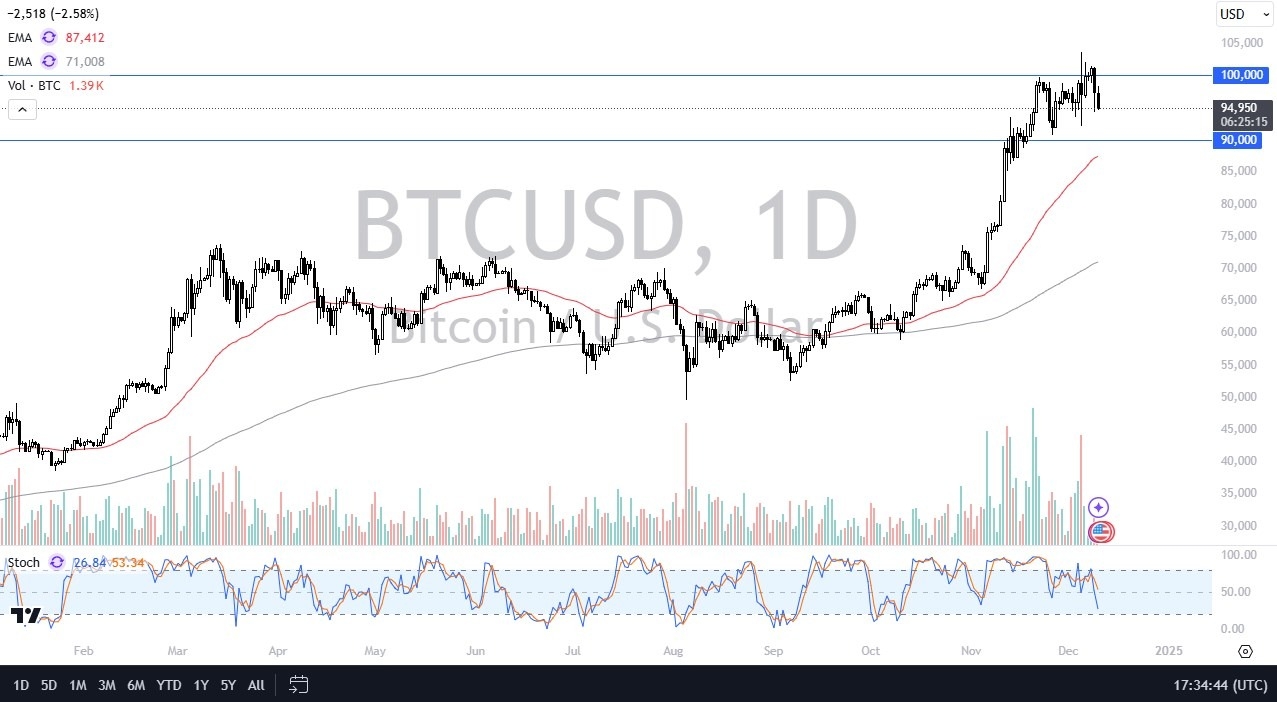

- During my daily analysis of Bitcoin, the first thing I noticed is that we of course are dropping again, and it looks like the $100,000 level will continue to see a lot of selling pressure.

- All things being equal, this is a market that has been noisy for a while, and with this, I also recognize that there is a significant amount of support near the $90,000 level.

- That being said, the market is likely to continue to see a lot of questions asked about whether or not we can finally take off.

Short-term pullbacks have offered opportunity so far, but you also need to keep in mind that the market had recently shot straight up in the air, and that’s something that you cannot expect to happen forever.

Top Forex Brokers

Quite frankly, I do think there are a lot of people out there trying to accumulate Bitcoin, but I also would point out that it would be foolish to think that we aren’t due for some type of pullback, or at the very least some type of long-term consolidation. In other words, this may look a whole lot like most of the year is coming soon.

However, if we do break out

I think at this point in time you do have to keep in mind that if we were to break above the $104,000 region that Bitcoin will spring much higher. However, we need to see some type of fundamental reason for that to happen. Recently, traders have gotten excited about the incoming trump administration, and the idea that perhaps the US government will be more friendly toward crypto. That may or may not be the case, but ultimately, that was a knee-jerk reaction and now we have to figure out whether or not it actually has value.

Wall Street of course has its ETF IBIT that everybody loves, and of course is something that Wall Street will be pumping up for retail traders to jump into. However, I also recognize that the market had gotten way ahead of itself this year, and quite frankly, a $30,000 pullback would not be completely out of bounds here. I’m not necessarily calling for that, but I do recognize that we could see a pretty significant drop. That will more likely than not just end up being a longer-term buying opportunity.

Ready to trade our free Forex signals on Bitcoin? Here’s our list of the best crypto brokers worth looking at.