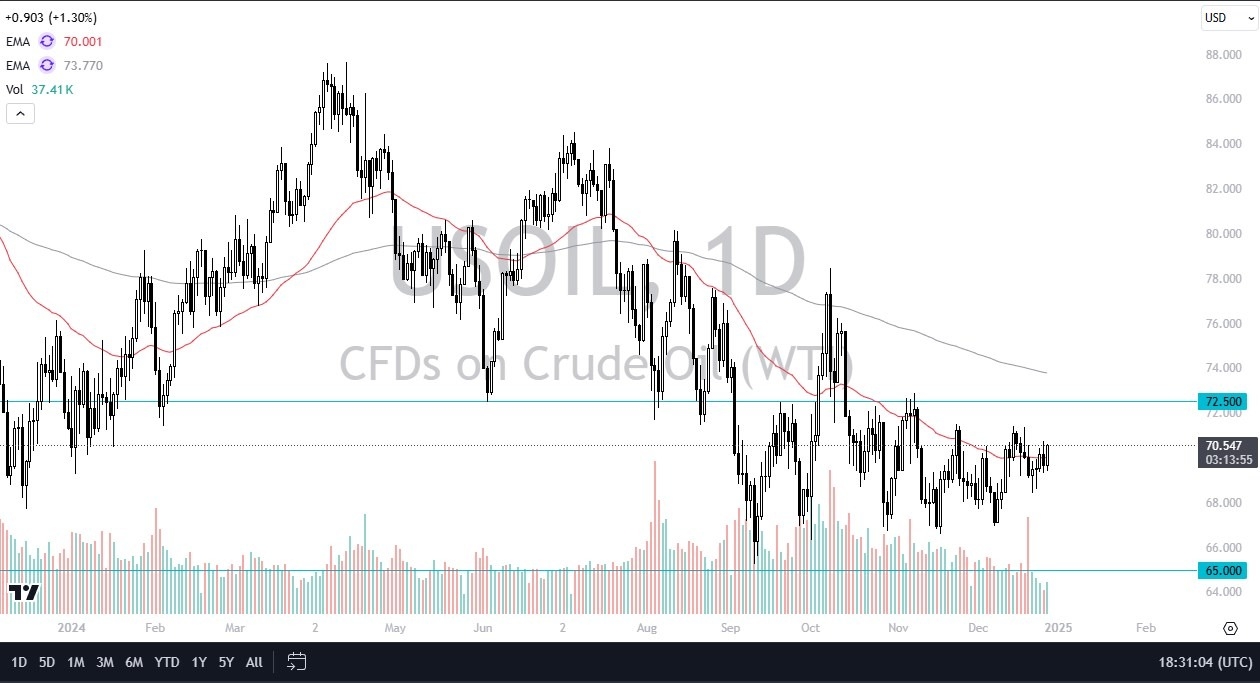

- During my daily analysis of the commodity markets, the West Texas Intermediate Crude Oil market has taken front and center stage, due to the fact that it rallied quite significantly during the day that had almost no volume and all other markets.

- This does make a certain amount of sense, because quite frankly I think the trade involving shorting oil is probably about to get blown up.

- The $72.50 level above is an area all be watching early in January, because breaking above that gets the market rolling to the upside rather quickly in my estimation.

Top Forex Brokers

Global Demand

Global demand is a little bit of a mixed bag, but when it comes to the United States, it’s obvious that the US economy is stronger than many others, and I think a lot of people will look at the WTI Crude Oil market through that prism. With this being the case, you have a situation where the market is likely to continue to favor buying dips, and between now and the Non-Farm Payroll announcement in January, it’s possible that we market will drift back and forth, but I think it remains a buy on the dip situation. If the employment numbers in January come out strong, it’s very likely that we will continue to see demand for the crude oil market strengthen, as it would signify that the US economy is still very strong.

On the downside, the $65 level is a massive support level that you must pay close attention to, and I think you would be witnessing a significant breakdown if we were to fall below there now. I don’t think that’s going to happen, but it is something that you need to keep in the back of your mind just in case. Any move toward the $68 level I suspect will find plenty of buyers at this point, as it has been somewhat supportive over the last couple of weeks. Either way, I think crude oil is about to start rallying for a bigger move, but we probably need to get through the holidays first.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.