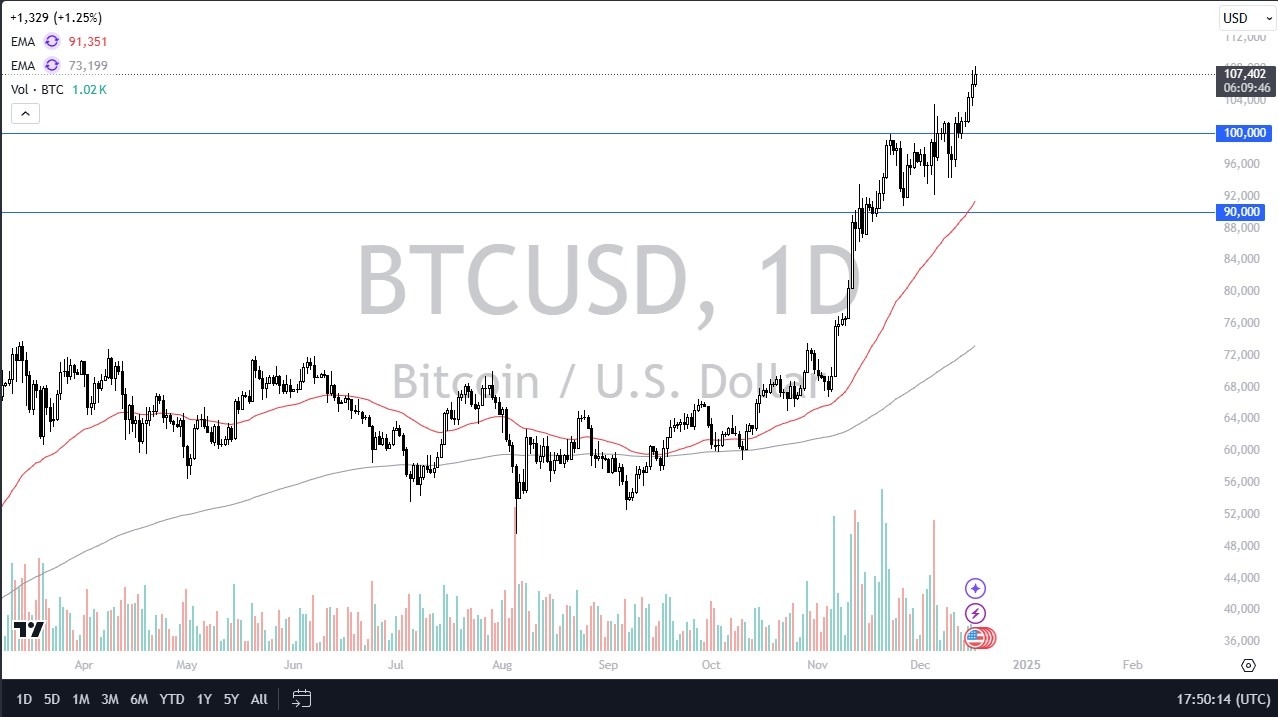

- Bitcoin has rallied pretty significantly during the trading session as we're up about 1.25% at the time of recording.

- However, we are getting stretched again. So, I think you will probably see a pullback sooner rather than later, but I also recognize that we're in a strong uptrend.

- So that pullback should be thought of as a potential buying opportunity with the Federal Reserve interest rate decision tomorrow, we could see some volatility due to that, especially if for some reason they surprise people.

But we have learned over the last several years that it's the central bank's job to acquiesce to Wall Street and Wall Street has a shiny new ETF that follows Bitcoin.

Top Forex Brokers

So, I do think they will do something to prop it up even if we do get a pullback. I'd be really interested near the $100,000 level, but at the end of the day, even if you break through there, you can't short the market, at least not until you break below $90,000. Speaking of $90,000, you also have the 50-day EMA hanging around there as well. So ultimately, this is a market that does have plenty of support.

I am Not a Fan of Chasing

I don't know that I would want to chase it here, at least not with a big position, unless of course you're a longer term holder, then that's a completely different setup. But for those of you who are thinking more short term, a pullback is really something you kind of want to see. And Jerome Powell making that happen tomorrow is a very real possibility. During the press conference, you might see swings of a couple of thousands of dollars. That might be your entry point. You just don't know.

Either way, it does look like it's trying to go higher, and I suspect that the $112,000 level might be the target with some interest paid to the $110,000 level above just from a psychological standpoint. It's still bullish even if we drop $15,000 at this point.

Ready to trade Bitcoin forex forecast? Here are the best MT4 crypto brokers to choose from.