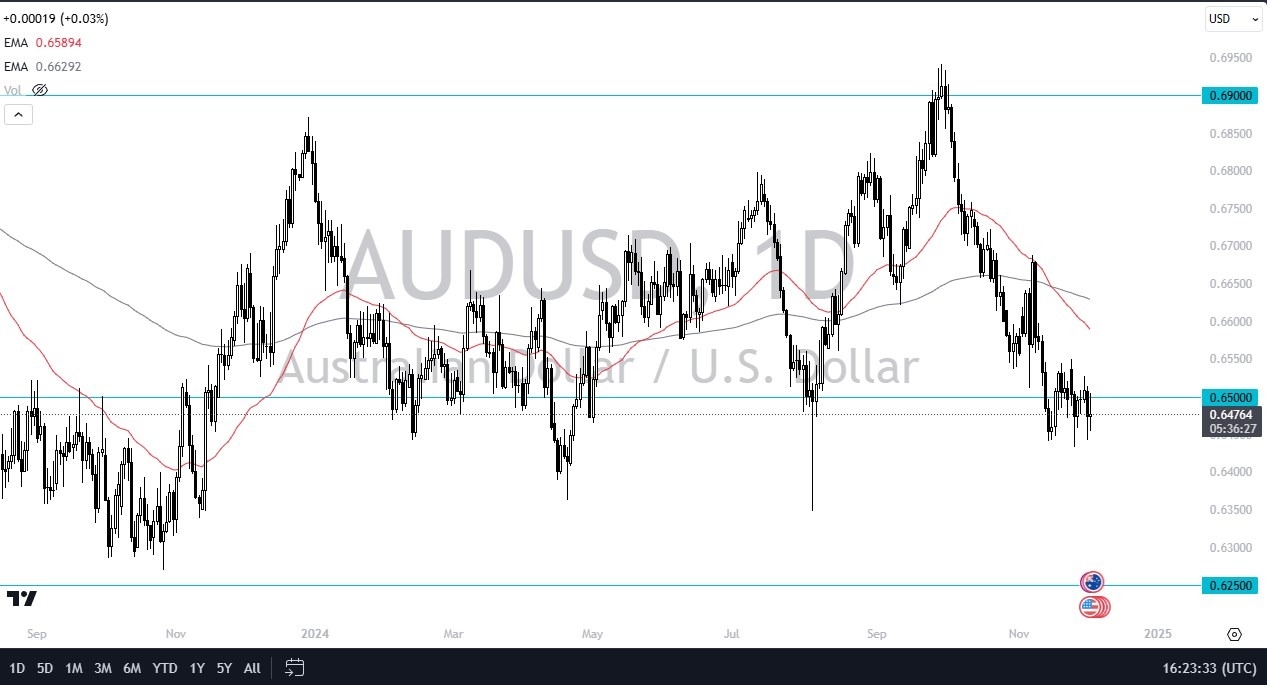

- In my daily analysis of the AUD/USD pair, the first thing that comes to mind is the word “consolidation”.

- After all, we have seen a lot of US dollar related pairs bounce back and forth, so it does make a certain amount of sense that we would see the same behavior in the Australian dollar.

- Beyond that, we also have to keep in mind that the Australian dollar is highly sensitive to Asia, so that comes into play as well.

All things being equal, this is a pair that will continue to be very noisy, and that will probably be the way going forward until we get some type of resolution as to what’s going on in the United States, and of course the global markets overall. The week features a couple of different numbers that people will be watching, including the Services PMI numbers coming out later in the day on Wednesday, and the Non-Farm Payroll announcement coming out on Friday. With this being the case, we could have a couple of days’ worth of sideways action as we try to sort out what happens with the greenback next.

Top Forex Brokers

Technical Analysis

The technical analysis in the AUD/USD currency pair is somewhat sideways in the short-term, but in the longer term we have to look at this area as a potential major support level. The area has been supported for a couple of years now, and we have bounced a couple of times in the past from this region. If we can break above the 0.6550 level, we can start to have that conversation again, but until then, I think it’s probably more likely than not going to be a scenario where we go sideways. If we break down below the 0.6450 level, then I think you have a situation where things could start to fall apart, perhaps opening up the door to the 0.6250 level.

As things stand right now, the US dollar seems to be swallowing just about everything it can get its hands on, and I just don’t see that changing anytime soon. It is because of this that I prefer to fade short-term rallies and show signs of exhaustion for short-term trades.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.