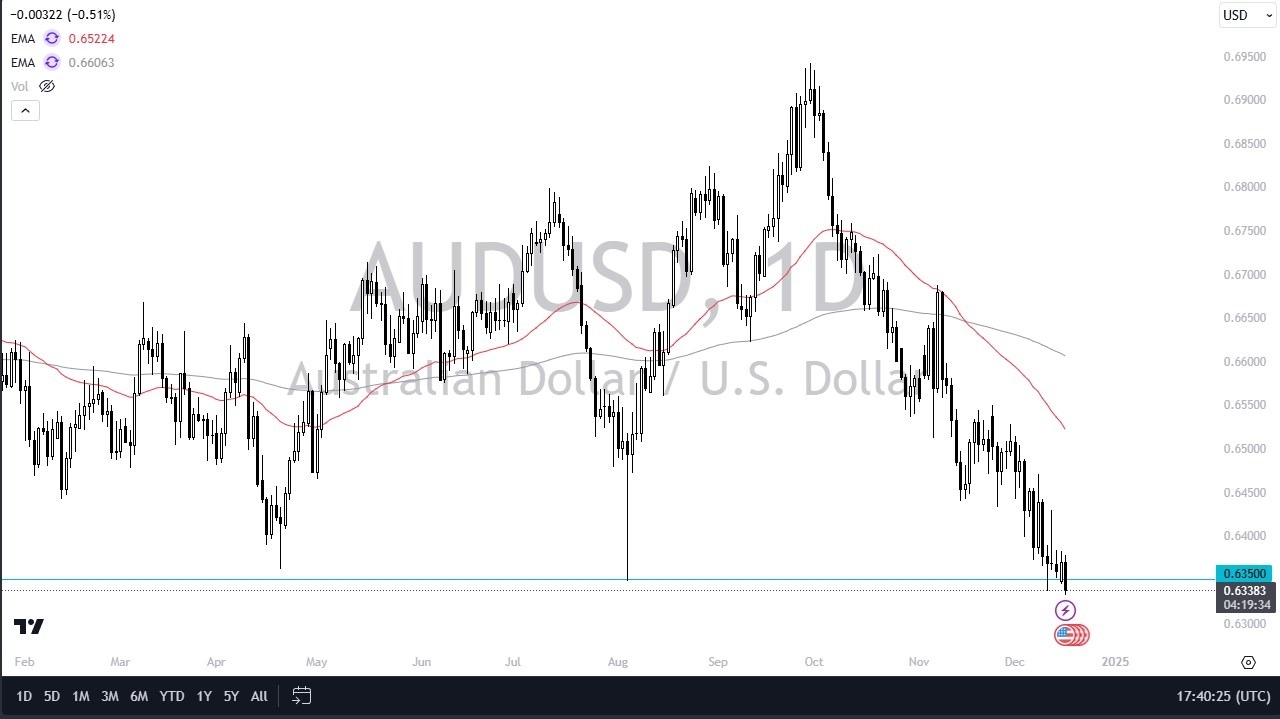

- The Aussie dollar fell yet again during the trading session on Tuesday, which is interesting because we are preparing to get the FOMC statement on Wednesday, which will be a big mover of the U S dollar.

- You would think that there would be more profit taking in greenbacks.

- In other words, a bounce here in the Australian dollar to prepare for what will be significant volatile noise. That tells you just how weak the Aussie dollar is right now.

Turning your attention to the Chinese bond market, something I don't say much, the Chinese yields are plummeting. They're absolutely cratering in the 10-year, and this suggests that people in China are very concerned about the economy on the mainland. If that's going to be the case, that takes a lot of potential exports off the table for Australia. And that's part of what we're seeing here.

Top Forex Brokers

Don’t Forget the Chinese Influence as Well

Australia is going to suffer if China slows significantly. At the same time, the United States seems to be chugging right along. And there's also talk that despite the fact there's going to be a 25 basis point cut, during the Wednesday session, the reality is the Federal Reserve won't be cutting much. From a technical analysis standpoint, we are at a pretty significant support level going back quite some time over the last couple of years. But we aren't seeing the price action that would have you thinking it's time to buy the Aussie.

We would need to see this AUD/USD market turn around and perhaps take out the 0.64 level to the any hope of momentum, but I would postulate what we will probably see is some type of knee jerk reaction during the FOMC statement that will only lead to a selling opportunity at the first signs of exhaustion. If we were to break down below 0.63 underneath, that's like a trapdoor opening in this pair will fall pretty hard.

Ready to trade our daily AUD/USD Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.