourly earnings came in a fraction higher than expected, at a month-on-month increase of 0.4%, and this would have been hawkish for the Dollar, but the jobs data was far worse than expected, barely showing an increase when over 100k net new jobs were expected.

- US JOLTS Job Openings – this was also much worse than expected, showing about half a million fewer new jobs than expected.

- US CB Consumer Confidence – this was much better than expected.

- German Preliminary CPI – this was notably higher than excepted, showing a month-on-month increase in prices of 0.4% when only 0.2% was anticipated. This is a little hawkish for the ECB’s interest rate.

- Bank of Japan Policy Rate and Monetary Policy Statement and Outlook Report – there were no surprises here.

- US Advance GDP – this came in a bit lower than expected, at an annualized 2.8% compared to the consensus forecast of 3.0%.

- Australian CPI – this saw a stronger than expected drop in the annualized rate, from 2.7% to 2.1%. The Australian Dollar is already weak, if it were not, it might have become so.

- Swiss CPI – this was a fraction lower than expected, at a deflation of 0.1% month-on-month, while no change in prices was expected.

- Chinese Manufacturing PMI – this was marginally stronger than expected.

- Canadian GDP – flat as expected.

- US ISM Manufacturing PMI – a little worse than expected.

- US Employment Cost Index – a little lower than expected, which makes sense as the number of new jobs created seems to be falling strongly indicated by other USA data.

- US Unemployment Claims – very slightly better than expected.

Top Forex Brokers

The Week Ahead: 4th – 8th November

The coming week’s schedule is shorter but includes two items that have the potential to make a very big impact, both elections and an anticipated FOMC rate cut in the USA. There will also be central bank policy meetings in the UK and in Australia.

- US Presidential and Congressional Elections

- US Federal Funds Rate and FOMC Statement

- Bank of England Official Bank Rate, Votes, Monetary Policy Statement and Report

- Reserve Bank of Australia Cash Rate, Rate Statement, and Monetary Policy Statement

- US ISM Services PMI

- US Unemployment Claims

- Canada Unemployment Rate

- New Zealand Unemployment Rate

Monthly Forecast November 2024

For the month of November, I make no monthly forecast, as the long-term trends in the Forex market are too unclear.

I forecasted that the EUR/USD currency pair would rise in value during October. Its performance was as follows:

Weekly Forecast 3rd November 2024

I made no weekly forecast this week, as there were no unusually strong directional price movements over the past week, which is the basis of my weekly trading strategy.

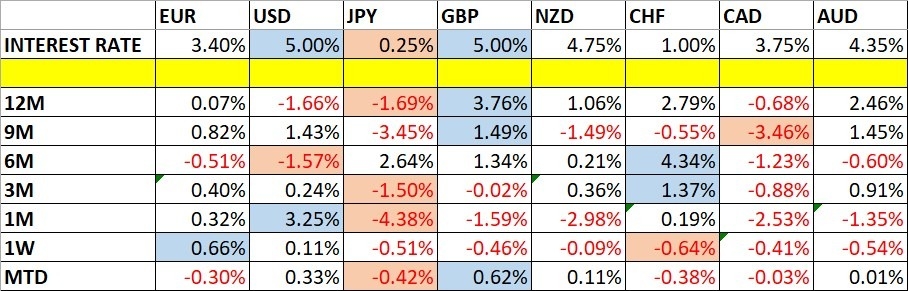

Last week, the Euro was the strongest major currency, while the Swiss Franc was the weakest.

You can trade these forecasts in a real or demo Forex brokerage account.

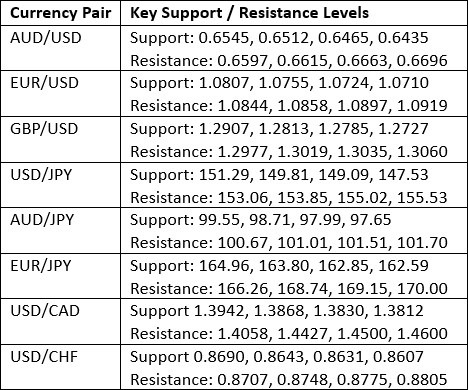

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bullish pin bar type candlestick which rejected the resistance level at 104.15. The Dollar has been rising for a few weeks, and continued to trade quite bullishly last week, but was held by that key resistance level.

