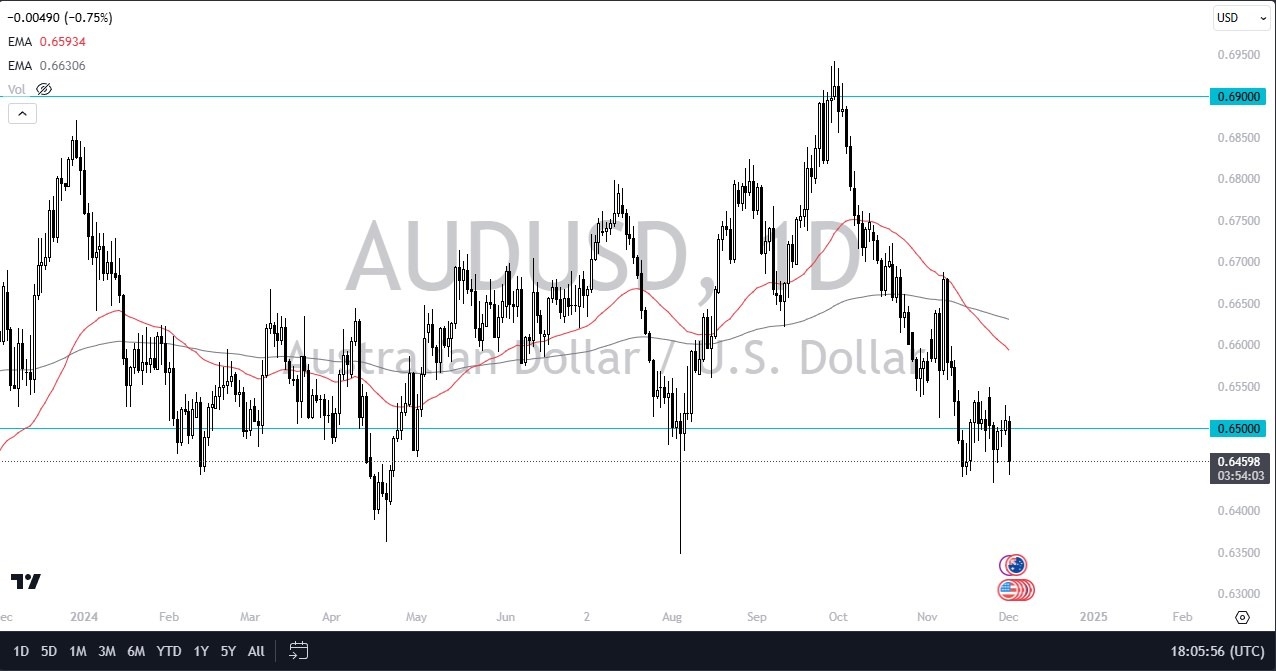

- The Aussie dollar fell pretty significantly during the trading session on Monday as we continue to see a lot of consolidation overall.

- All things being equal, this is a market that I think given enough time probably continues to see a lot of questions asked about it in this general vicinity.

- I think the 0.6450 level is a significant area of short-term support, but if we break down below there, then I think we can look into the 0.635-0 level given enough time.

Overall, I think this is a situation where the US dollar continues to beat up on everything else, and it's possible that we will continue to see more of a fade in the rally type of scenario. If we can break above the 0.655-0 level, then you can start to make the argument of a little bit of a rally from the Australian dollar.

Top Forex Brokers

But as I look at the forex world in the US dollar across the board, I think you've got a situation where anytime you get a chance to pick up cheap US dollars, that's exactly what you should be doing. In general, I think this is a market that is short-term range bound trading more than anything else. And therefore, you have to look at it through that prism.

Slightly Oversold

We are a little oversold, so a little bit of a bounce makes a certain amount of sense, just as a rally towards the 0.6550 level probably offers a short-term selling opportunity, all things being equal. It's worth noting that the PMI numbers on Monday came in for the manufacturing sector a little better than anticipated, but it is still in the contraction area. So, with this, I don't know that much changes. You also have to keep in mind that the jobs number is on Friday, so that is worth paying attention to.

Ready to trade our daily AUD/USD Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.