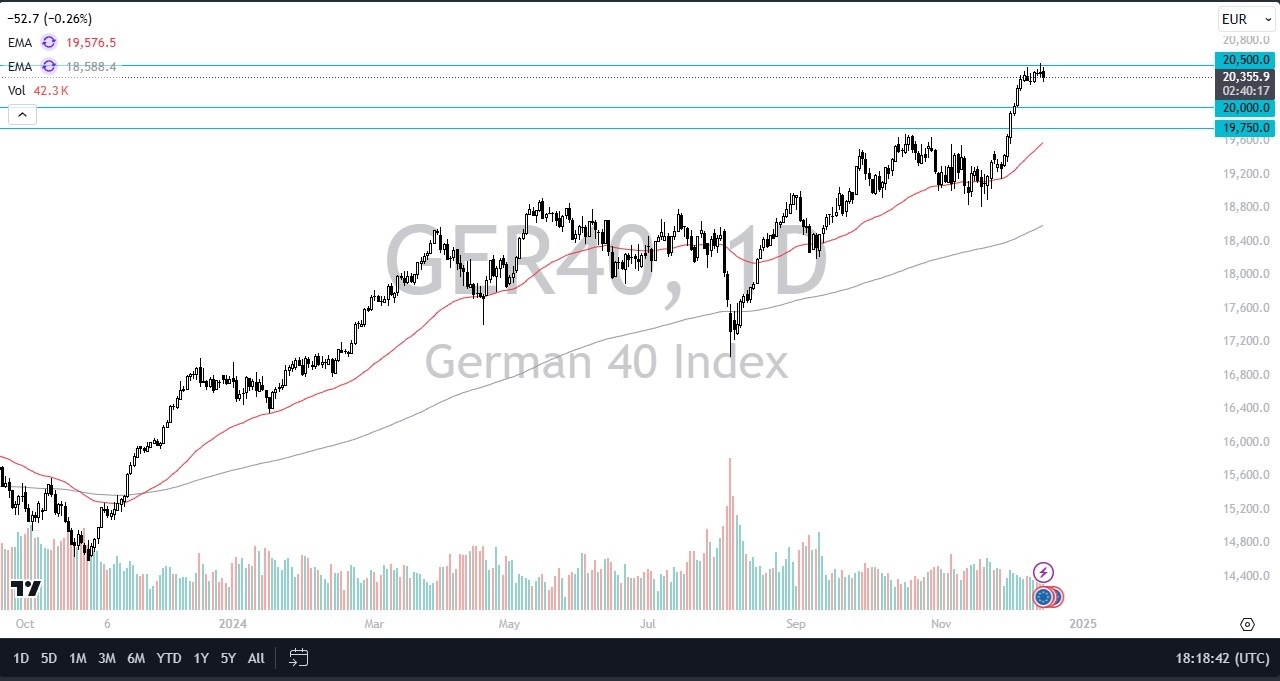

- The German index has pulled back ever so slightly during the trading session on Monday, but really at this point, you can't read too much into the price action other than the last couple of weeks have been somewhat sideways underneath the crucial 20,500 euros level.

- This is a market that has led the way for the rest of the European and now, the overall global stock markets with perhaps the exception of the United States.

The United States is in its own world right now, but what Germany is waiting for is looser monetary policy coming out of the European Union. The ECB of course has been somewhat cautious with its tone and wording, but it's also worth noting that the ECB is going to remain a little looser than many other large central banks. And that of course, is a major gift for stock traders.

Top Forex Brokers

Shorting Isn’t in the Cards Right Now

Overall, I don't think this is a market that you would be selling anytime soon, and I do think that if you get a little bit of a pullback at this point, you are probably more likely than not to see buying opportunities present themselves. I would be very interested in this market closer to the 20,000 euro level. If we do in fact, get that opportunity. I don't think that's going to be the case, but in the worst case scenario, we could see that happening.

I also recognize that if we were to break above the 20,500 level on a daily close that should open up the DAX to going much higher, perhaps as high as 20,800 before it's all said and done. Regardless, I don't have any interest in shorting this market, and I think the DAX will lead the way for a lot of other indices, especially those in the European Union.

Ready to trade our daily stock market forex analysis? Here are the best CFD brokers to choose from.