AUD/USD

The Australian dollar has been all over the place during the course of the week, as we had broken above the 50 Week EMA, then turned around to drop to the 0.65 level. All things being equal, this is a market that has been very noisy, and of course has a major influence put upon it by risk appetite, so with this being the case I think we have a situation where we are still trying to search for the bottom near the 0.65 level, so as long as we can stay above there, there might be traders willing to jump in and “by the dips” for short-term trades.

The Australian dollar has been all over the place during the course of the week, as we had broken above the 50 Week EMA, then turned around to drop to the 0.65 level. All things being equal, this is a market that has been very noisy, and of course has a major influence put upon it by risk appetite, so with this being the case I think we have a situation where we are still trying to search for the bottom near the 0.65 level, so as long as we can stay above there, there might be traders willing to jump in and “by the dips” for short-term trades.

USD/CAD

The US dollars been all over the place against the Canadian dollar, as we got both the Federal Reserve interest rate decision, and the Canadian employment figures this week. Furthermore, we also got the results of the US election which seems to be very pro-dollar at the moment. We are currently at the top of a larger range, between the 1.3450 level in the 1.40 level above. As we are threatening the 1.40 level, keep in mind that a break above that level would be a major turn of events and could send in a lot of “FOMO traders” try to take advantage of it. Because of this, I think you need to watch this pair very closely, but if we do pull back from here, there should be plenty of support near the 1.38 level.

Top Forex Brokers

NZD/USD

The New Zealand dollar has been all over the place during the course of the week, as we continue to see a lot of noisy behavior. It’s probably worth noting that we are hanging around the crucial 0.60 level, which of course is a large, round, psychologically significant figure, but I also recognize that the true support from a longer-term standpoint is down at the 0.5850 level. In other words, we are getting fairly close to a point where the New Zealand dollar might become “too cheap.”

NASDAQ 100

The NASDAQ 100 has shot straight up in the air during the course of the week, as we continue to see a lot of bullish pressure, as the Federal Reserve cutting rates has boosted the market, right along with the idea of the US election having people willing to come in and buy stocks, as well as jumping in and taking a lot of risk in most markets. With this being the case, I think this continues to be a “buy on the dips” type of stock market.

WTI Crude Oil

The West Texas Intermediate Crude Oil market has gone back and forth during the course of the trading week, as we are closing out near the $70 level. Furthermore, the $65 level underneath will continue to be a major support level, as it has been important over the last 2 years. As long as we can stay above there, then it’s likely that there will be plenty of value hunters willing to jump in and pick oil out. If we were to break down below there, it would be a major disaster just waiting to happen. On the other hand, the market were to break above the $75 level, then we could see a shot toward the $82.50 level.

AUD/USD

The Australian dollar initially rallied a bit during the course of the trading week, reaching near the ¥102.50 level. By doing so, this is a market that I think will continue to see a lot of volatility, but the fact that we ended up forming the candlestick as we have, and the fact that we are sitting at the ¥100 level suggests that we could see buyers jump in as well. All things being equal, this is a market that will be paying close attention to risk appetite, which will make this go up and down. I do think that there are buyers underneath, but it is going to be a very noisy course of events.

The Australian dollar initially rallied a bit during the course of the trading week, reaching near the ¥102.50 level. By doing so, this is a market that I think will continue to see a lot of volatility, but the fact that we ended up forming the candlestick as we have, and the fact that we are sitting at the ¥100 level suggests that we could see buyers jump in as well. All things being equal, this is a market that will be paying close attention to risk appetite, which will make this go up and down. I do think that there are buyers underneath, but it is going to be a very noisy course of events.

CAC 40

The Parisian CAC 40 initially rallied during the week to test the 50 Week EMA, before turning around and breaking down significantly. At this point, it looks like the market is trying to hang around the €7300 level, which of course is an area that is important. After that, we also have the €7000 level that could offer a significant amount of support as well. On the other hand, if we were to turn around a break above the top of the candlestick for the week, it could open up more buying pressure to send this market toward the €7750 region.

The Parisian CAC 40 initially rallied during the week to test the 50 Week EMA, before turning around and breaking down significantly. At this point, it looks like the market is trying to hang around the €7300 level, which of course is an area that is important. After that, we also have the €7000 level that could offer a significant amount of support as well. On the other hand, if we were to turn around a break above the top of the candlestick for the week, it could open up more buying pressure to send this market toward the €7750 region.

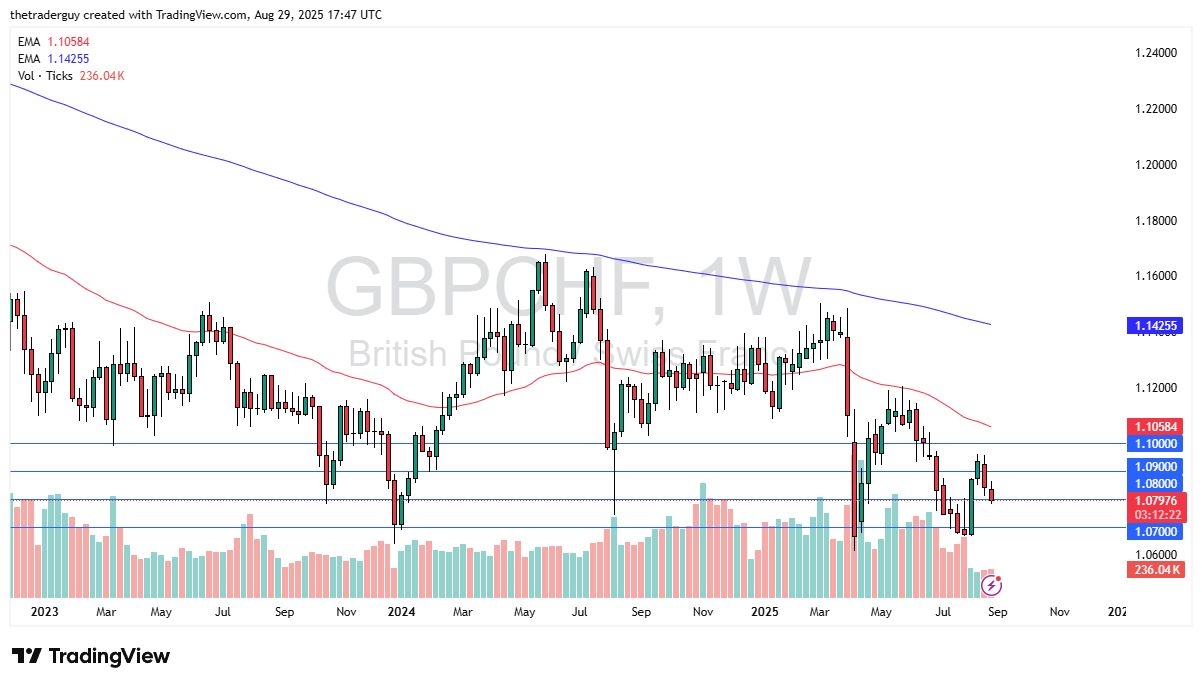

GBP/CHF

The British pound has been all over the place during the course of the week, initially dropping well below the 1.1250 level, only to turn around and show signs of life. At this point, it looks like we are trying to drive this pair higher, but if we can break above the 1.1350 level, then it opens up a move to the 1.15 level over the longer term. On the other hand, if we break down below the 1.1150 level, then it’s possible that the market could drop down to the 1.10 level.

Ready to trade our Forex weekly forecast? We’ve shortlisted the top forex trading accounts to choose from