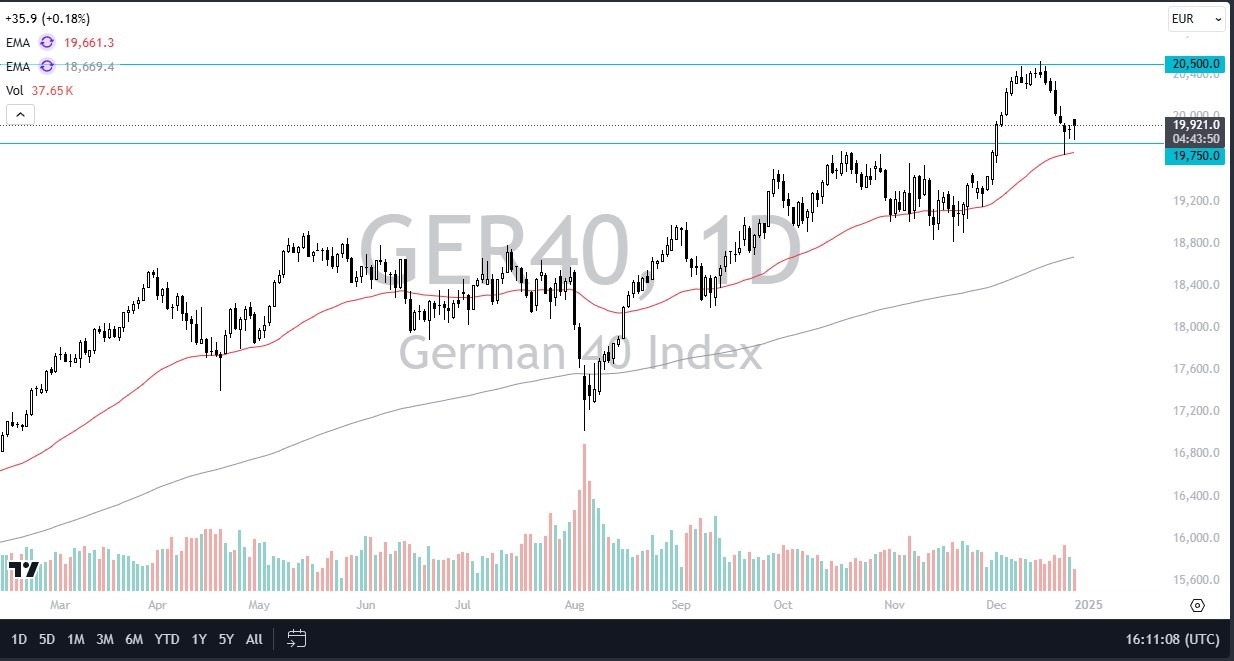

- The German index initially fell during the trading session on Friday as we had seen indices around the world take a beating, but we have turned around the show signs of life.

- The 19,750 level is an area that you need to be paying close attention to as it's shown itself to be supportive a couple of times.

- We also have the 50 day EMA sitting just below there.

By bouncing the way we have, I think there's a potential that we try to take out the 20,000 euros level above. If we do, then I think you've got a shot at the market, perhaps trying to reach the highs again. I don't have any interest in shorting the DAX.

Top Forex Brokers

Volume = Nein

I recognize that part of what we are seeing here is just a simple lack of volume over the holidays. We are in a strong uptrend. I do believe that the ECB will continue to loosen monetary policy. As a result, I think you've got a situation where the DAX will eventually take off. The market breaking above the 20,500 level would be extraordinarily bullish.

On a breakdown from here, I do think there's plenty of support though, especially near the 19,000 euro level. So even if we do break down, I'm still not ready to short the DAX. In fact, if I thought there was going to be trouble in Europe in the stock indices, I would probably be shorting other indices like Spain, for example. The German index is considered to be one of the safer ones. So, it climbs higher right along with risk appetite. But depending on how far out on the pendulum, we are, you may want to be in the DAX, you might want to be in Spain. That's the same when we start to fall apart. Generally, the DAX won't fall apart like other indices in Spain or Italy. So, all things being equal, it does look like we are trying to recover and that's how I'm approaching this.

Ready to trade our daily stock market forex analysis? Here are the best CFD brokers to choose from.