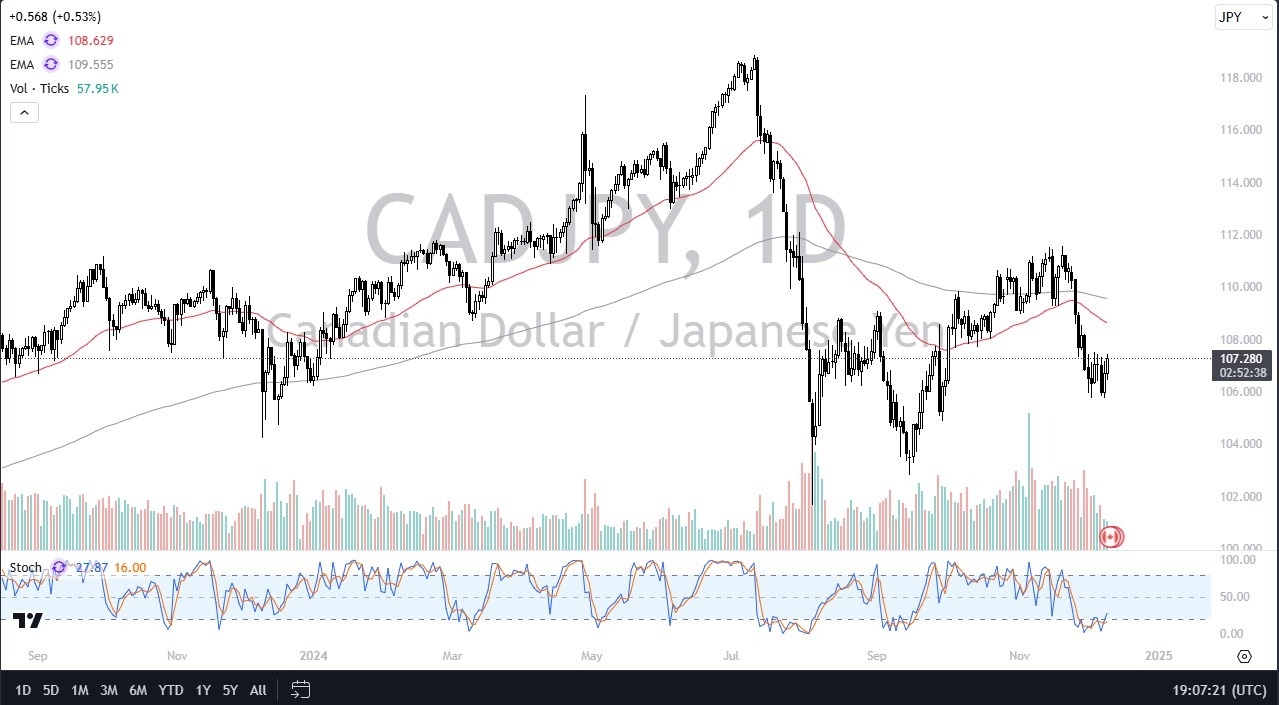

- The Canadian dollar has rallied a bit during the early hours on Tuesday, but we are still struggling with the 107.50 yen level, an area that has a significant amount of resistance built into it, followed by the 108 yen level.

- So I think we've got some work to do, but it's definitely in an area that I think a lot of people will be watching.

- As I look across the Forex world, the Japanese yen finds itself on the back foot, and that's part of what's going on here, because the Canadian dollar looks horrible as well.

This is simply a battle between a couple of lightweights, and therefore I think you have to assume that although it's going to rise, it may not rise as quickly as some others. Nonetheless, I do think there's money to be made here. Currently, the 106 yen level is a major support level. If we were to break down below there, then it would probably be a sign that both of these currencies are struggling.

Top Forex Brokers

The Technical Setup

As things stand right now, this looks a lot like a market that is going to try to make a move towards the 50-day EMA, which is currently right around the 108.50 level. After that, we have the 110 yen level that could be of importance as a target. In the short term, I would anticipate the short term pullbacks do get bought into.

The interest rate differential here isn't as high as maybe the pound against the end or the US dollar against the yen. But this might be a good way to hide from the US dollar at this juncture, as we have the CPI numbers in America coming out on Wednesday, followed by the PPI numbers on Thursday. So, it could be a good place to trade, at least for the next couple of days. As things stand right now, I'm watching that 107.50 yen level for a potential signal to get long.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.