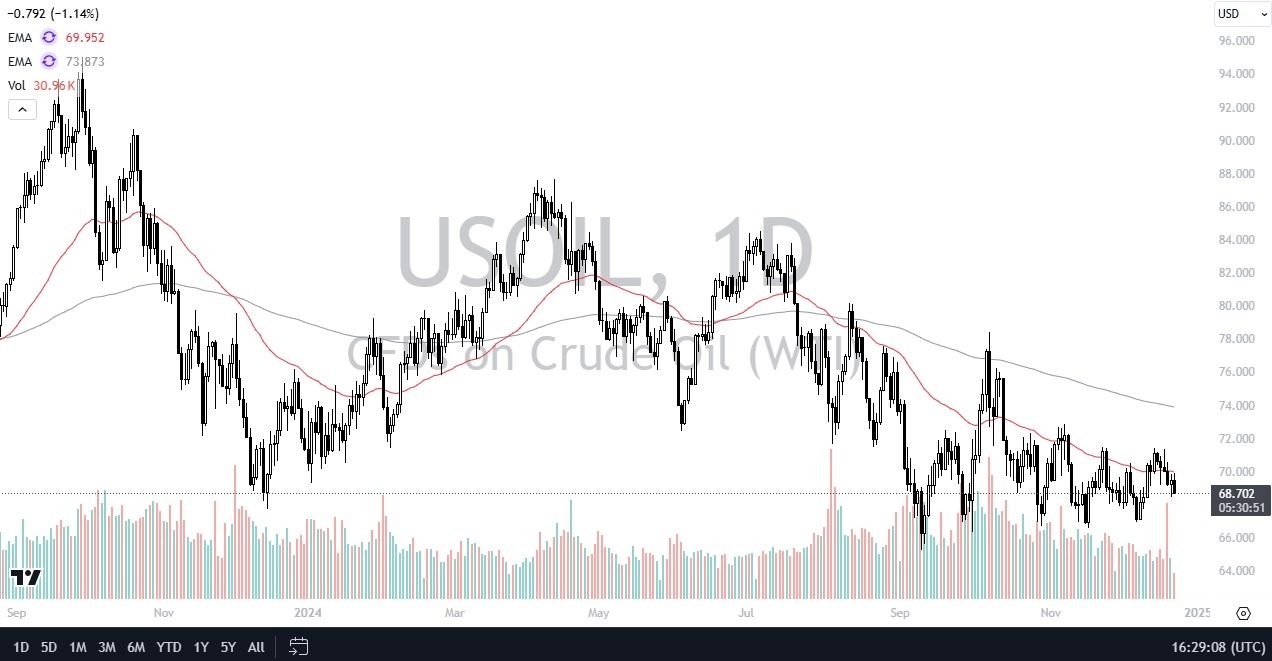

- During my daily analysis of the commodity markets, the West Texas Intermediate Crude Oil market, or the “US Oil” market grabs my attention because we continue to build a fairly significant base and at relatively low levels historically speaking.

- After all, the last couple of years have seen the area near $65 offer a massive support level, and this has been repeated since early September.

Top Forex Brokers

Technical Analysis is Still Gruesome

From a purely technical analysis standpoint, this market still looks pretty gruesome, but I also recognize that there are more things at play than simple moving averages. While the 50 Day EMA is sitting at the $70 level and has offered a significant amount of support over the last 2 days, I don’t care. Yes, you can use it as a bit of a marker, but I think the $70 level is the real key here. The 200 Day EMA currently sits at the $74 level and is dropping, so that could offer a bit of resistance as well. However, like I said earlier, this is all about the technical analysis.

The Middle East is going to continue to be an area of concern, and as long as that’s the case, you do have the possibility of the crude oil market being quite volatile. Furthermore, it’s worth noting that the one thing that does work in the favor of crude oil from a technical analysis standpoint is that the support level near the $65 level goes back at least 2 years, if not more. I suspect that we are simply trying to “build a base” before taking off to the upside.

Central bankers around the world have been slashing rates, and in theory that should stimulate the economy in multiple parts of the world. If that’s going to be something they are successful at, this means that the demand for crude oil will start to pick up again. Between that and everything that’s going on with Russia in the Middle East, it’s difficult to imagine that we break down drastically without some type of global financial crisis. Not saying that can happen, just that it looks more likely than not to be an area that value hunting occurs.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.