The price is above its level from three months ago, but below its level from six months ago, suggesting a long-term mixed trend in the greenback, which suggests uncertainty.

It is also worth noting that despite the recent bullish momentum, the price is trading right in the middle of a consolidating triangle chart pattern. This is suggestive of ultimately ranging behaviour.

This week's outlook for the US Dollar is very unclear, as there are two huge events taking place this week: the US elections, which will see a new President elected and might see either or both Houses of Congress change hands too. After that, the US Federal Reserve will be holding a policy meeting at which it is almost unanimously expected to cut rates by 0.25%.

I recommend being very careful in trading the US Dollar long this week, and to wait until the US election result becomes clear.

EUR/USD

I expected the EUR/USD currency pair to have potential resistance at $1.0897.

The H1 price chart below shows how the price action rejected this resistance level with a large inside bar, marked by the down arrow within the price chart below. This rejection occurred during the overlap of the London / New York sessions, right at the start of the New York session last Friday as crucial US economic data was released. This can often be a great time to find reversals in major currency pairs such as this one.

This trade has not quite reached a floating profit as large as the risk, if they stop was placed just above the swing high which was at the high of the week.

This currency pair is likely to be affected by the US election results which will begin to emerge at the end of Tuesday, as well as Eurozone and US economic data. A Harris victory in the Presidency will likely see the price rise, and there could be some legs in that as Trump is currently a marginal favourite in the betting markets, so the surprise momentum could be on the Harris side.

AUD/JPY

I expected the AUD/JPY currency cross to have potential support at ¥99.55.

The H1 price chart below shows how the price action rejected this resistance level with a large inside bar, marked by the up arrow within the price chart below. This rejection occurred during the overlap of the London / New York sessions last Thursday, right at the end of the London session.

This trade has not quite reached a floating profit as large as the risk, if they stop was placed just below the swing low which was at the low of the week.

Both the Australian Dollar and the Japanese Yen have been relatively weak currencies recently, so don’t expect to see exceptionally directional movement here. Instead, it will likely be a good environment to trade reversals from support and resistance levels.

XAU/USD

I have been bullish on Gold for weeks as it has continued to make bullish breakouts to new highs. The upwards trend which got strong a few weeks ago has produced a very profitable trade on the long side for trend traders.

Many assets reversed strongly last week against a resurgent US Dollar at the end of last week, and Gold was no exception as it fell quite strongly after making a new record high on Wednesday. However, Gold has fallen by less than many other assets, which suggests a residual strength in the precious metal.

Despite Gold's reputation as a risk hedge, historically, the price of Gold has tended to be positively correlated with major stock market indices.

Gold could move quite strongly over the coming week as markets digest the US elections on Tuesday and the FOMC meeting which is expected to produce a rate cut after that. I think Gold will be more likely to rise strongly if initial results suggest a Trump victory for the Presidency rather than a Harris one, simply because Trump will probably boost risk-on sentiment.

I still see Gold as a buy, but only following a daily close at a new record high closing price above $2,787.

S&P 500 Index

Despite making a new record high two weeks ago, the rise in this major stock index seems to have run out of momentum, at least for the time being. The price action last week was bearish, suggesting that the price has further to fall.

The next step for this equity index is likely to be the result – or at least the initial result – of the US Presidential election this Tuesday. Betting markets are narrowly favouring Trump, although the polls are extremely close. Betting markets saw a small but significant swing towards Harris over the weekend.

A Trump victory is more likely than a Harris victory to produce a strong bullish move here, although any new President tends to enjoy a bullish domestic stock market for a while.

Due to the long-term bullish picture and the upcoming US election, I will be eager to enter a new long-trade here if we get a daily close at a new all-time high above 5,878. I will be more confident in this trade if Trump wins or seems likely to win when the new high closing price is made.

There could be good support around 5,680 which might produce a significant bullish bounce, possible even to new high prices.

Bottom Line

I see the best trading opportunities this week as

- Long of Gold in USD terms following a daily close above $2,787.

- Long of the S&P 500 Index following a daily close above 5,878.

Ready to trade our Forex weekly forecast? Check out our list of the best Forex brokers.